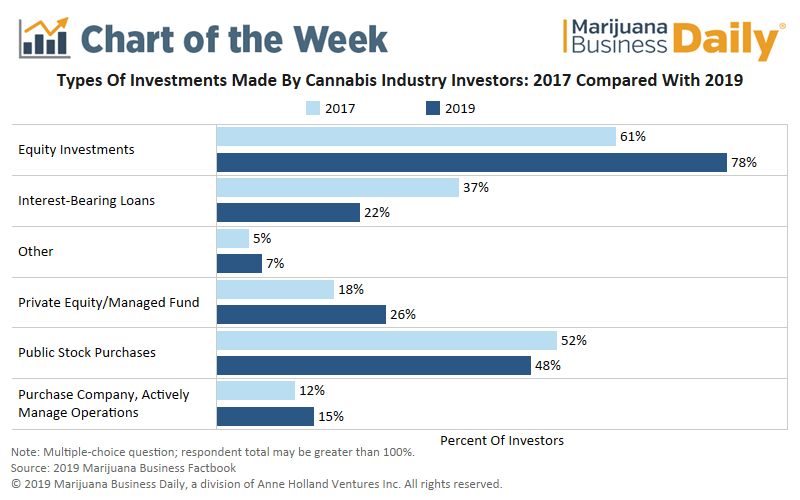

Cannabis investors are changing their investment strategy in a bid to capture higher returns, shifting away from extending loans to companies in favor of investing in their shares.

As the perceived risk of investing in the cannabis industry recedes, investors see more upside from investing in cannabis companies’ stock and are less interested in loan financing, according to data presented in the Marijuana Business Factbook.

While a loan guarantees a given rate of return over a set period of time, equity has the potential to provide even greater returns – albeit with a greater level of risk.

Analysts perceive this shift away from debt to equity financing as a signal of the long-term sustainability of the cannabis industry.

The number of opportunities to invest in private equity and managed funds also has increased.

High-net-worth individuals and family offices have shown interest in the cannabis space and a preference for placing funds into these investment vehicles rather than in individual companies.

Here’s what else you need to know about the situation:

- Through July 19, 2019, data from Viridian Capital Advisors shows that North American cannabis companies raised $6.1 billion in equity and $2.4 billion in debt through 369 transactions, lending credence to the theory that investors currently are more inclined to seek equity over loan financing.

- Viridian data also shows the cultivation and retail sectors have raised the most capital so far this year at $5.1 billion – 62% of which was equity raises.

Maggie Cowee can be reached at maggiec@mjbizdaily.com