The recent criminal conviction of the husband of Trulieve Cannabis CEO Kim Rivers has cast an unflattering spotlight on the multistate marijuana operator, focusing attention on how the profitable company secured its Florida business license and renewing questions about its dealings with a construction firm partly owned by Rivers’ spouse.

The case also offers lessons for all cannabis industry executives by shedding light on key issues that can, at the very least, affect public perceptions about a company and its top leadership. These same issues can carry legal and financial implications, too.

To be clear, neither Rivers nor Trulieve have been charged with any wrongdoing.

Moreover, J.T. Burnette’s conviction last month on five federal charges involving public corruption were related to his real estate development activities in Florida and had no connection to Trulieve.

Burnette was found guilty of participating in a multiyear scheme to extort bribery payments of $10,000 a month to a then-city commissioner in an effort to secure real estate development projects in Tallahassee. Sentencing is scheduled for Oct. 28.

The case created negative publicity about the Florida-based MSO because:

- Trial testimony revealed that in 2016, Burnette, Rivers’ boyfriend at the time, bragged to undercover FBI agents about helping prevent Trulieve competitors from winning a medical marijuana license in Florida’s new, voter-approved MMJ market.

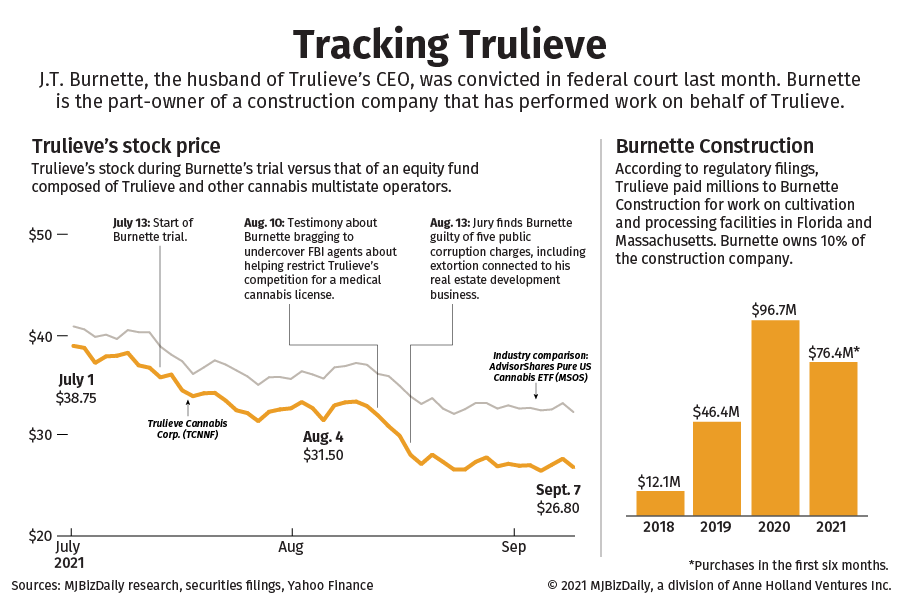

- In addition, an MJBizDaily examination of regulatory filings shows that Trulieve has contracted to pay more than $230 million since 2018 to Florida-based Burnette Construction for work in Florida and Massachusetts. Burnette owns 10% of the firm, according to Trulieve regulatory filings. Trulieve’s spending with Burnette Construction includes $96.7 million in 2020 and purchases of $76.4 million in the first six months of 2021, company regulatory filings show.

Such business transactions can raise potential conflict-of-interest issues – or, at the least, the appearance of them.

Mike Regan, founder of Denver-based MJResearchCo and a contributor to MJBizDaily and MJBizFinance, declined to comment specifically about the Trulieve-Burnette relationship.

But in general, he told MJBizDaily via email, investors in publicly held companies prefer stocks that don’t have such so-called “related-party transactions.”

“Investors worry about the potential for managers to use related-party dealings to enrich themselves at the expense of shareholders, and it is difficult from the outside to figure out if any related-party dealings are beneficial or harmful to shareholders,” Regan wrote.

For its part, Trulieve’s board of directors reiterated its “strong support” of Rivers shortly after the jury returned its guilty verdict on Burnette.

“We have consistently maintained that neither Trulieve nor our CEO are involved in the case,” Trulieve said in a Twitter post in response to Burnette’s conviction.

Trulieve and Rivers declined to comment for this article.

An ‘optics problem’?

The case “may be mostly an optics problem,” said Lauren Newell, an associate dean and professor at the Ohio Northern University Pettit College of Law who is an expert in marijuana and corporate law and previously represented businesses on behalf of the elite New York City law firm Boies Schiller Flexner.

