Aurora Cannabis CEO Miguel Martin might have one of the hardest jobs in the marijuana industry – turning around a company that has lost billions of dollars and been producing far more product than it could sell.

In short, the Canadian company Martin inherited eight months ago was in deep trouble – and he’s not afraid to concede mistakes had been made.

Martin, former CEO of hemp company Reliva, joined Aurora as chief commercial officer after it acquired Reliva in 2020.

Two weeks after Martin was appointed CEO, Alberta-based Aurora reported a net loss of 3.3 billion Canadian dollars ($2.7 billion) for the previous fiscal year.

And then billionaire investor Nelson Peltz, who was brought on as a strategic adviser, jumped ship.

Months earlier, Aurora had embarked on a “business transformation plan” to align general costs and capital spending with reality.

Martin did not waste any time after taking over, continuing on the path the company had embarked on to rightsize the business: Layoffs continued, more facilities were shuttered, and the businesses was refocused.

Martin has been doing all of this remotely from his home in Richmond, Virginia. The CEO hasn’t been to Canada since he was elevated to CEO in September 2020.

Martin spoke with MJBizCanada about lessons learned from Aurora’s past and how the company’s transformation plan is laying the foundation for the future.

What challenges do you have running Aurora from the United States?

I’m someone that learns by being on the ground. And I like to be with consumers particularly.

In all my past roles, and CPG companies, I like to be in stores, I like to be talking to consumers, I like to be talking to budtenders.

So I think that part’s harder. But I give the company a lot of credit. Everybody’s doing a great job.

Aurora announced its business transformation in February 2020. You were elevated to CEO six months later. How is the transformation going, in your view?

My opinion of the transformation is (it’s) going very well.

We have the domestic medical business, which we’re No. 1 in. Medical is where this whole thing started. In many cases, it’s where many countries start and is a pathway towards rec.

So that’s one of the three legs of the stool. We’ve focused on that. We’ve changed some of our core offerings.

International, the second leg of the stool, is also going really well. There’s no syndicated data on international business, but I would suspect that we’re probably doing better than any other Canadian LP (licensed producer).

In the largest markets, Germany, where a lot of people have struggled, we’ve done really well.

We put in new leadership to our international business. … So that part of the business and transformation is going really well.

The other leg of the stool is the rec business. And that’s hard. We’re still getting there.

A company like Aurora that built massive infrastructure back in the day – I know it seems like 10 years ago, but it was only a couple years ago – companies at that point were really valued on how much production capacity they had.

It took Aurora longer, and to be honest, we’re still in it, to rightsize what we need to do on the rec business, and we’re in the midst of doing that. Would I like that to happen sooner? I would.

That part of it is a work in progress. We’re bullish that we’re going to be able to get there.

The fourth leg of the stool is sort of a phantom leg that a lot of people aren’t talking about, but we’re really talking about soon, is science and genetics.

Aurora, whether people give us credit for it or not, through the acquisition of Anandia and MedReleaf, we have what might be one of the deepest genetic labs out there.

You see the Canopy litigation against GW (Pharma). Suddenly, that’s going to become a bigger part of the story. Not something that I know is top of mind for most people now, but it really will be.

Aurora lost a lot of market share in 2020. Do you have a plan to get that back, or do you intend to aim for a share of certain segments?

Aurora had that market share really on the back of Daily Special (the company’s value brand). Daily Special was a spectacular success in the spring of last year.

There was so much excess flower production, that it was either throw it out or sell it for really low margin. That piece of the business is really challenging.

The reason the question is astute is because overall market share doesn’t mean a whole lot. You want to be able to have good market share in the categories where you can make money, and sell premium flower, premium categories.

