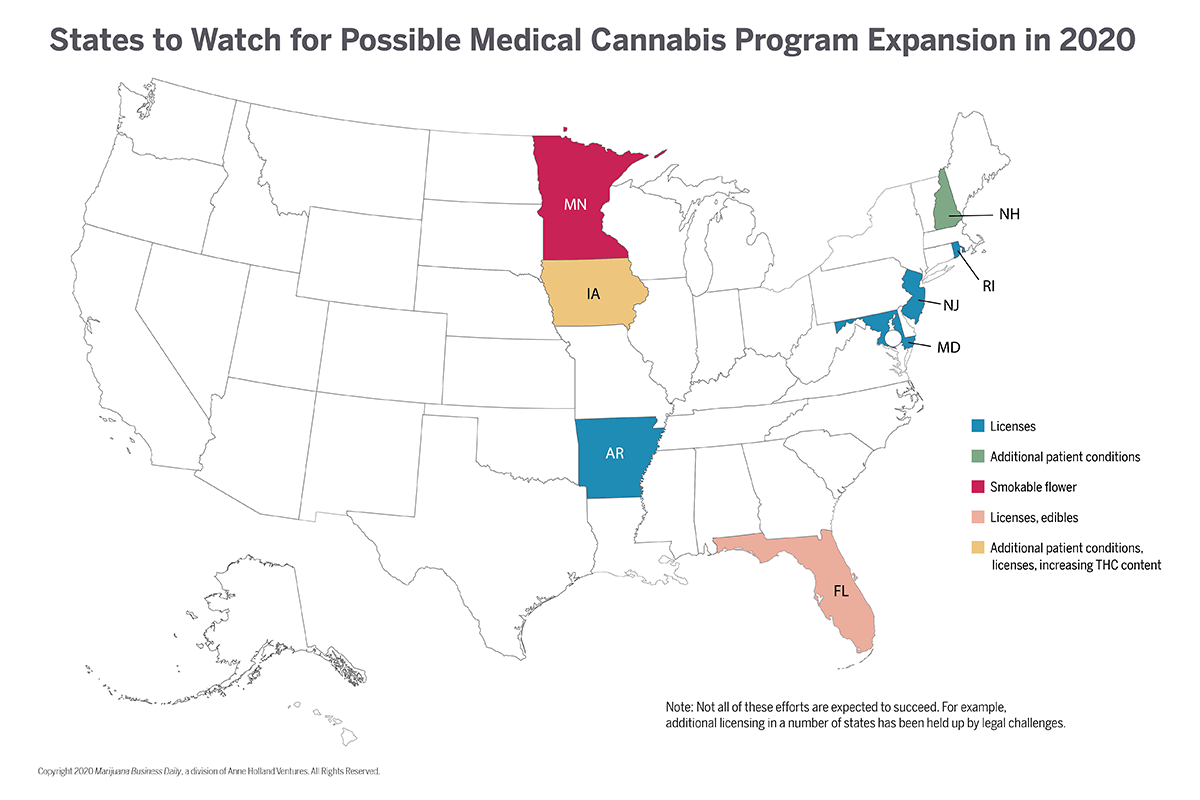

Several states could expand their medical cannabis programs this year through new laws or regulatory policies, opening the door to additional business licenses, more sales for existing cannabis operators and fresh business for ancillary companies.

The business prospects in the eight states listed below might not be as glitzy as new, hundred-million-dollar-plus cannabis markets. But they reflect the steady progress of medical marijuana programs across the country.

A caveat is that even while programs improve, medical marijuana sales tend to decline in states that also have recreational markets.

O’Keefe attributed potential medical marijuana expansion to state lawmakers who see that the “dire predictions of opponents don’t materialize.”

In recent years, numerous states have boosted MMJ business prospects by adding qualifying patient conditions and licensing additional cultivators, processors and dispensaries to meet growing demand.

But in some states, such as Florida, Maryland and New Jersey, new licensing opportunities have become mired in protracted legal battles.

Even in states where only existing medical marijuana operators benefit from program expansion, market growth can translate into additional business for ancillary companies ranging from equipment and packaging suppliers to law firms and accountants.

Here are the states to keep an eye on for possible medical marijuana opportunities in 2020:

Arkansas: State wants existing license holders to begin operations.

- 2019 dispensary sales: $28 million (state data).

- State of the market: Arkansas has licensed 32 dispensaries, but only 17 had opened their doors as of early February. Two licensed cultivators haven’t yet opened.

