(This story has been updated to correct Glass House Brands’ name.)

After 2021’s record-breaking year for mergers and acquisitions, many marijuana industry insiders predicted that 2022 would be an even more active year.

But so far, that’s not been the case.

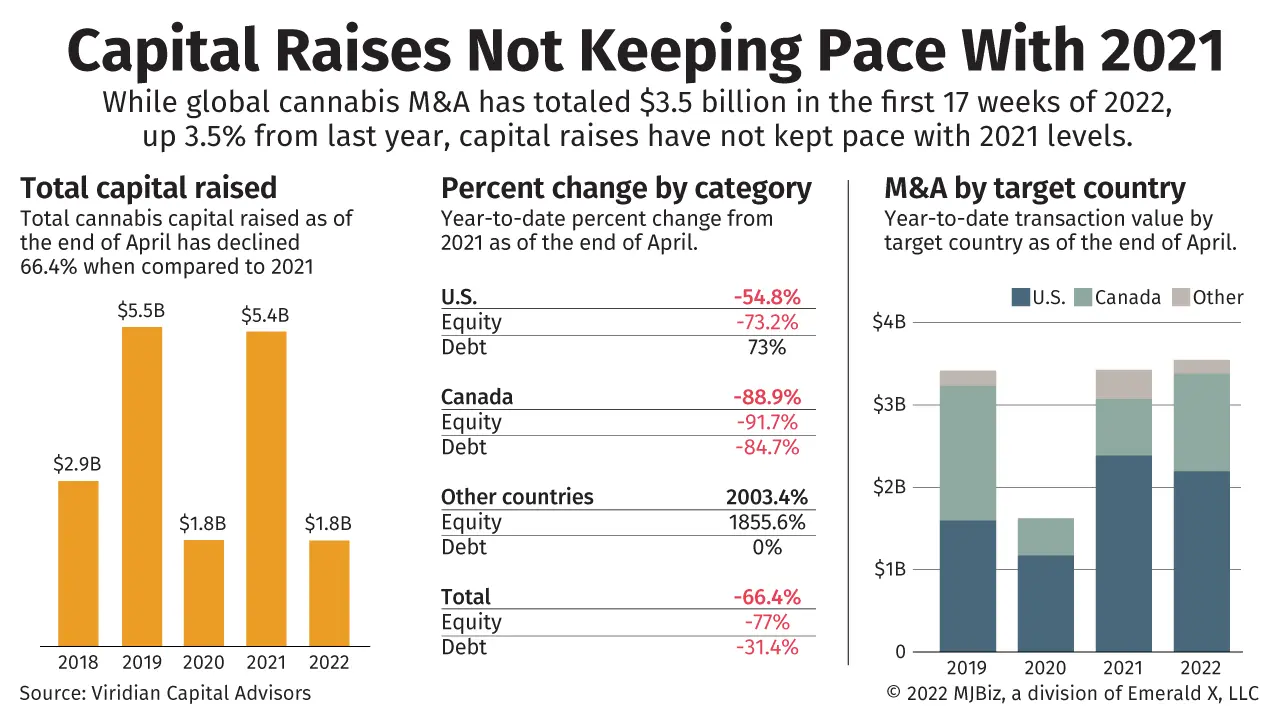

Total year-to-date M&A volume decreased by 62% in the United States compared to 2021, and there were 39% fewer transactions, according to Viridian Capital Advisors, a New York-based cannabis capital, M&A and strategic advisory firm.

But Frank Colombo, Viridian’s director of analytics, said consolidation activity remained healthy in 2022, particularly when megadeals such as Trulieve Cannabis’ $2.1 billion acquisition of Harvest Health & Recreation are taken out of the equation.

For comparison, he said that Jan. 1-Sept. 9, 2022, is about 9% ahead of 2020 for the same date range.

And two sizable deals involving multistate operators are likely to close soon: Cresco Labs’ $1.4 billion acquisition of Columbia Care and Verano Holdings’ $400 million purchase of Goodness Growth Holdings.

“2022 may be down, but it’s too soon to count it out in the M&A Olympics,” Colombo wrote in his Sept. 12 newsletter. “While (2022) is unlikely to catch 2021, it is far from a disastrous year for M&A.”

Capital raises are down

The marijuana industry isn’t the only one that has seen M&A slow in 2022, according to Morgan Paxhia, the co-founder and managing director of San Francisco-based Poseidon Investment Management.

There’s a cyclical nature to these types of deals, but cannabis capital markets have been particularly tight for the past 20 months, he said.

“The market wants to see (public marijuana companies) prove that they can be operating cash-flow positive or even free cash-flow positive, meaning after paying taxes and everything,” Paxhia said.

“That’s a big task to accomplish when you’re trying to be acquisitive, when you don’t have confidence in your ability to raise capital if you need to or what that cost of capital would look like because interest rates are obviously through the roof, right?”

