Vertically integrated cannabis companies in Arizona’s fledgling recreational market are reporting long customer lines and robust sales after a lightning-quick market launch less than three months after voters approved adult-use legalization.

Dispensary operators, which were given first crack at recreational licenses, report that initial adult-use sales were two to three times the value of their usual medical cannabis sales, underscoring the strong demand for newly available rec products, particularly flower.

As dozens of Arizona’s existing medical marijuana dispensaries open to recreational shoppers, there are few signs of the initial supply problems that have plagued other new markets such as Maine or Illinois.

But a number of operators told Marijuana Business Daily that shortages could be on the way in the weeks and months ahead.

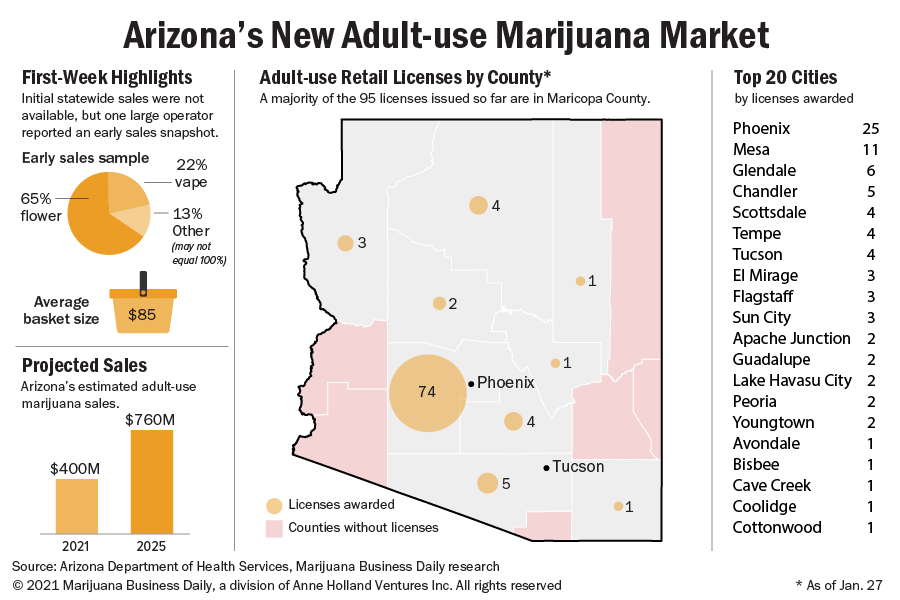

Seventy-three of the state’s 130 licenses were first approved for recreational sales on Jan. 22, and that total increased to 95 licenses approved by Wednesday.

MJBizDaily projects Arizona’s recreational market could be worth $375 million-$400 million in Year One and $700 million-$760 million by 2024.

However, state-level recreational sales figures are unavailable for now.

Marijuana tax payments are remitted a month after the fact, Arizona Department of Revenue spokeswoman Michelle Carella told MJBizDaily in a statement explaining the lack of initial sales data.

“We will have a better insight into sales in March and April,” Carella wrote in an email.

Strong consumer demand

Arizona dispensary operators described a lively first weekend of adult-use sales.

The Mint Dispensary announced it would be opening to recreational shoppers at its locations in Guadalupe and Mesa shortly after being approved on Jan. 22.

“I don’t know how they got down here so fast – literally in 20 minutes, the line was around the building,” co-founder and Chief Operating Officer Raul Molina said.

The Mint’s two stores saw more than 7,200 customers from Friday through Sunday, Molina added, with an average basket size of around $78.

Curaleaf, the second-biggest Arizona operator with nine licenses and eight dispensaries currently open, has seen early recreational sales worth between two and 2½ times its previous daily medical sales, Curaleaf Arizona President Steve Cottrell said.

Average basket value has been roughly $85, with flower comprising about 65% of initial sales and vapes comprising 22%.

Harvest Health & Recreation is Arizona’s biggest marijuana player, with 19 licenses and 15 dispensaries now open for recreational sales.

