The number of financial institutions actively banking marijuana-related businesses in the United States is rising, but the true number is far fewer than U.S. Treasury data indicates, according to one industry executive.

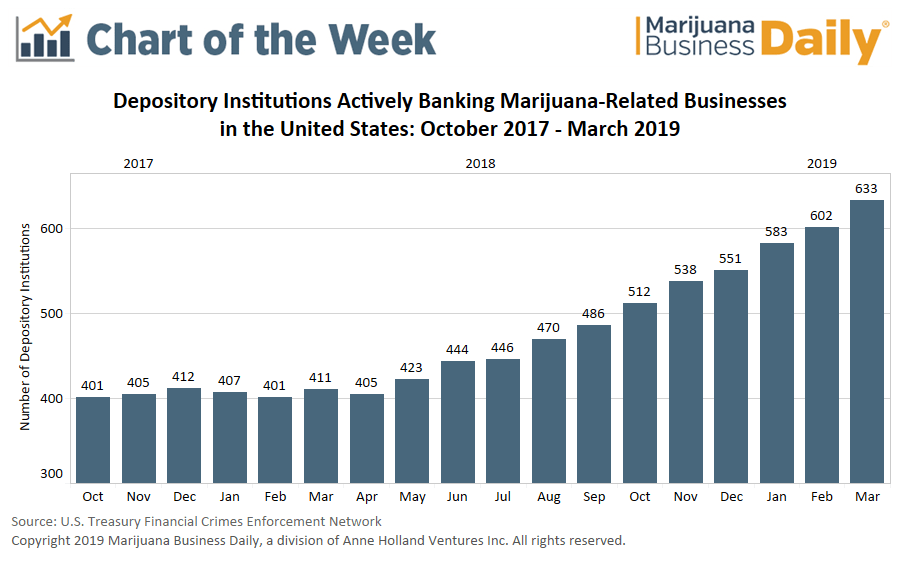

Data released by the U.S. Treasury’s Financial Crimes Enforcement Network (FinCEN) shows the number of banks and credit unions actively banking marijuana-related businesses has increased steadily, reaching 633 institutions at the end of the first quarter versus a little more than 400 at the start of 2018.

But these numbers are misleading, according to Tyler Beuerlein, executive vice president for business development at Scottsdale, Arizona-based Hypur, a technology provider that enables depository institutions to bank highly regulated industries, including cannabis.

Beuerlein said the FinCEN numbers don’t reflect the true number of depository institutions openly banking cannabis businesses because they are based on suspicious activity report (SAR) filings.

A SAR is filed when an account is suspected of being affiliated with a cannabis business and sometimes results in the account being closed.

As such, a SAR is not necessarily an indicator of an open, transparent relationship between a financial institution and a marijuana business.

Instead, Beuerlein – who also serves as vice chair of the National Cannabis Business Association’s Banking Access Committee – suggests the estimate be based on factors that demonstrate a depository institution actually wants to serve marijuana businesses, including:

- The institution is actively banking 10 or more plant-touching operators.

- The institution has dedicated marijuana-related business programs.

- The institution is actively seeking to increase the number of marijuana businesses it serves.

Beuerlein pegs the number of banks and credit unions following this description at fewer than 40.

Despite this relatively low number, Beuerlein said banks and credit unions are entering the space and believes the majority of plant-touching marijuana businesses now have access to banking services.

Here’s what else you need to know about the situation:

- The highest concentration of depository institutions actively banking marijuana-related businesses is in the Pacific Northwest, with the greatest growth now occurring in California, according to Beuerlein.

- He said banks currently outnumber credit unions in terms of number of institutions but that credit unions tend to have a higher volume of marijuana clients than banks.

- The 2019 Marijuana Business Factbook found 90% of ancillary businesses serving the marijuana industry have access to banking compared with 76% of plant-touching companies.