Cannabis sales in Arizona are thriving nearly a year after the state’s adult-use program launched, but some industry officials fear smaller operators, including social equity license holders, risk getting swallowed by big companies.

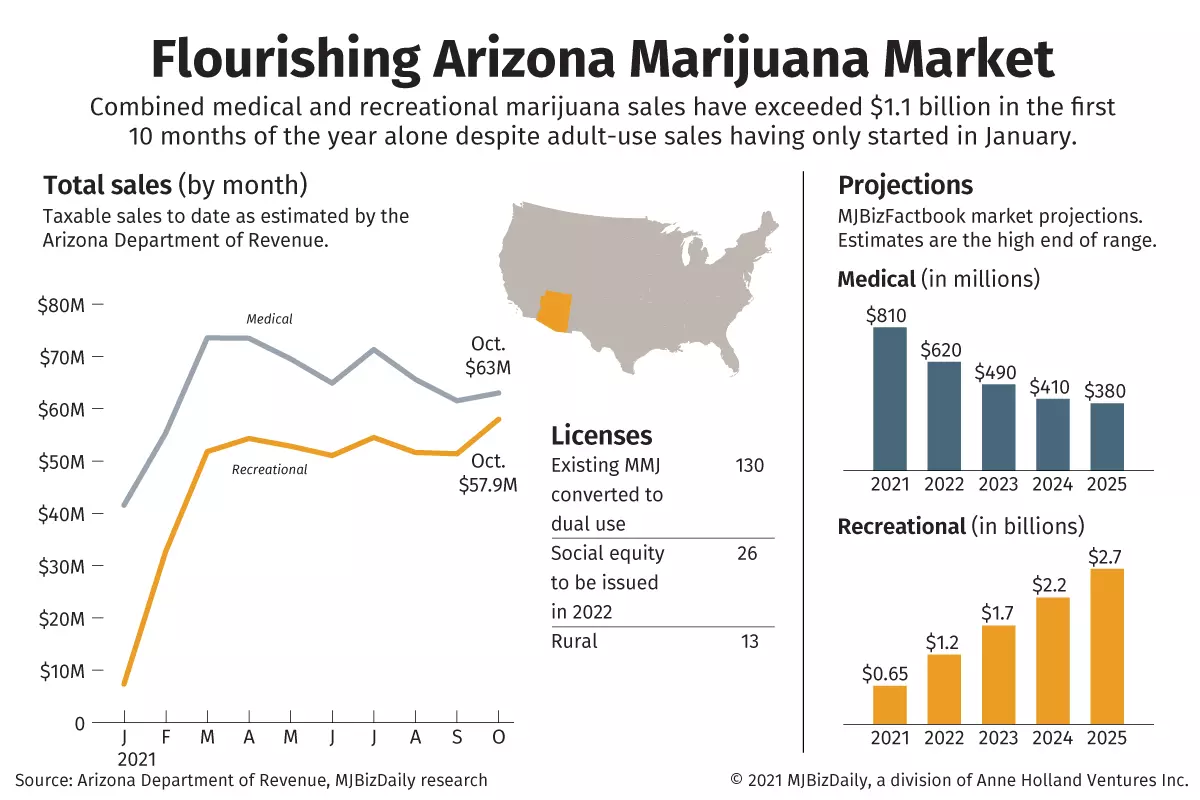

Medical and recreational sales combined topped $1.1 billion in the first 10 months of this year alone, and the MJBizFactbook projects adult use will drive combined annual revenue to $3 billion by 2025.

Industry officials said the boom reflects the novelty of adult-use cannabis, a broader range of products and coronavirus-related federal stimulus checks distributed in 2020 and earlier this year.

The entrance of multistate operators over the past couple of years has ushered in a new level of sophistication and additional product choices for consumers, experts agreed.

The state is preparing to issue 26 social equity licenses to minority and economically disadvantaged entrepreneurs.

But some industry officials worry those operators will find it hard to compete or might ultimately be gobbled up by larger operators, including MSOs.

“Certainly, there is pressure on the smaller regionals to grow, grow, grow,” Arizona cannabis attorney Janet Jackim said.

“That’s the cycle of the new industry – get more locations, push out more products,” she added. “They have to have acquisitive growth.”

Consolidation represents ‘natural evolution’

Another cannabis attorney, Laura Bianchi, noted that “consolidation is the natural evolution of any industry.”

In Arizona, the consolidation trend is pronounced because of the state’s limited-license, vertically integrated structure.

The numbers break down this way:

- 130 medical marijuana licenses converted into dual MMJ and adult-use permits.

- 13 rural licenses issued in April to fill coverage gaps.

- 26 recreational-only social equity licenses that will be issued around the spring of 2022 through a lottery – unless it’s stopped by legal challenges.

Business leaders need reliable industry data and in-depth analysis to make smart investments and informed decisions in these uncertain economic times.

Get your 2023 MJBiz Factbook now!

Featured Inside:

- 200+ pages and 50 charts with key data points

- State-by-state guide to regulations, taxes & opportunities

- Segmented research reports for the marijuana + hemp industries

- Accurate financial forecasts + investment trends

Stay ahead of the curve and avoid costly missteps in the rapidly evolving cannabis industry.

The rural licenses already have been flipping.

Jackim said one rural license recently sold for more than $8 million – just a paper license without any real estate or facilities.

“They (the buyers) know they’ll get their investment back quickly,” Jackim said.

She said many operators are finding they can make good money in Arizona from specialty marijuana products such as concentrates and edibles that offer a high profit margin.

