Low-priced cannabis has changed the face of Canada’s regulated marijuana industry over the past year, with many producers launching value-flower brands at competitive prices.

Now, that low-cost trend is arriving for marijuana-derivative products, including vape cartridges and edibles. (Such products are sometimes called “Cannabis 2.0” in Canada because of the second set of federal regulations that enabled them.)

Competition is increasing, average prices have fallen and some producers are extending their value-flower strategies to the derivative segment.

That could bode well for attempts to capture market share away from the illicit market, but it might also signal tighter margins for some producers.

Like dried flower, many of those derivative products carried relatively high price tags when they launched around the new year.

But point-of-sales data from Seattle-based cannabis market intelligence firm Headset shows that the average per-gram price of vape products has declined this year across three key markets:

- In British Columbia, from 114.57 Canadian dollars ($87.21) in January to CA$95.84 ($72.95) in August

- In Alberta, from CA$138.64 in February to CA$80.88 in October

- In Ontario, from CA$118.45 in January to CA$104.92 in August, not including the government-operated Ontario Cannabis Store.

The price of edibles on a THC-per-milligram basis has also declined year-to-date in Alberta and Ontario, although the cost has increased slightly in B.C.

Owen Bennett, tobacco and cannabis analyst for New York-based Jefferies, said the shift to value in the flower segment happened only after competition picked up.

“I think you’ll see a similar thing now in derivatives, as more and more products come available, and more and more better-quality products, then that will force a shift into value similar to what you saw in flower,” he said.

New competition and price normalization

Delta, British Columbia-based Pure Sunfarms recently launched three new vape-cartridge SKUs in Ontario, B.C. and Alberta – Canada’s first-, third- and fourth-largest provinces by population, respectively. (Quebec, the second-biggest province by population, has banned vapes.)

The greenhouse producer had already established a reputation for low-cost products, and its vape products are no exception: On the Ontario Cannabis Store website, the 0.5-gram cartridges sell for CA$6.59 per 0.1 gram, less than almost every other competitor.

Pure Sunfarms CEO Mandesh Dosanjh believes the company’s vapes, which contain a winterized full-spectrum extraction rather than distillate, are the lowest-cost, full-spectrum vape available in Canada’s licit market.

Even though Pure Sunfarms’ flower and vape products compete against other producers’ value brands on price, Dosanjh said he hates “getting lumped in as a value brand, but I understand it.”

The company’s philosophy for its single adult-use brand is simply pricing quality cannabis appropriately, he said.

“We never wanted to go in and be seen as this company that is trying to gouge consumers and having to drop prices quickly because there’s more competition coming out,” Dosanjh said.

“We wanted to say to customers, ‘Great product at the prices it should be,'” he added. “And I think that philosophy helps us build trust and confidence with customers, whether they’re retail operators or end consumers.”

He characterized the race toward more affordable cannabis in Canada as part of a process of price normalization in the face of new competition.

Before legalization, Dosanjh continued, illicit-market customers who paid premium prices were used to getting premium products.

“When we launched our products, it definitely caused disruption in the marketplace, and I think it woke people up to the fact that, ‘Oh wow, these guys are going to produce that high-quality product at that price point – we really need to rethink our strategy because our products can’t compete with these guys, especially not when we’re charging 30%, 40% more price.'”

Value-priced edibles, new value flower brands

This summer, Moncton, New Brunswick-based producer Organigram launched its first value-priced cannabis edible, a flavored “Trailblazer Snax” chocolate bar containing 10 milligrams of THC.

CEO Greg Engel said the product is targeted for value-conscious consumers, with a focus on affordable pricing and a large size.

“We’ve had a long-standing relationship with The Green Solution in Colorado, so we look at their data and we can see what’s happening from a trend perspective, and we know there’s a broad range there and different consumers are looking for different product types,” he said.

Organigram also has plans for further value-priced derivative products, according to Engel.

“One of the things we’re looking to do in the future is to go to a larger size 510 (vape) cartridge to provide more value in that category,” he said.

Meanwhile, Organigram’s flower portfolio now includes three different value brands, including a new pre-milled discount flower product called “Shred.”

Engel described each of Organigram’s value-flower brands as offering a distinct proposition, based on market research.

But he also said the company has launched new, high-THC offerings under its premium “Edison” brand and highlighted the importance of having a full slate of product offerings.

“You can’t just go all in and (say), ‘We’re only a value company,'” Engel said.

“You have to have a range of products.”

The potential pitfalls of value brands

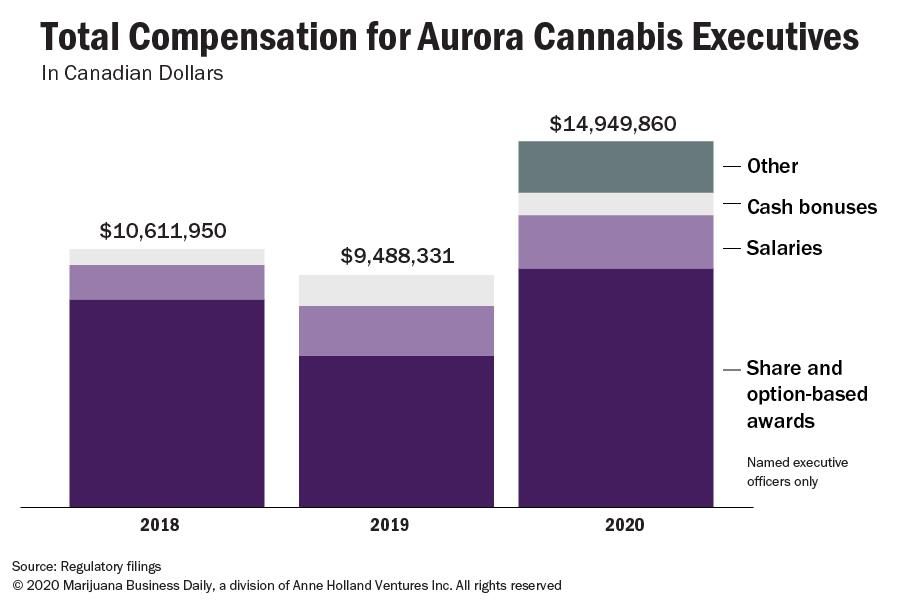

Going too far down the path of value brands carries risks, as Edmonton, Alberta-based Aurora Cannabis learned this year after launching its “Daily Special,” a value-priced flower product.

Aurora sold more cannabis by volume during the fourth quarter, but revenue declined as the budget brand grew to encompass 62% of the company’s net revenues from dried cannabis and its average selling price shrank.

In response, Aurora announced it was repositioning its brand portfolio to focus on higher-margin premium brands.

Aurora’s mistake wasn’t moving into the value segment, according to Bennett, the Jefferies analyst.

“It was almost like they saw it was having a bit of success and threw everything behind it and didn’t think about the long-term consequences,” he said.

Producers need to take care to manage their brand portfolios strategically, ensuring that their value market share is appropriate for their sales targets, Bennett added.

Bennett expects producers of discount cannabis will ultimately run up against a new roadblock at the country’s growing number of retail stores.

“They obviously want to stock the higher-margin products. … They’re not going to stock every discount brand on the market, so what they’re going to do is probably pick one or two,” he said.

“And therefore I think a lot of these discount brands may start to struggle to get shelf space, and therefore, that could raise problems for companies that are largely reliant on discount right now.”

Solomon Israel can be reached at solomon.israel@mjbizdaily.com