(This story has been updated with comments and additional information.)

Cannabis producer Canopy Growth is shuttering more facilities across Canada amid a fresh round of layoffs in an effort to streamline operations and improve margins, the struggling company announced Wednesday.

The cuts come amid a broad supply-demand imbalance in the Canadian cannabis industry. The glut has resulted in a mountain of cannabis inventory – both unpackaged and packaged – sitting in warehouses.

Approximately 220 employees will lose their jobs as part of the latest closures, and the Smiths Falls, Ontario-based producer is abandoning outdoor cannabis cultivation in Canada.

As a result of the latest moves, Canopy expects to record pretax charges of up to 400 million Canadian dollars ($312 million) in the third and fourth quarters of the current fiscal year.

- St. John’s, Newfoundland and Labrador.

- Fredericton, New Brunswick.

- Edmonton, Alberta.

- Bowmanville, Ontario.

The production sites represent roughly 17% of Canopy’s greenhouse and indoor Canadian footprint, the company said.

The decision to close the sites came after an end-to-end review of the company’s operations, Canopy CEO David Klein said in the announcement.

“These actions will be an important step towards achieving our targeted $150-$200MM of cost savings and accelerating our path to profitability,” Klein said.

The review, announced during the company’s second-quarter earnings call, looks at people, process, technology and infrastructure.

Canopy also said it will shut down its outdoor cannabis grow operations in Saskatchewan.

That means Canopy will be completely out of the outdoor cultivation business.

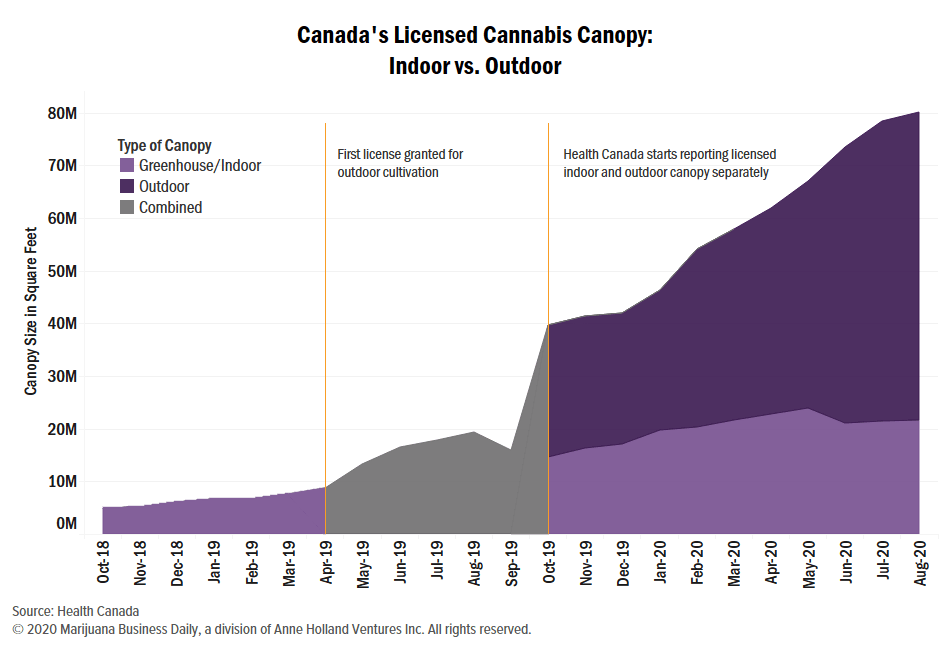

The move comes as Canada is awash in outdoor cannabis cultivation capacity. The country’s producers sat on nearly three times more licensed outdoor-grown canopy than indoor capacity this past summer.

Canopy has not made a profit in recent years.

Over the past four quarters, Canopy has lost over CA$1.5 billion, including a net loss of CA$97 million in its most recent quarter ended Sept. 30.

In lieu of answering questions from Marijuana Business Daily, Canopy Vice President of Communications Jordan Sinclair provided the following statement:

“Canopy Growth has made the strategic decision to close five of its production facilities as a result of the larger restructuring efforts outlined by the company earlier this year. This change comes as the Company continues to adjust its operations to match market demand. After careful analysis, we are confident our remaining sites will be able to produce the right breadth, quality, and quantity of cannabis products to our consumers.

“These decisions are never easy and we want to thank the employees affected for their contributions to Canopy Growth.”

Latest layoffs

Large Canadian cannabis producers have reported billions in losses since Canada legalized marijuana in late 2018.

In 2019 alone – the first calendar year recreational products were allowed to be sold – collective net losses exceeded CA$6 billion.

But the deficits come as Canada sets records for adult-use cannabis sales almost monthly – evidence that the problems emanate from the businesses’ boardrooms, and their struggles should not be considered representative of the Canadian industry as a whole.

In an effort to rightsize their operations, more than 3,000 jobs have been eliminated by a handful of companies, and their cultivation footprints have been seriously curtailed.

The closures came after the industry significantly overshot the production capacity needed to meet demand in Canada’s expanding adult-use marijuana market.

Canopy’s Klein did not waste time after taking over as CEO at the start of this year.

Klein immediately launched a restructuring plan that ultimately led to about 1,000 job losses and shuttered facilities across the country.

But the company’s fresh focus on beverages, an unproven niche that accounts for a tiny fraction of industry sales, is risky, analysts say.

‘Not surprising’

Michaela Freedman, an international cannabis business consultant and founder of Toronto-based MF Cannabis Consulting, said Canopy’s troubles are symptomatic of a company that tried to “do anything and everything.”

“Internationally, they were buying up and building facilities from scratch, not really understanding the market – of course, because there wasn’t one,” she said.

“They didn’t take the go slow approach like some good businesses do.”

After a global expansion spree in 2018 and 2019, Canopy has spent 2020 in full retreat.

In May, Canopy ceased cultivation in some parts of Africa, Canada, Colombia and the United States.

Canopy was among the Canadian producers – like competitor Aurora Cannabis – that had invested heavily in far-flung areas of the world where real medical marijuana markets remain years, maybe decades, away.

“I think Canopy is finally accepting the repercussions of their terrible business model, and I think they probably should have closed down some of these facilities and rolled back some of their foreign engagement a lot sooner,” Freedman said.

“It’s unfortunate, but I think a lot of people have learned from Canopy. I think we’re going to see a lot of better businesses.”

Canopy’s shares trade as CGC on the New York Stock Exchange and WEED on the Toronto Stock Exchange.

Matt Lamers is Marijuana Business Daily’s international editor, based near Toronto. He can be reached at mattl@mjbizdaily.com.