The Annual Marijuana Business Factbook 8th Edition

Exclusive U.S. Marijuana Business & Finance Data

Need realistic data and financial numbers for American marijuana-related businesses?

Download your copy of MJBizDaily’s bestselling FACTBOOK 2020 for just $199.

- Marijuana Business FACTBOOK 2020: 261 pages

- DECEMBER UPDATE NOW AVAILABLE: New data for 15 charts plus state-by-state data

- 101 exclusive charts

- Market details for 36 states + DC

- Cultivator, product, retail & investor financial information

- An exclusive report from Headset on COVID-19 and the Cannabis Industry

[purchase_link id=”208274″ text=”Order Digital Factbook” style=”button” color=”white”]

Exclusive Data for Your Business

Who Benefits from the Marijuana Business Factbook

Entrepreneuers

Put together a business plan — or adjust it for COVID – more easily.

Get financial charts for wholesale cultivation, marijuana products and retail, including:

- Revenues

- Expenses

- Net product margins

- Typical start-up costs

Private equity

Check the FACTBOOK to see if company projections are realistic.

Includes:

- State-by-state and niche-specific market data

- How much other investors are putting into the sector

- Whether COVID should change your strategy

Business owners

Compare your financials to the “norm.” Use this data to compete,

forecast and pitch investors.

- Top 10 mistakes businesses make when pitching investors

- Interest rates for cannabusiness loans

- Forecasts for how COVID may affect your business

Questions? Call 720-213-5992, ext.1 or email to CustomerService@MJBizDaily.com

[tabby title=”Table of Contents”]

Chapter 1: National Cannabis Industry Facts, Figures & Trends – 1

Chapter 2: State-By-State: Legal Overview, Market Data and Outlook – 25

Chapter 3: Wholesale Cultivators: Financial and Operational Data – 175

Chapter 4: Cannabis Product Manufacturers: Financial and Operational Data – 193

Chapter 5: Cannabis Retailers: Financial and Operational Data – 213

Chapter 6: Cannabis Business Funding & Investing – 245

Appendix

[tabby title=”Top Charts”]

- Highest Paying Cannabis Industry Jobs

- Profitability of Wholesale Cultivators: Year -Over-Year Comparison & Net Profit Margins

- Annual Revenue & Operating Costs Per Square Foot for Indoor Cultivators

- Fastest Growing Adult-Use Edibles & Topicals Subcategories by Market

- Cannabis Product Manufacturers: Revenue, Expenses & Startup Costs

- Average Basket Sizes by Market & Time Period

- Profitability of Retailers in 2019

- Global Cannabis Industry Investments by Sector & Year

- Investors’ Primary Considerations When Evaluating Cannabis Business Investments

[tabby title=”Full List of Charts”]

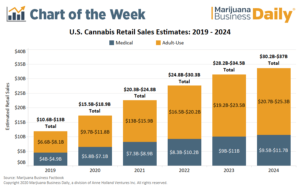

UPDATED Chart 1.01: U.S. Cannabis Retail Sales Estimates: 2014-2024

UPDATED Chart 1.02: U.S. Cannabis Industry Total Economic Impact: 2019-2024

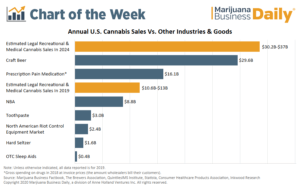

Chart 1.03: Annual U.S. Cannabis Sales Vs. Other Industries & Goods

Chart 1.04: Estimated Number Of Cannabis Businesses In The United States: 2020

Chart 1.05: U.S. Cannabis Industry Employment Estimates: 2019-2024

Chart 1.06: Number Of Full-Time Workers In The Cannabis Industry

Chart 1.07: Nationwide MMJ Patient Counts: 2014-2019

UPDATED Chart 1.08: Marijuana Legalization By State

Chart 1.09: 2020 Adult-Use Cannabis Sales By Week & Market: Percent Change Vs. Same Week In 2019

Chart 1.10: Adult-Use Cannabis Sales By Month & Market In 2020: Percent Change Vs. Same Month In 2019

Chart 1.11: Monthly Adult-Use Cannabis Sales In Massachusetts & Oregon

Chart 1.12: Monthly Cannabis Sales In A Sampling Of Medical Markets

UPDATED Chart 1.13: Vape Pens Share Of Adult-Use Cannabis Sales By Market & Month

UPDATED Chart 1.14: Overview Of Public Cannabis Market Performance

UPDATED Chart 1.15: Overview Of Cannabis Industry Investment Climate

Chart 1.16: Support For Marijuana Legalization & Portion Of U.S. Population That Has Used Cannabis In The Past Month: Breakdown By Year

Chart 1.17: Overview of Major Federal Marijuana Reform Bills In Congress

UPDATED Chart 1.18: Current Status Of State Cannabis Legalization Efforts: Breakdown By Status, Bill Type & Market

