(You can have cannabis finance content such as this delivered directly to your inbox. Simply sign up here for our weekly MJBizFinance newsletter.)

Deal of the Week / In partnership with Viridian Capital Advisors

Curaleaf takes marijuana debt financing to new level

Curaleaf Holdings (CSE: CURA; OTCQB: CURLF), the world’s largest cannabis company by market cap, announced the private placement of a $425 million senior secured note this week.

The deal includes:

- An 8% coupon.

- Five-year maturity.

- No original issue discount (OID), warrants or convertibility.

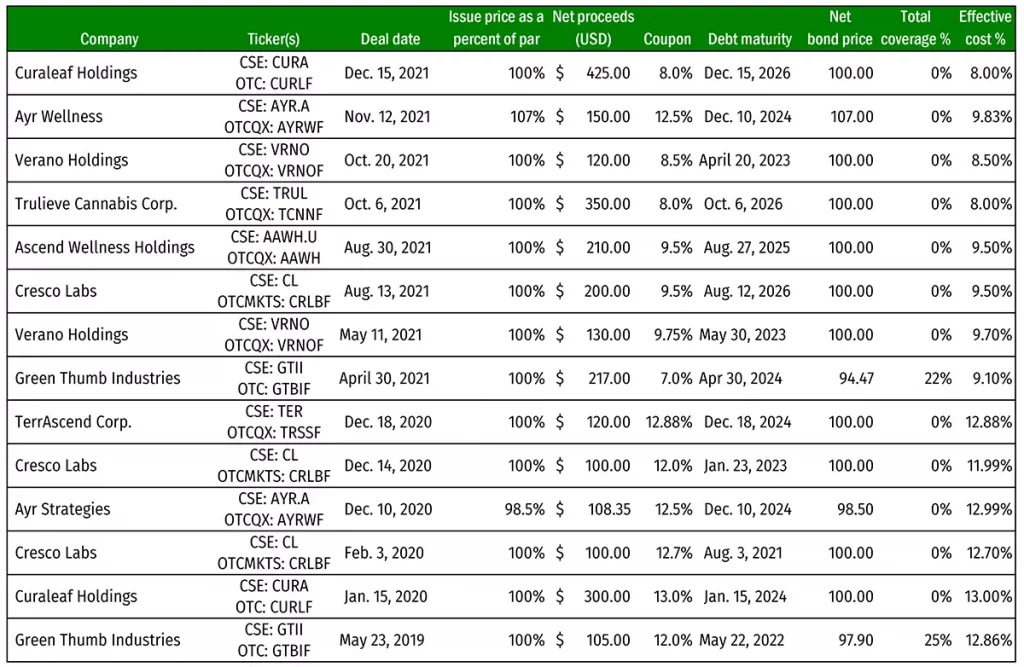

This offering is the largest debt deal ever completed by a U.S. multistate operator, as shown in the table below.

The table displays the most significant debt transactions completed in U.S. cannabis history, arranged in chronological order.

Larger transactions are becoming more popular because they cater to institutional investors entering the market and seeking more liquidity. There have been 14 debt transactions of more than $100 million; 11 have closed since December 2020.

Effective costs for these issues are trending steeply downward. The Curaleaf transaction ties for the lowest effective cost among large deals, matching Trulieve Cannabis Corp.’s issue in October.

There is still significant room for further tightening, however.

The Curaleaf issue, at 8%, represents a spread of 679 basis points over the five-year treasury, which corresponds closely to the Bank of America CCC index.

The BofA Single-B index is approximately 300 basis points tighter, demonstrating that Curaleaf might expect to do a five-year deal at 5% if it was viewed as a Single-B high-yield bond.

(Viridian Capital Advisors ranks Massachusetts-based Curaleaf as the No. 3 MSO credit, behind Green Thumb Industries and Trulieve, but believes it would garner a BB rating if federally legal.)

The upper tier of MSOs no longer needs equity-linked features in their transactions.

Early in cannabis financing, almost every transaction had convertibility or heavy warrant coverage because the “debt” was actually equity, as most companies had negative EBITDA.

The top-tier MSOs are now solidly EBITDA positive and would be cash positive if not growing at rapid rates.

The debt market is as bifurcated as the equity market. The same enormous valuation metric spread between the largest MSOs and everyone else is apparent in the debt market.

A graphic demonstration of this gap appears in the graph above.

Dollar-weighted average effective cost of cannabis debt spiked upward in the first half of December 2021 despite the record-setting Curaleaf placement.

Why?

The $93 million Schwazze deal completed earlier this month at an effective cost of 21.6% skewed the average upward to 10.44%.

The Schwazze transaction demonstrates the vast gulf between top-tier pricing and second- and third-tier pricing:

- Convertibility at a low (<10%) premium.

- Original issue discount (2%).

- High coupon (13% total, 9% cash, 4% payment-in-kind).

Other recent small transactions have been even more expensive.

The Greenwave Technology Solutions deal had a 6% OID, a total of 230% warrant coverage (combined convert with warrants) and carried an effective rate of more than 80%.

It is not factored into the average cost since Viridian now treats Greenwave as a non-cannabis company because of its shift into steel recycling.

Viridian believes more large debt transactions will hit the market as astute financial officers keep their equity powder dry, awaiting a catalyst for better equity pricing.

The difference between the Curaleaf and Schwazze deals demonstrates that the cannabis debt market has not fully matured.

Viridian expects to see reduced effective costs for lower-tiered credits as they show positive EBITDA and solid business strategies.

The learning curve for entering the cannabis industry is steep. Start with the fundamentals.

MJBiz Cannabis 101 Email Course

A 10-part email course designed to educate new hires and aspiring professionals on the key fundamental areas of the legal cannabis industry, including:

- History of legal cannabis in America

- Overview of plant-touching + ancillary business sectors

- Cannabis finance and investing

- Cannabis marketing and brand building

- Employment + hiring opportunities

- And much more!

Gain a comprehensive understanding of this complex industry with this free resource.

Why ESG is more than a buzzword in cannabis

I’ve used this space to talk about environmental, social and governance (ESG) policies in cannabis operations – particularly as it relates to attracting new investors to your business.

The catch is, it has to be a material program, not just lip service, especially for younger investors.

We ran a column this week that provides some great tips on how to build a material ESG plan for your company.

The nugget that caught my attention, however, is what “material” actually means to investors doing their due diligence on your operations.

“Materiality reflects what matters most to a company and where its greatest exposure might exist vis-a-vis various stakeholders.”

If your investors value ESG, they want to know that you do as well and are willing to take actions to address the issues related to those values.

That means making sure it’s an integral part of your operations and not just a one-off designed to make your company look better.

Not only that, implementing ESG-focused measures can boost your bottom line by ensuring you’re thinking about these issues for a long-term benefit to your operations.

For example, if you’re a cultivator, you had better be considering how you’d deal with a drought and/or water restrictions that have become more common because of climate change.

The world is changing, and investor expectations are changing with it.

Don’t miss out on funding by not paying attention.

– Jenel Stelton-Holtmeier