The medical cannabis market in Maryland is flourishing, with sales rapidly moving toward half a billion dollars a year.

Experts credit that success, in part, to clear and transparent regulations – and regulators who have balanced compliance with patient access.

But a huge lingering issue looms: litigation and investigations into a 2019 licensing round that was designed to boost diversity in the industry.

Four cultivation and 10 processing licenses hang in the balance, as does the state’s reputation to provide fair access to minorities and women.

With huge state funding shortages because of the massive impact of the coronavirus crisis, Maryland is under increasing pressure to legalize recreational marijuana, said Bridget Hill-Zayat, a Hoban Law Group attorney who is licensed to practice in Maryland, New Jersey and Pennsylvania.

But, she cautioned, “I think there are issues absolutely that have to be addressed, including minority ownership.”

Market with strong growth

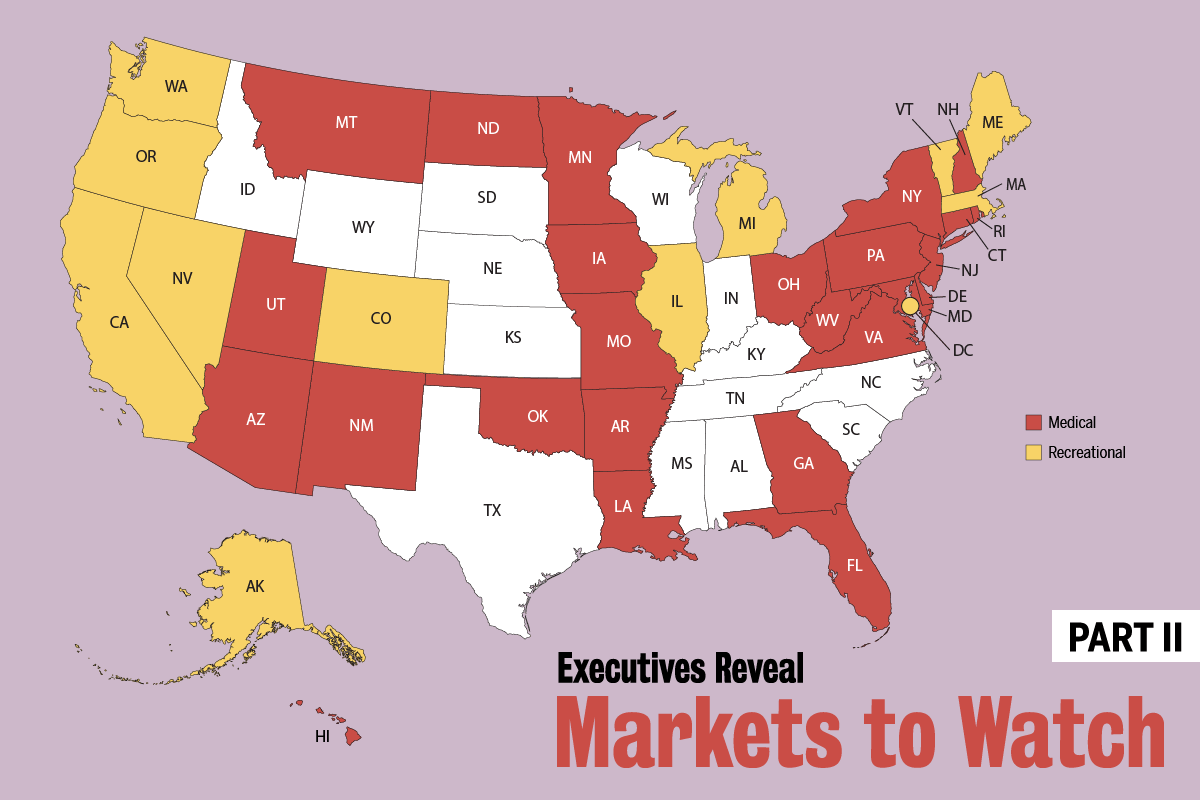

Maryland joins Florida, Oklahoma and Pennsylvania in a group of recently launched medical cannabis markets whose sales are overshadowing MMJ markets where adult-use programs recently launched, according to the new Marijuana Business Factbook.

Maryland’s MMJ market ranks near the top in the U.S. in terms of dispensaries (92) per capita – signaling the prospect of further sales and patient growth.