Chart 1.19: Selection Criteria For Awarding Adult-Use Retail Licenses In Illinois

Chart 1.20: Adult-Use Cannabis Markets In Illinois & Michigan: Monthly Sales & Estimated Sales By 2024

UPDATED Table 2.1: State-By-State Cannabis Sales Estimates For 2020

UPDATED Table 2.2: Number Of Registered Patients And Operating Medical Marijuana Dispensaries By State

UPDATED Table 2.3: Number Of In-State Customers And Operating Retail Stores By State In 2020

Chart 3.01: Commercial Cannabis Markets That Allow Wholesale Cultivation Businesses

Chart 3.02: Number Of Cultivation Licenses & Sales-To-License Ratio In Sampling Of Adult-Use & Medical Cannabis Markets

Chart 3.03: Total Five-Year Cost Of License & Application Fees For Wholesale Cultivators In Sampling Of Medical & Adult-Use Markets

Chart 3.04: Colorado’s Adult-Use Cannabis Market: Average Market Rate For Wholesale Flower & Number Of Cultivation Licenses Issued

Chart 3.05: Weekly U.S. Wholesale Cannabis Spot Index: May 2019 Through April 2020

Chart 3.06: Top Challenges For Wholesale Cultivators

Chart 3.07: Portion Of Investors Planning Investments In Wholesale Cultivation Businesses: Breakdown By Year

Chart 3.08: Wholesale Cultivator Business Expectations For 2020

Chart 3.09: Share Of Adult-Use Cannabis Sales By Year In California, Colorado, Nevada & Washington State

Chart 3.10: Total Number Of Flower Brands & Share Of Flower Sales By Brand: Breakdown By Market & Year

Chart 3.11: Colorado’s Adult-Use Flower Market: Share Of Sales By Brands By Annual Revenue

Chart 3.12: Colorado & Washington State’s Adult-Use Flower Market: Price Difference Of Top 10 Brands From Statewide Average In 2019

Chart 3.13: Wholesale Cultivators: What Is The Key Differentiator Of The Cannabis You Grow?

Chart 3.14: Colorado’s Adult-Use Cannabis Market: Average Market Rate For Wholesale Cannabis Allocated For Retail Vs. Extraction

Chart 3.15: Profitability Of Wholesale Cultivators: Year-Over-Year Comparison & Net Profit Margins In 2019

Chart 3.16: Annual Revenue & Operating Costs Per Square Foot For Indoor Cultivators In Adult-Use Markets

Chart 3.17: Wholesale Cultivators: Typical Number Of Employees & Annual Revenue Generated Per Full-Time Employee

Chart 4.01: Manufactured Cannabis Products Hierarchy

Chart 4.02: Cannabis Products: Specialty Goods Vs. Commodities

Chart 4.03: Adult-Use Cannabis Markets In California, Colorado, Nevada & Washington State: Combined Cannabis Product Sales & Share

Chart 4.04: Top 10 Highest-Paying Cannabis Industry Jobs In 2019

Chart 4.05: Top Challenges For Cannabis Product Manufacturers

Chart 4.06: 2019 Adult-Use Cannabis Sales & Sales Percent Change From 2018: Vape Pens, Concentrates & Edibles

Chart 4.07: 2019 Adult-Use Cannabis Sales & Sales Percent Change From 2018: Beverages, Capsules, Tinctures And Sublinguals & Topicals

Chart 4.08: Fastest-Growing Adult-Use Edibles & Topicals Subcategories From 2018 To 2019 By Market

Chart 4.09: Concentration Of Colorado & Washington State’s Adult-Use Cannabis Product Market: Breakdown By Category & Year Using HHI

Chart 4.10: Colorado & Washington State Adult-Use Cannabis Markets: Number Of Retailers & Brands Per Category By Year

Chart 4.11: Equivalized Item Prices By Year & Market: Concentrates & Vape Pens

Chart 4.12: Equivalized Item Prices By Year & Market: Edibles, Topicals & Beverages

Chart 4.13: Vape Share Of Adult-Use Cannabis Sales By Month & Market

Chart 4.14: Timeline Of Significant Partnerships Between Cannabis Companies & Mainstream Brands To Create Infused Cannabis Products

Chart 4.15: Excise Tax Rates In Illinois’ Adult-Use Cannabis Market

Chart 4.16: Year-Over-Year Comparison Of Cannabis Product Manufacturers’ Business Expectations For The Next 12 Months

Chart 4.17: Cannabis Product Manufacturer Overview: Revenue, Expenses & Startup Costs

Chart 4.18: Portion Of Profitable Cannabis Product Manufacturers & Net Profit Margins In 2019

Chart 4.19: Cannabis Product Manufacturers: Number Of Full- & Part-Time Employees

UPDATED Chart 5.01: Retail Cannabis Market Overview: Number Of Markets & Estimated Retail Sales By Year