The widely publicized court proceedings included the revelation that Burnette boasted to undercover agents about working with a state lawmaker/childhood friend to tweak medical cannabis licensing criteria in Florida that would prevent certain competitors from qualifying.

The comments focused attention on the circumstances surrounding Trulieve’s acquisition of a license to operate in the lucrative Florida medical cannabis market, which this year is expected to generate dispensary sales of up to $1.3 billion, according to the 2021 MJBizFactbook.

Trulieve won one of the initial five medical marijuana licenses in Florida and has held the top position in that market from the beginning, fueling the company’s growth and ability to expand to other areas of the country.

The Florida Department of Health, which regulates the state’s medical marijuana industry, didn’t respond to MJBizDaily inquiries about whether regulators will reexamine Trulieve’s licensing in light of the testimony that emerged during Burnette’s trial.

Trulieve in investor spotlight

Investors signaled their displeasure with both the trial and its outcome.

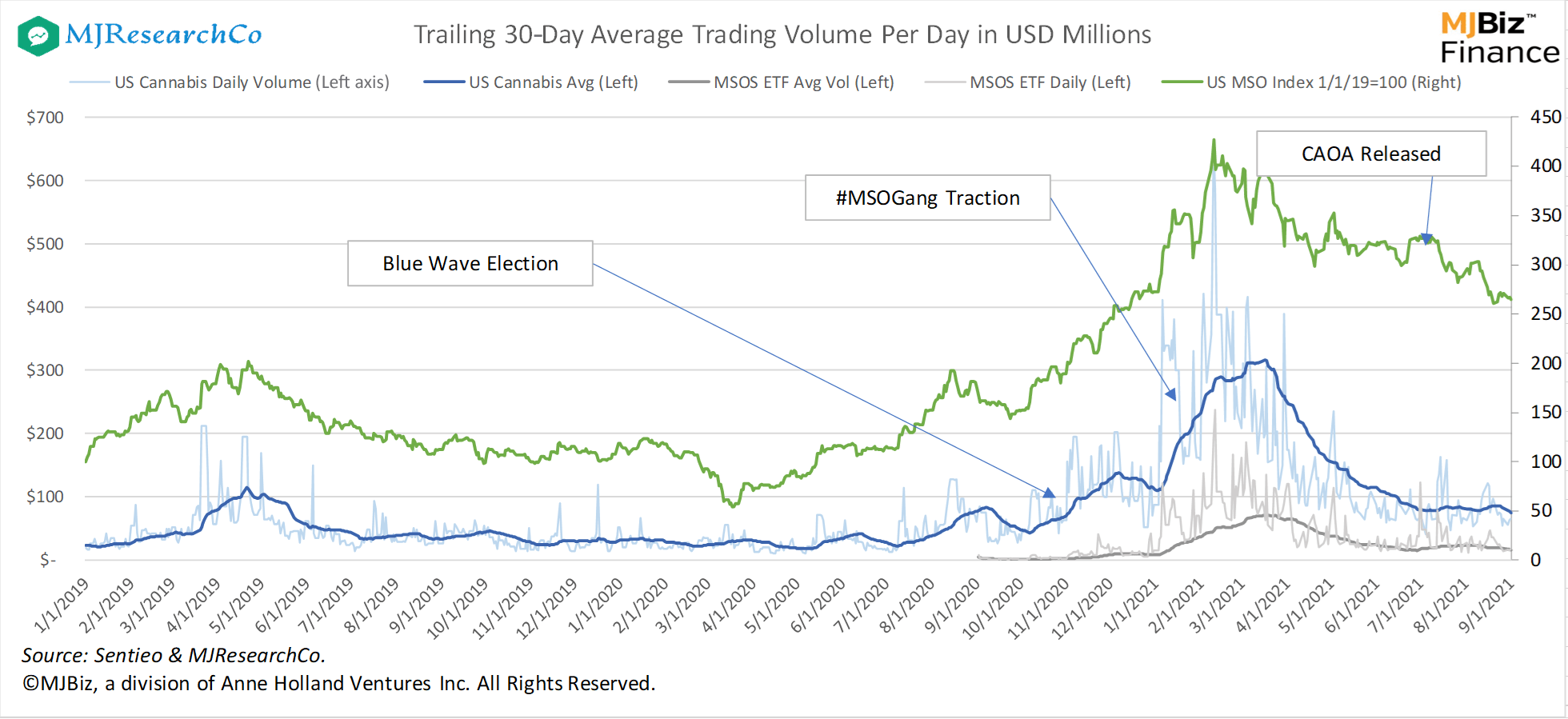

Cannabis stocks in general have declined sharply in recent months as hopes of federal legalization in the near term have waned.

