(This story has been updated from an earlier version.)

Merger and acquisition activity is heating up in Canada, which has put a spotlight on the growing disparities between the U.S. and Canadian cannabis industries.

Here’s what you need to know about the situation:

- Canada effectively legalized medical marijuana at the federal level in 2001 and began authorizing the production of MMJ through federally licensed producers in 2014. Many of the country’s largest MMJ producers are publicly traded, giving them relatively easy access to banking and capital.

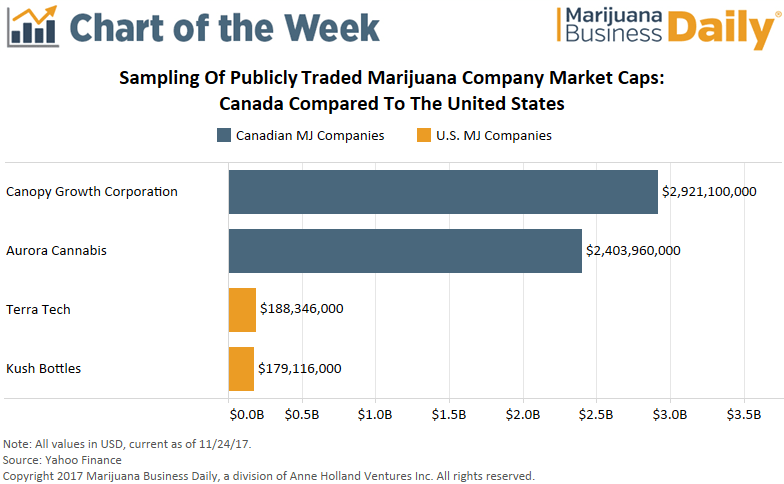

- Because of the federally illegal nature of marijuana in the United States, the country’s largest publicly traded businesses that focus specifically on the marijuana industry – Terra Tech Corp. and Kush Bottles – are not able to work with cannabis in as straightforward a manner as Canadian marijuana companies. Kush Bottles (OTC: KSHB) does not actually touch the plant, while Terra Tech (OTC: TRTC) is a holding company for several plant-touching subsidiaries. Though these companies are allowed to trade on over-the-counter markets, their overall value is limited relative to public marijuana companies in Canada.

- To date, Canada has issued 74 MMJ production licenses, though only about half the licensees are authorized to actually sell medical cannabis to patients. In the United States, there are an estimated 8,600 plant-touching businesses operating in medical and recreational markets throughout the country.

- Canada’s Aurora Cannabis and Canopy Growth Corp. have made significant moves in recent weeks. After making a friendly bid of 544 million Canadian dollars ($425 million) for rival marijuana producer CanniMed Therapeutics, Aurora is attempting a hostile takeover. Canopy Growth announced a joint venture with Amsterdam’s Green House Brands and Denver-based Organa Brands to create products for the global marijuana market and also secured a 12% stake in Mississauga, Ontario-based TerrAscend. Since Oct. 20, the price of Canopy Growth stock (Toronto Stock Exchange: WEED) has risen 46%, while Aurora (TSE: ACB) has seen its price shoot up 107%.

Eli McVey can be reached at elim@mjbizdaily.com

To sign up for our weekly Canada marijuana business newsletter, click here.