UPDATED Chart 5.02: Retail Cannabis Sales By Market & Year

UPDATED Chart 5.03: Estimated Sales In 2024 & 2020-2024 CAGR In Sampling Of MMJ Markets

UPDATED Chart 5.04: Estimated Sales In 2024 & 2020-2024 CAGR In Sampling Of Adult-Use Markets

Chart 5.05: Number Of Medical & Adult-Use Dispensaries & Sales To Dispensary Ration In Sampling Of Adult-Use & Medical Cannabis Markets

Chart 5.06: Number Of Adult-Use Cannabis Retail Stores Per 100,000 Residents

Chart 5.07: Total Five-Year Cost Of License & Application Fees For A Sampling Of Medical & Adult-Use Cannabis Markets

Chart 5.08: Retail Business Structure Overview By Market

Chart 5.09: Overview Of Medical Cannabis Markets With Product Sales Restrictions

Chart 5.10: Impact Of Legalizing Adult-Use Cannabis On MMJ Patient Counts In Colorado, Illinois, Massachusetts, Nevada & Oregon

Chart 5.11: Top Challenges For Cannabis Retailers

Chart 5.12: The Impact Of 280E On A Retailer’s Bottom Line

Chart 5.13: Cannabis Retailers: What Is Your Store(s) Key Differentiator?

Chart 5.14: 2019 Adult-Use Cannabis Sales & Sales Percent Change From 2018: Breakdown By Category & Market

Chart 5.15: Share Of Adult-Use Cannabis Sales By Year, Category & Market

Chart 5.16: Colorado & Washington State Adult-Use Cannabis Sales By Year

Chart 5.17: Colorado & Washington State’s Adult-Use Cannabis Market: Total Units Sold & Average Equivalized Item Price By Category & Year

Chart 5.18: Colorado & Washington State’s Adult-Use Cannabis Market: Average Items Per Basket & Median Number Of Trips Per Shopper

Chart 5.19: Adult-Use Retail Cannabis Profit Margins: Breakdown By Category, Market & Year

Chart 5.20: Year-Over-Year Comparison Of Retailer’s Business Expectations For The Next 12 Months: Breakdown By Market Served

UPDATED Chart 5.21: 2020 Adult-Use Cannabis Sales by Week & Market: Percent Change Vs. Same Week In 2019

Chart 5.22: Average Basket Sizes by Market & Time Period

Chart 5.23: Share Of Adult-Use Cannabis Sales In 2020 By Market, Category & Time Period

Chart 5.24: Share Of Adult-Use Flower Sales By Week & Price Point In Washington State

Chart 5.25: Cannabis Retailers: Startup Costs By Business Type & Market Served

Chart 5.26: Cannabis Retailers: 2019 Revenue By Business Type & Market Served

Chart 5.27: Profitability Of Retailers In 2019

Chart 5.28: Number Of Retail Store Locations & Square Feet Of Retail Space Per Store For Dispensaries & Rec Shops

Chart 5.29: Retailers: Typical Number Of Full- & Part-Time Employees By Business Type & Market Served

UPDATED Chart 6.01: Global Investment Activity In The Cannabis Industry By Company Type & Year

UPDATED Chart 6.02: Global Cannabis Industry Investments By Sector & Year

UPDATED Chart 6.03: Global Cannabis Stock Index Performance Versus S&P 500

Chart 6.04: Portion Of Publicly Traded Companies Missing EBITDA Estimates: Breakdown By Quarter & Company Type

Chart 6.05: Portion Of The Population That Has Used Cannabis In The Past Month: Breakdown By Year, Region & Age Group

Chart 6.06: Adult-Use & Medical Dispensary Licenses: Total Issued In U.S. Compared To Sampling Of Publicly Traded U.S.-Based Cannabis Companies

Chart 6.07: Source Of Capital To Launch: Operational Plant-Touching Cannabis Businesses Based In The U.S.

Chart 6.08: Percentage Of Operational Marijuana Businesses Actively Seeking Funding Or Planning To In 2020

Chart 6.09: Typical Amount Of Funding Operational Cannabis Businesses Are Currently Seeking

Chart 6.10: Interest Rates Paid By Operational Plant-Touching Cannabis Companies

Chart 6.11: What Primary Factor Would Cause Active Investors To Stop Funding Cannabis Businesses?

Chart 6.12: Cannabis Industry Investors: Typical Investment Amount To Date, Additional Investment Amount Planned For 2020 & Size Of Each Investment

Chart 6.13: Types Of Cannabis Businesses Investors Have Previously Funded & Plan To Fund In 2020

Chart 6.14: Funding Stages Targeted By Cannabis Investors

Chart 6.15: Investors’ Primary Considerations When Evaluating Cannabis Business Investments

Chart 6.16: Top Mistakes Private Cannabis Businesses Make When Seeking Funding, According To Investors

[tabbyending]

Thank You to Our Annual Marijuana Business Factbook 8th Edition Data Partners