As for the social equity licenses, the application process ends Dec. 14, and experts believe as many as 2,000 applications could qualify for the lottery based on how many potential applicants took a required state training program.

The recreational-only equity licenses are so valuable – they would fetch $10 million-plus on the market – that they’ve caused an eruption of alleged backroom deals and two lawsuits.

Individuals who qualify under the provisions laid out by the state’s social equity program must own at least 51% of the business and meet three of four criteria based on income, past marijuana convictions and residency in a community deemed as disadvantaged.

Social equity partners heavily courted

But the combination of those requirements and the fact these are the last adult-use licenses to be issued have caused large operators to aggressively recruit social equity partners.

The Phoenix New Times reported recently that those recruitment efforts have included sending flyers to individuals living in the areas targeted as disadvantaged, and offering financial inducements to partner up.

“It’s very, very disheartening to see how this program is going,” said Celestia Rodriguez, co-founder of Acre 41, a social equity applicant that has filed a lawsuit to stop the process.

The lawsuit claims the program doesn’t go far enough to ensure that the licenses will be controlled by social equity businesses.

A hearing on the case is scheduled for January, but legal experts say it’s likely the court will give the state latitude and decline to intervene.

Rodriguez said she’s seen agreements where social equity-qualified individuals are offered $1,000 just to partner on an application.

“MSOs are stuffing the ballot,” she said. “I wouldn’t be upset if they were partnering and treating them (individuals) as true social equity partners, but that’s not the case.”

As the rules now stand, the social equity licenses can immediately be resold outright, she said.

Several experts interviewed agreed, while Jackim said she reads the rule as requiring the 51% to be sold to another social equity individual.

“I can bet my last dollar that they (the larger operators) most definitely will get control of the licenses,” Rodriguez said.

Two companies aggressively recruiting social equity partners declined to talk with New Times, while an official from Elevated Arizona told the publication the company wanted to work with people to provide capital and experience and wasn’t “trying to buy anybody out.”

Big cannabis concerns foreshadowed

Not that these trends weren’t predicted.

Turn back the clock 18 months, and MSOs were moving aggressively into Arizona’s medical cannabis market in anticipation of recreational marijuana. An adult-use industry was approved by Arizona voters in November 2020 and launched soon after in January 2021.

Experts worried then that the industry-backed recreational marijuana initiative – the Smart and Safe Arizona Act – would favor existing MMJ license holders because it would allow them to secure the most adult-use permits.

Today, Florida-based MSO Trulieve Cannabis is in the top spot in the state after acquiring leading operator Harvest Health & Recreation.

Trulieve has 16 stores in operation in Arizona and 320,000 square feet of cultivation and processing space, three additional licenses and an option to acquire a 20th license.

Massachusetts-based Curaleaf Holdings has nine stores in operation in Arizona, while Chicago-based Verano Holdings has six after a wave of acquisitions earlier this year.

There are a number of Arizona-based operators as well, but they have fewer licenses.

Greta Brandt, for example, is president of Phoenix-based The Flower Shop, which has three locations in the Phoenix metro area.

She has seen the spurt of mergers and acquisition activity, most recently after voters approved adult use last year.

Brandt acknowledges the pressure to grow bigger to compete.

The 26 equity license holders will take some market share, she noted.

Adult-use sales have started to plateau after a giddy start, and a product glut is a possibility because of all the cultivation projects in the pipeline in Arizona.

She said companies that have only two, three or four licenses “will be seeking to acquire more licenses to remain competitive against the larger MSOs.”

That includes The Flower Shop: “We’re always looking,” Brandt said.

She said The Flower Shop is working with partners to apply for a social equity license, but she disagrees with the practices some are engaged in.

Brandt predicts that 80% of the social equity licenses will change hands, “which defeats the purpose of the social equity licenses.”

As for her company, she said, it’s predominantly female-run with a focus on hiring minorities and veterans. “That’s where I can give back,” she noted.

Bianchi, founding partner of Scottsdale-based Bianchi & Brandt, said she understands concerns that Arizona might become dominated by big cannabis, but she cited The Flower Shop, one of the law firm’s clients, as an example of a strong smaller operator that has grown organically.

Expansion options for local companies

For those local operators, Bianchi said, expansion options include:

- Building out more advanced cultivation and processing facilities.

- Acquiring one of the rural licenses or social equity licenses.

- Branching out to new markets elsewhere in the country.

Brandt, for example, also has a medical cannabis operation in Utah.

But, in terms of M&A, Bianchi said, there also needs to be the recognition that “you’re buying high,” that prices have skyrocketed.

As for social equity, she said she believes the state is “really trying to do the best it can” and a “lot of people out there want to be good partners and meet the goals of the program.”

Bianchi said partnerships can be beneficial in helping social equity applicants have access to capital, expertise and the tools they need to succeed.

Demitri Downing, founder of the Arizona Marijuana Industry Trade Association, said the legal challenges to Arizona’s social equity process should be “getting people to look at the big picture.”

He believes the state’s limited licensing scheme is an “unnecessary obstacle to social equity,” and “we should be worried about big cannabis evolving from within.”

“I think we’ve got it all wrong,” Downing said. “We should be moving away from the paradigm of limited licensing” to a free market similar to the MMJ industry in Oklahoma.

He said tax revenues then could be used to create social equity funds at the local level. “Let them (local officials) determine who deserves social equity.”

For example, in Arizona, some of those who benefit should be tribal members who were convicted of running illicit marijuana operations, said Downing, a former tribal prosecutor.

“Those are the entrepreneurs who should be awarded.”

Jeff Smith can be reached at jeff.smith@mjbizdaily.com.