Steve White, CEO of the publicly traded company, was unable to disclose initial sales figures, but he said the early rush “tested the stores’ capacity” at some locations, particularly in light of coronavirus-related public-health restrictions and company policies.

“We did a good job of ensuring that our inventory was where it needed to be to not have early supply-chain disruptions,” he said.

The Flower Shop, a medium-sized operator with three dispensaries, did between three and 3½ times its usual medical sales from the afternoon of Jan. 22 through the weekend, President Greta Brandt said.

Cannabis flower comprised at least 55% of early sales, Brandt added, with an average basket size of about $100, or two to three products.

“We have been preparing for rec sales for the last four months. Our inventory has been bulked up by three times just anticipating the foot traffic,” said Brant.

Concern over possible supply issues

New cultivation facilities should be on the way to Arizona: The state Department of Health Services said recreational licensees can begin applying for an additional off-site cultivation permit in April, which Arizona’s Marijuana Industry Trade Association described as an unexpected and exciting opportunity.

But despite being well-stocked for now, The Flower Shop’s Brandt anticipates Arizona’s recreational supply situation could change soon.

COVID-19 delayed construction on new cultivation sites, she said, and the recreational market launched sooner than some operators anticipated.

New cannabis testing requirements enacted in November contributed to supply-chain backlogs even before the adult-use market launched, Brandt added.

“We’re anticipating seeing a supply shortage. … The (wholesale) cost per pound, I believe, will start to skyrocket in the next few weeks,” she said.

Lilach Mazor Power, founder and CEO of single-license operator Giving Tree Dispensary, offered a similar outlook.

“I feel like we are going to be OK for the first month, or six (or) seven weeks,” she said. “But after that, we are going to see some supply issues.”

Some operators in Arizona’s vertically integrated market aren’t wholesaling to others in order to prioritize their own stores’ supply, Power added.

Curaleaf Arizona’s Cottrell said possible shortages are “definitely a concern,” which is why Curaleaf has invested in new cultivation capacity.

“When you jolt from an addressable market of 300,000 people to an addressable market of 6 million people, you of course are going to have a shock to the supply chain,” said Samuel Richard, executive director of the Arizona Dispensaries Association.

But Arizona’s potential supply challenge isn’t an issue of insufficient cultivation licenses, said Richard, since each vertically integrated license allows cultivation.

“To the extent that there is an issue, or is a challenge, it’s a capital one,” he said.

Richard estimates that somewhere between 50% and 75% of Arizona’s 130 licenses “actually have fully built-out and operational offsite cultivation.”

“If we can hold on for that (first) few months, I’m hopeful that the investments (made) in the second half of 2020 will start to come online in time to supply the market,” he said.

Harvest CEO White said the company had been stocking up on third-party supply for months ahead of the market’s launch and observed the wholesale market tightening over that period.

But White said those who anticipate a supply shortage might not be accounting for cannabis companies from other states entering Arizona and cultivating or manufacturing under someone else’s license.

“Those people who have made those moves, or are considering making those moves, I think are going to have an impact on supply in the wholesale market,” White said.

“My hope is that they will, at least in part, make up for the increase that we’ve seen in demand.”

Limited number of new licenses

Arizona’s marijuana licensees have the advantage of a limited number of licenses, with the 130 existing licenses tied to the number of pharmacies in the state at a ratio of one license per 10 pharmacies.

Arizona is due to issue 26 more licenses under a social equity program, as well as a smaller number of licenses in so-called “empty counties” with zero dispensaries or only one dispensary.

Samuel Richard of the Arizona Dispensaries Association expects the grand total will be 165 to 170 licenses.

After that, additional licenses won’t be issued until Arizona’s pharmacy count increases significantly.

“It will always be that 10-to-one (ratio) unless the voters decide to change that,” Richard explained.

Curaleaf Arizona’s Cottrell said the new licenses will be needed to meet market demand.

“I know we’re only a week into this so far, but from 7 a.m. to 10 p.m. there is a line at every Curaleaf store, all day,” he said.

“It’s a great opportunity for everybody that has the license.

“We’re very privileged to be in this position.”

Solomon Israel can be reached at solomon.israel@mjbizdaily.com