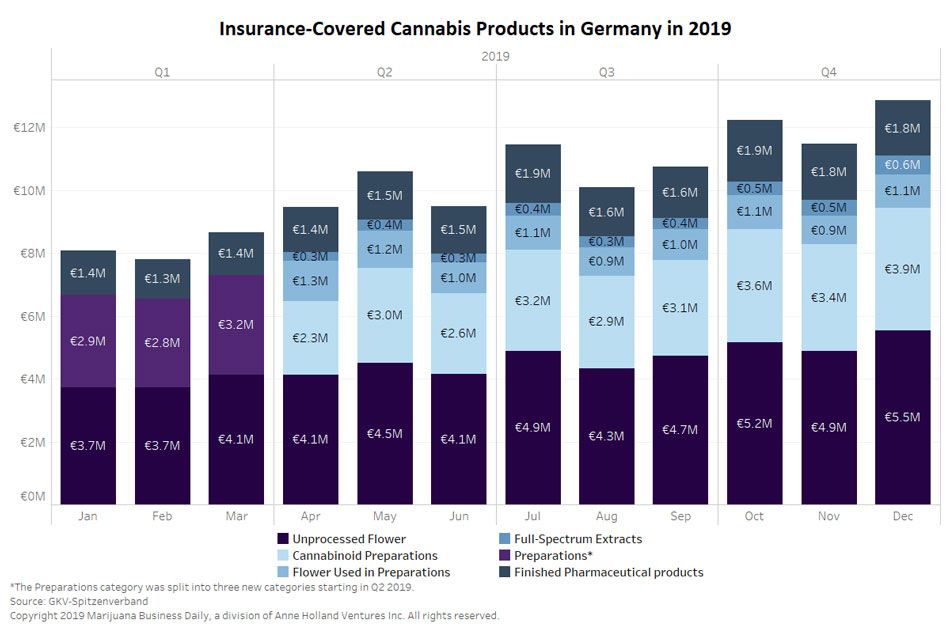

Insurance reimbursements for medical cannabis in Germany reached a new high during the October-December period, propelling total reimbursements last year up nearly 70% from 2018, according to new data from the German National Association of Statutory Health Insurance Funds (GKV-Spitzenverband).

Despite some supply issues toward the end of 2019, reimbursements for medical marijuana reached 36.6 million euros ($40 million) in the fourth quarter of 2019.

That is a 13% increase over the previous quarter, when 32.3 million euros worth of medical cannabis was reimbursed.

Statutory Health Insurers – which cover about 90% of the German population – reimbursed a total of 123 million euros ($132 million) of medical cannabis in 2019, in line with the “roughly 120 million euros” that Marijuana Business Daily forecast in December, when data for the last quarter of the year was still unavailable.

The 123 million euros reimbursed in 2019 represents a 67% jump over the 74 million euros reimbursed in 2018.

German pharmacies processed 267,348 prescriptions under the statutory program in 2019, up 44% from the 185,370 prescriptions they processed the previous year.

The larger increase in euros than in number of prescriptions indicates that doctors issued prescriptions for larger quantities on average.

December 2019 was the biggest month since the current regulatory framework was implemented in early 2017, with total reimbursements reaching almost 13 million euros that month.

Of that December total, 6.6 million euros worth of flower were reimbursed, up 14% from the 5.8 million euros covered by insurers in November.

Products from Canadian producer Aurora Cannabis became unavailable at the end of November. The December increase in flower reimbursement suggests German patients who had been using Aurora’s flower found replacement varieties from competitors.

Market size

All reimbursement data is based on retail prices at pharmacies, which are the only authorized points of sale to patients in Germany.

For products not included in the “finished pharmaceutical products” category, pharmacies mark up prices as much as 100%.

Reimbursement data does not include private prescription sales, which are paid out of pocket by patients.

Because reimbursement data doesn’t include privately funded prescriptions, the euros covered by statutory health insurers shouldn’t be considered as the total market value, which is somewhat higher.

The German government acknowledged earlier this month in a reply to a parliamentary inquiry that it doesn’t know how much cannabis was sold in Germany in 2019 because it has no data about private prescriptions.

Another way of assessing the total size of the German market is to look at import data because, so far, Germany has depended exclusively on international suppliers for most product categories, including flower.

A total of 6,719 kilograms (14,813 pounds) of flower were imported into Germany in 2019, “primarily for pharmacy dispensing,” according to government data.

Product mix

Germany continues to be – by far – the largest importer of medical cannabis in the world, with its domestic flower production not expected to reach the shelves until October 2020.

Through the end of 2019, all flower and full-spectrum extracts reimbursed had been imported either from Canada, the Netherlands or Portugal.

Flower – which includes the categories “unprocessed flower” and “flower used in preparations,” normally sold as ground flower – accounts for slightly more than half the total medical cannabis market.

It represented 51% of total cannabis reimbursements during the fourth quarter of 2019, almost exactly the same as the 52% it represented in the previous quarter.

Reimbursement of full-spectrum extracts grew slightly but remained at only 4% of the reimbursed market.

Coverage of cannabinoids preparations increased slightly from the previous quarter and now stand at 30% of the insurance-covered market.

The category is represented mostly by dronabinol manufactured in Germany by C3 – a subsidiary of Canada’s Canopy Growth – but also includes pharmaceutical CBD that several companies supply to pharmacies that sell it exclusively under prescription.

Finished pharmaceutical products, a category represented mostly by Sativex, slightly decreased from the previous quarter, reaching 15% of the reimbursed market in the quarter.

The latest

Despite lockdowns and border closures in Europe because of the coronavirus outbreak, no medical cannabis supply disruptions are expected in the near term.

An MJBizDaily survey of pharmacies on Monday showed the following flower varieties were readily available in different regions:

- All five Bedrocan varieties (imported from the Dutch Office of Medical Cannabis by several German wholesalers).

- Several varieties imported from Canada by Aurora, Canopy and Tilray.

- Several varieties imported by German wholesaler Cannamedical (the only company that currently imports from Canada, the Netherlands and Portugal).

Recently, new Canadian facilities received EU-Good Manufacturing Practice (GMP) certification, a key step to be able to supply the German market. But previous experiences show it could still take a while before their products become available to German patients.

Earlier this month, the German cannabis agency Cannabisagentur – part of German Federal Institute for Drugs and Medical Devices (BfArM) – launched an application process seeking a distributor to ship all future domestically produced medical cannabis flower to pharmacies.

According to the application-process documentation, the first delivery is expected in October 2020.

Only the German subsidiaries of Canadian companies Aphria and Aurora, along with Germany’s Demecan, are able to cultivate in Germany.

Combined, the three companies are expected to harvest 2,600 kilograms of pharmaceutical-quality cannabis flower annually over a four-year period.

They are permitted to sell their product only to the cannabis agency at the price offered during the application process, which was 2.3 euros per gram on average.

Alfredo Pascual can be reached at alfredop@mjbizdaily.com