High interest rates and low stock prices, Paxhia explained, mean stock-based M&A deals are more expensive, so such transactions are under more scrutiny.

According to Viridian, U.S. marijuana capital raises are down by nearly 65% year-to-date, and equity capital raises decreased by 97% for cannabis cultivators and retailers.

One reason for that, according to Viridian’s Colombo, is that larger companies are flush with cash.

They could raise capital now, but with rumors swirling that federal banking reform could be passed, it makes more sense to wait.

“If you really think the Secure and Fair Enforcement (SAFE) Act is going to go through this year, finally, then you’d be crazy to raise equity now,” Colombo said in a phone interview, referring to legislation that would allow U.S. financial institutions to serve state-legal marijuana businesses without fear of punishment.

“Why would you do that when the possibility of a big uptick in the market – maybe even looking six months into 2023 – there’s a possibility of uplisting. All that stuff is nothing but positive optionality for the MSOs.”

Smaller companies, on the other hand, are riskier investments, which could explain why their capital raises are also down.

“The one part of the market that has held in there the most are the medium-sized deals, like the $25 (million) to $100 million deals,” Colombo said.

“It’s kind of the Goldilocks zone, where those companies are viewed as big enough so that they’re not just venture-capital risk, but they’re small enough that they need the money, so they are going out and raising capital.”

Waiting on SAFE

If the U.S. Congress were to pass SAFE Banking reform this year, however, the industry’s access to capital could radically shift, with a likely upswing in stock prices and the potential for more institutional investment.

“It could completely change the landscape and reaccelerate things faster than in a more organic way,” Paxhia said.

Pablo Zuanic, managing director at New York-based investment banking firm Cantor Fitzgerald, said SAFE Banking could also help small and midsized companies stay afloat and ward off potential acquirers.

“Some of these companies don’t even have access to loans,” he said. “It’s not even a question of what the interest rate is, they just don’t have access.

“With SAFE Banking, a lot of them could have access. If I’m a second- or third-tier operator right now, it’s very tough for me. If I get SAFE Banking, I know I can maybe survive.”

If SAFE Banking does not pass, however, Zuanic said many small and midsized business owners will be forced to sell or, worse, shut down entirely.

Distressed M&A and regional hot spots

Cannabis companies in California and other mature marijuana markets could be eager to sell, but it will be tricky to attract buyers in the cultivation space.

Retail, on the other hand, is still evolving as many municipalities are still in the process of allowing sales.

According to Viridian’s Colombo, that’s one area that could be attractive to acquirers.

The potential for interstate marijuana commerce could also rapidly grow the value of cannabis cultivators in oversaturated, more mature markets.

Interstate commerce legislation recently was signed into law in California, with caveats, and is under consideration in New Jersey.

“California cannabis is known for higher quality at a lower cost,” said Matt Karnes, founder of New York-based marijuana financial consultancy GreenWave Advisors.

“Glass House Brands is a good example of a good brand with high quality and lower costs. They have a 5.5 million-square-foot facility. They’d be able to accommodate most of the U.S.”

A rescheduling of marijuana at the federal level also could invite acquisition offers from pharmaceutical, alcohol or other non-cannabis industries.

Without federal reform, however, M&A activity will continue to be driven largely by MSOs and focus less on distressed companies in the West and more on states with emerging markets.

Most multistate operators are well-positioned for revenue growth, Zuanic said, but examining an MSO’s revenue gaps within legal states is one way to identify where they might make their next acquisition.

Florida-based Trulieve, for example, makes most of its money in its home state, Arizona and Pennsylvania.

Meanwhile, a company that wants to be a “top-five MSO” would need to do business in the largest restricted markets, such as Illinois, New Jersey, New York and Virginia, Zuanic said.

Keep an eye on Cresco and Columbia Care

It’s tough to predict which companies will be ready to make acquisitions in the near future, but a few recent deals – including one that didn’t close – could be telling.

Trulieve, for example, might not be a candidate to acquire more companies since it could still be in the process of integrating its massive acquisition of Arizona’s Harvest Health, Paxhia said.

And earlier this month, New York-based multistate cannabis operator Ascend Wellness Holdings announced it had scrapped its planned acquisition of MedMen Enterprises’ New York operation, citing concerns about the California company’s assets.

To many, the move was a signal that the New York market is already too competitive to buy into.

Poseidon’s Paxhia, meanwhile, is keeping a close eye on Cresco’s acquisition of Columbia Care, which involves complex regulatory hurdles and rests on the sale of overlapping assets in states held by the two companies to obtain regulatory approval by state regulators.

“If that is proven to be successful, I do think that does open up opportunity for other situations like that to emerge,” Paxhia said.

“Because, if there’s confidence that there are buyers for those spun-out assets – creating basically a new MSO, as a result, then maybe whoever that new group is or the new groups are could go and do a similar thing with some other operators that could free them to make other moves.”

Kate Robertson can be reached at kate.robertson@mjbizdaily.com.