Consider:

- Sales have been growing exponentially since the market launched in December 2017. Sales reached $252 million last year, up from $109 million in 2018.

- The Marijuana Business Factbook projects sales will roughly double this year, to $425 million-$525 million, and reach $825 million-$1 billion by 2024.

- June sales totaled $37.6 million, up more than 20% since January. The number of registered patients also climbed 20% during that period, to 105,765 as of July 13, according to state figures.

- Maryland legalized edibles last year, providing another significant boost to the market.

That growth has come despite the state capping the number of dispensaries and cultivators as well as licensing costs that are some of the highest in the nation.

Still, the Maryland market has drawn the interest of many of the usual multistate operators as well as independents.

Adam Goers, vice president of corporate affairs for New York-based MSO Columbia Care, said the company has experienced strong sales from what he characterizes as a “great location” in Chevy Chase near Washington DC.

“We’ve seen and ultimately expect a good market,” Goers said. “I think it’s one of the best programs in the country in looking to balance regulatory needs and making sure it’s not standing in the way of patient access.”

He said Maryland is part of Columbia Care’s strong regional focus along the East Coast and Mid-Atlantic states.

Diversity issues linger

But the medical marijuana program’s Achilles’ heel has been lack of diversity. Only 10% of the program’s investors are minorities, according to a recent study.

Regulators opened licensing in 2019 to boost racial and gender diversity, but the effort has been mired in litigation and investigations.

The Maryland Medical Cannabis Commission last fall hired outside consultants to conduct two investigations:

- Determine whether the licensing evaluation process was fair.

- Check the veracity of information included in the top-ranking applications.

The commission is currently awaiting completion of those investigations, David Torres, the commission’s communications director, wrote in an email to Marijuana Business Daily.

According to Torres, the commission won’t consider awarding any license preapprovals from that round “until it has received and reviewed the findings of these investigations.”

Frustrated minority applicants

Jume Akinnagbe, the CEO of Remileaf, which applied for grower and processing licenses, said her group remains in litigation with the state over applications that weren’t accepted.

The case is complex, but Remileaf’s applications were refused for allegedly being late on a second submission deadline.

Akinnagbe said she arrived at the building on time but went in the wrong entrance. By the time she found the right entrance, it was 5:05 p.m. – five minutes after the deadline.

Akinnagbe, the owner of two sleep clinics in Maryland, said her investor-backed team includes her brother, who has a medical degree; other individuals with advanced degrees; and a cannabis grower with 18 years of experience on the West Coast.

“We’re not unaccustomed to challenges,” Akinnagbe told MJBizDaily. “A lot of us grew up in areas that were economically distressed.”

But she said the experience has led her to conclude that there are systemic, structural and political barriers to African Americans trying to break into the cannabis industry.

The state’s legislative Black Caucus also has been outspoken against Maryland’s licensing process.

Akinnagbe said the process has been “impoverishing” rather than empowering, costing the group about $200,000 so far in application and legal costs.

“What we want is just access to these licenses,” she said. “We want the ability to compete on fair ground, the ability to be transformational figures in our community.”

Prospects for adult-use legalization

It’s unclear when Maryland might take up recreational marijuana and how the lingering diversity issue might play into legalization efforts.

Democrats control the General Assembly, but “the Black Caucus in the General Assembly has been very vocal about disparity of ownership,” Hill-Zayat noted.

Gov. Larry Hogan is a Republican who has yet to warm to adult-use legalization.

Experts, however, view rec marijuana legalization as virtually inevitable given budget deficits, the Black Lives Matter movement and public support for legalization. The only question is when.

“States across the country are taking a look at this, whether it’s Maryland or its neighbor to the north, Pennsylvania,” Goers said.

In the meantime, Maryland’s medical marijuana market continues strong.

“Most of what I hear is that it’s a very robust market and people are doing well,” Hill-Zayat said. “A lot of licensees right now are expanding.”

She said she gets inquiries from those interested in breaking into the market, but by law, licensees must possess their permits for three years before they can sell.

Still, everyone is in a bit of a holding pattern because of the litigation over the licensing of additional cultivators and processors.

Said Goers: “I hope the courts and (state medical cannabis) commission can get this figured out soon.”

Jeff Smith can be reached at jeffs@mjbizdaily.com