Trulieve stock is no exception, but what distinguishes the company’s share declines in the past two months is how they have been tied to Burnette’s trial.

Trulieve shares, traded on the U.S. over-the-counter markets under the ticker symbol TCNNF and the Canadian Securities Exchange as TRUL, slid around 15% in the days after the trial started in mid-July, stabilized, then slumped another roughly 15% in the days after the mid-August jury verdict.

The post-verdict slide came despite the fact Trulieve only a day earlier had posted its 14th consecutive quarterly profit and an industry-best $40.9 million in earnings after beating expectations.

Rivers and Trulieve

Rivers was subpoenaed in 2017 for information in connection with the federal public corruption investigation involving Burnette, but, according to the company’s regulatory filings, no information requested from federal officials was related to Trulieve.

Burnette and Rivers had worked together in various business ventures before Rivers focused on the medical cannabis industry.

Trulieve said in a regulatory filing in 2019 that it concluded Rivers wasn’t a target of the federal corruption investigation, and the potential liability from the case wasn’t great enough to prevent her from continuing as CEO.

After the verdict against her husband was announced, Rivers tweeted that she had “never been more confident in the future of Trulieve nor more proud of what we have built over the past five years. I look forward to the future and am grateful for your support. Onward!”

Burnette transactions raise eyebrows

Concerns about Burnette’s transactions with Trulieve preceded his recent trial.

The late Robert Fagan, then an equity analyst with Stifel GMP in Canada, wrote in 2019 that the transactions involving Burnette “are admittedly not our favorite company attribute.” Fagan died in 2020.

An examination of regulatory and state filings revealed this about the Trulieve-Burnette relationship:

- According to Trulieve’s 2021 shareholder proxy statement filed with Canadian securities regulators, Burnette Construction has built Trulieve’s cultivation and processing facilities. The builder also provides labor, materials and equipment on a cost-plus basis.

- In 2020 alone, Trulieve paid $96.7 million to Burnette Construction, according to the company’s 10-K annual report to the U.S. Securities and Exchange Commission. The projects were mostly in Florida but included $39 million for work on Trulieve’s facility in Holyoke, Massachusetts, according to the proxy statement.

- Burnette incorporated the firm as Burnette Construction & Development in 1998, according to Florida Division of Corporations records, and was sole owner until gradually transferring most of his ownership in 2015 and 2016 to Caleb Burnette, who heads the Burnette commercial roofing business. J.T. Burnette then served as treasurer of Burnette Construction until stepping down in June 2019, a month after he was indicted, according to state records.

Newell said that “it’s not a problem per se” for Trulieve to have hired Burnette Construction.

“Sometimes it can even save a company money to contract with a related party because the company may get preferential terms in the deal,” she said.

But “it can look bad” and raise red flags if it’s not handled appropriately, Newell said.

Such transactions need to be fair to the corporation and its stockholders, meaning they are comparable to an arm’s length transaction, where the buyer and seller are unrelated, she said.

Approval by disinterested or independent directors after full disclosure can help prevent the transaction from raising liability issues.

How the transactions are disclosed to stockholders also is critical.

“Full disclosure saves you, and a lack of disclosure damns you,” Newell said.

Trulieve didn’t disclose the relationship in its 2019 shareholder proxy statement filed in Canada but has since done so in regulatory filings.

In a recent filing, Trulieve said the use of Burnette Construction “was reviewed and approved by the independent members of the board of directors, and all of the invoices are reviewed by our chief legal officer.”

Critical time

The conviction of Rivers’ husband comes at a pivotal time for Trulieve, given its pending acquisition of Arizona-based multistate marijuana company Harvest Health & Recreation.

The deal was valued at $2.1 billion when it was announced in May and touted as the largest U.S. marijuana transaction to date.

If the acquisition closes, as expected, Trulieve will gain a leading position in Arizona’s marijuana market, and the combined company will operate in 11 states, stretching across the Southeast, Northeast and Western United States.

Trulieve would rival Massachusetts-based Curaleaf as the largest marijuana operator in the U.S.

Behind Trulieve’s success stands Rivers.

“She’s not disposable, especially if you truly believe she had no part in the alleged wrongdoing,” Newell said. “You want to ride out the storm if you can.”

Jeff Smith can be reached at jeff.smith@mjbizdaily.com.