Demand for medical marijuana in Germany continued to increase in the third quarter, albeit at a slower pace than the previous quarter.

Total cannabis sales covered by statutory health insurance surpassed 50 million euros ($56.8 million) in the first nine months of 2018, with all categories of allowed medical cannabis posting gains between the second and third quarters.

The latest application deadline for cultivators passed earlier this month, and the winners of the 13 contracts to grow 200 kilograms (440 pounds) a year won’t be announced until at least April 2019.

This second call for applications was launched after the first solicitation process was halted.

Germany currently imports cannabis from the Netherlands and Canada.

‘Irregular growth (is) normal’

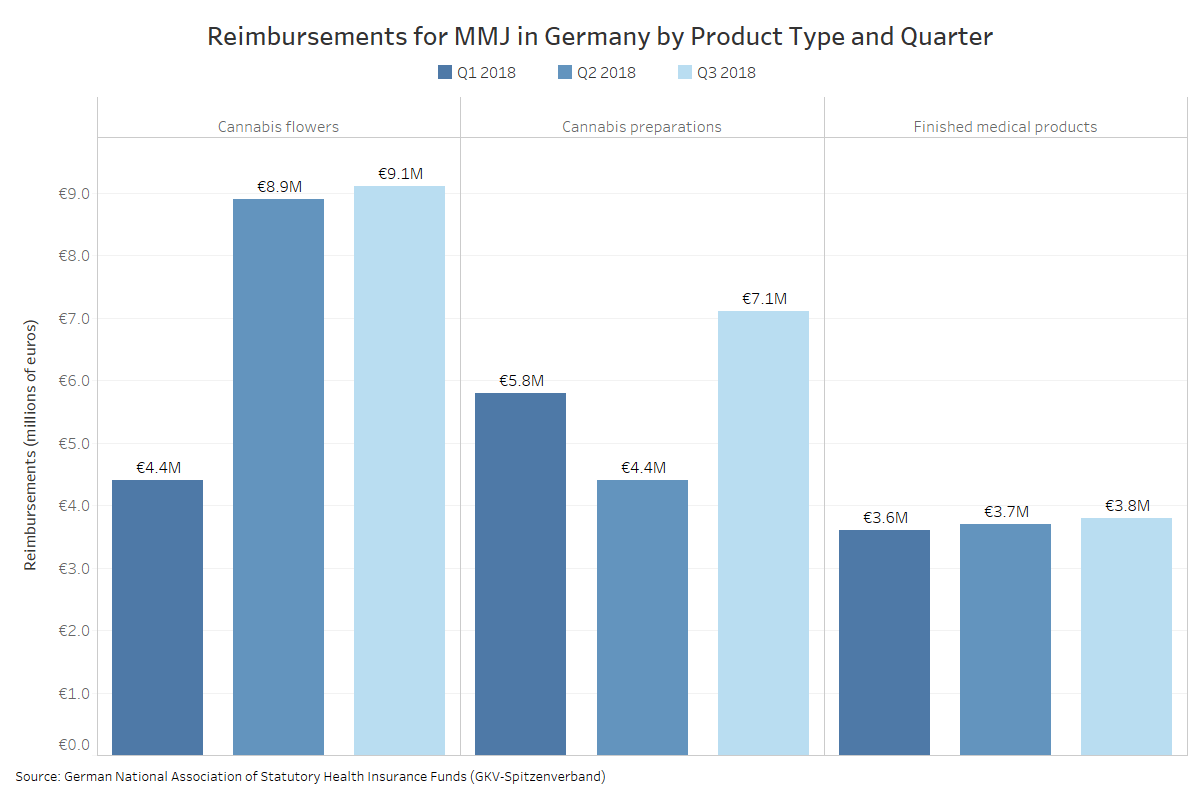

Germany allows for medical marijuana to be dispensed in three different categories, each of which saw very different changes in demand during the third quarter.:

- Unprocessed cannabis flower: After sales doubled from the first quarter to the second, they stagnated in the third at about 9 million euros. On average, this represents demand of roughly 150 kilograms per month.

- Cannabis preparations: Demand for cannabis preparations increased drastically in the third quarter, with statutory health insurance coverage valued at 7 million euros.

- Finished approved medical products: Coverage for finished cannabis products also increased slightly to 3.8 million euros, with Sativex accounting for the majority of products sold.

Sales to patients who independently pay for their cannabis prescriptions or have private health insurance are not included in the published data.

While the latest data show no significant growth in flower during the third quarter, the stagnation isn’t raising concern for companies already exporting to Germany.

On an annual basis, “sales of cannabis flowers and cannabis preparations almost tripled, clearly overtaking the prescriptions of finished medicinal products,” Hendrik Knopp, managing director of Aphria Germany, told Marijuana Business Daily.

The newness of the market is likely the primary reason for the slowdown, rather than any “material problems,” according to Pierre Debs, managing director of Ontario, Canada-based Canopy Growth’s European subsidiary, Spektrum Cannabis.

“Irregular growth is a normal aspect of a new program,” he said.

Tilray sued over product marketing

A spokesperson for British Columbia-based Tilray told MJBizDaily the company was sued earlier this year “regarding the compliance of an informational flyer with German laws governing advertising of pharmaceutical products.”

Tilray is the only Canadian company exporting extracts to Germany in addition to flower.

Those extracts are included in the “cannabis preparations” category.

“An organization acting on behalf of a competitor who wished to remain anonymous launched a competition law challenge against Tilray over said informational flyer claiming that Tilray was attempting to market its product as an approved medical product,” the spokesperson said.

“Tilray responded by issuing a cease-and-desist declaration for the informational flyer in question and destroyed all copies.”

On appeal, the Dusseldorf Higher Regional Court upheld Tilray’s right to distribute the extracts, but, according to the spokesperson, issued a ban on further materials that may give the “impression that it is a finished medicinal product with authorization.”

Alfredo Pascual can be reached at alfredop@mjbizdaily.com