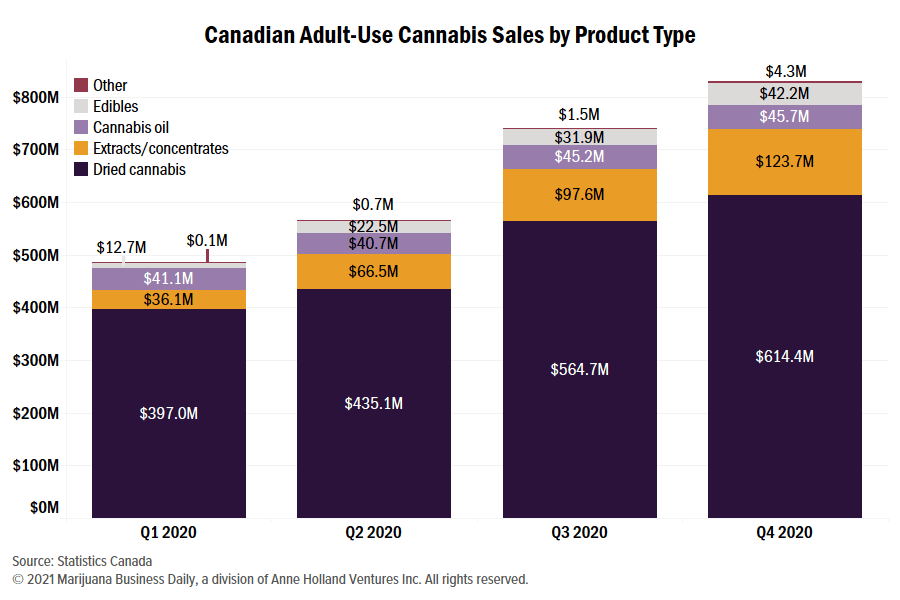

There is clearly a space in the Canadian market for premium flower. There’s clearly space in the premium market for things like concentrates and rosin and vapor, which all have premium margins.

Even if it’s a discount label, say in concentrates, as an example, it’s going to have significantly higher margins than value flower.

Aurora spent vast sums of money on large cultivation facilities in Canada. Did Aurora’s then-executives expect those to ever reach full production?

I would think so. I’ve not had that conversation with previous management.

If you look back, I think there were three forces at work that made what seems hard to understand, easier to understand.

First is, you’re right, when you look back at those time periods, all of the valuations of these companies were based on production capability.

Because the thesis at that time was that you were going to be able to grow cannabis in Canada and ship it all over the world. And that all of these big markets – U.K., France, Spain, South America – were on the precipice of opening up.

The second is the investors. When you look at investors, cannabis was faced with an issue, because institutional investors couldn’t invest. So, at that time, you had massive, to this day, massive retail investors. And they viewed that metric (cultivation capacity) as critical.

Third, I think there was a belief at that time that, as a fallback, the Canadian market was going to grow at a different rate and that the illicit market was going to come down, or the U.S. was going to open up.

And so in this irrational sort of arms race on facilities, you had the big companies go there.

And the other thing to remember is you had Altria and Constellation come in with billions of dollars.

When that’s all happening, and you’re in the frenzy, I can get it.

For me, at this stage right now, our objective is to be a successful, publicly traded cannabis company. (Aurora trades as ACB on the Toronto Stock Exchange and the New York Stock Exchange.)

Part of that is being financially healthy and making money. And so you have to be able to do that with the right footprint.

And that’s why we’ve made some of the decisions that we’ve made around our manufacturing footprint.

Let’s talk about overseas for a minute, where similar missteps occurred. Vast sums of money went out the door in international markets, where there were almost no local sales.

I’m going to be as respectful as I can.

I think when you have an executive set that never operated businesses in those markets, it’s easy to not quite understand what’s real and what’s not real. And that’s not a knock on anybody.

But if you look at folks like myself and some of the current CEOs, we’ve operated in those markets.

I’ll give you an example. Everybody, including Aurora, got terribly excited about South America and Central America.

And having worked those markets, the fluid nature of the political environment there, no matter what the current scenario is, would lead me to believe that’s not a great place to invest.

I’m much more interested in places like Germany, France, the Netherlands, Poland and Czech Republic, because there are steady political environments. And when you get into this sort of cadence with the (World Health Organization) and the regulatory environment and alignment with other markets, you know it might take longer, but you’re not going to be surprised.

You’re not going to get whipsawed by one political action by one party and another.

I think that’s why Germany is such a great market, particularly for us. We got three of the nine tenders in France. I’m much more bullish on that than I am about what may or may not happen in Mexico.

And that’s no disrespect to Mexico. I was born in Mexico, but that’s a very fluid political environment.

But you’re right, a bunch of people chased and created a thesis that I would argue never came to be.

This interview has been edited for length and clarity.

Matt Lamers is Marijuana Business Daily’s international editor, based near Toronto. He can be reached at matt.lamers@mjbizdaily.com.