- What’s happening: Medical marijuana regulators, concerned about patient access and frustrated with delays, recently awarded a 33rd license to the next highest-ranking applicant in the Pine Bluff region to meet demand.

- Potential business impact: Arkansas MMJ spokesman Scott Hardin told Marijuana Business Daily “it would not be surprising to see additional licenses issued.”

Florida: High court might open door to stand-alone licenses; edibles a possibility.

- 2019 dispensary sales: $450 million-$550 million (MJBizDaily estimate).

- State of the market: Florida has 13 active vertically integrated operators out of 22 licensed companies, which together operate 222 dispensaries statewide as of Jan. 31. Trulieve has a 40%-plus market share.

- What’s happening: The Florida Supreme Court is expected to decide this year on whether to break up the state’s vertically integrated licensing structure so that individual business permits would be available. The state, which has one of the nation’s fastest-growing markets, also could finally issue rules for MMJ edibles sales.

- Potential business impact: The state could be compelled to issue additional, stand-alone licenses. Edibles could dramatically change the market landscape and bolster sales.

But Sally Peebles, a partner with Vicente Sederberg’s Florida law office, doesn’t anticipate new licensing this year.

Even if the Florida Supreme Court rules that the vertically integrated structure has been unconstitutional, she said it likely will take the state a while to draft new licensing rules and request applications.

Legislation also has been introduced to remove license limitations, but Peebles considers that effort a long shot to be passed into law this year.

Iowa: Legislative push to expand low-THC program.

- 2019 dispensary sales: $5 million-$6 million (MJBizDaily estimate).

- State of the market: Iowa has five dispensaries and a 3% THC cap.

- What’s happening: Some Democratic lawmakers want to add qualifying patient conditions and dispensaries as well as eliminate the THC cap. Gov. Kim Reynolds, a Republican, is open to some expansion but vetoed a bill last year that would have removed the THC cap.

- Potential business impact: The market is poised to become more robust, depending on the scope of any expansion.

Maryland: Additional licenses mired in litigation.

- 2019 dispensary sales: $252 million (state data).

- State of the market: Maryland counted nearly 90 dispensaries statewide as of late 2019. Minority-owned businesses failed to win any of the initial 15 cultivation licenses, even though Maryland law required racial diversity among licensees.

- What’s happening: The state ordered a new licensing round, which was conducted last year. More than 200 applicants competed for four cultivation and 10 processing licenses. The awards have been held up by legal challenges.

- Potential business impact: Additional licenses would bolster market sales and competition.

Minnesota: Licensees press for smokable flower.

- 2019 dispensary sales: $35 million-$45 million (MJBizDaily estimate).

- State of the market: This is one of the most restrictive medical marijuana programs in the country with just two vertically integrated operators: Minnesota Medical Solutions, owned by multistate operator Vireo Health, and LeafLine.

- What’s happening: Minnesota Medical Solutions and LeafLine are pushing for the legalization of smokable flower, saying it would lead to more affordable products.

- Potential business impact: Smokable flower could dramatically increase sales in a program that has struggled to be viable.

New Hampshire: Lawmakers could expand patient conditions.

- 2019 dispensary sales: $20 million-$25 million (MJBizDaily estimate).

- State of the market: New Hampshire has four licensed dispensaries that, thanks to legislation in 2018 and 2019, can open one satellite dispensary each.

- What’s happening: The state House recently approved adding insomnia and opioid-use disorder to the list of qualifying patient conditions, but the measure still needs Senate approval.

- Potential business impact: New conditions would likely boost MMJ sales for existing operators.

New Jersey: 24 dispensary licenses face legal challenges.

- 2019 dispensary sales: $95 million-$120 million (MJBizDaily estimate).

- State of the market: New Jersey has only seven dispensaries serving 60,000 patients.

- What’s happening: Expanding the state’s medical marijuana market was Plan B after an effort to legalize adult-use cannabis stalled last year. But 24 additional dispensary licenses are being held up because of court challenges.

- Potential business impact: Market growth will be constrained until new dispensaries come online.

Rhode Island: Six new dispensary licenses planned.

- 2019 dispensary sales: $50 million-$65 million (MJBizDaily estimate).

- State of the market: Rhode Island counts three dispensaries and 51 stand-alone cultivators.

- What’s happening: The state plans to issue six additional retail-only dispensary licenses.

- Potential business impact: New license opportunities are likely this year.

Jeff Smith can be reached at jeffs@mjbizdaily.com

Research editor Eli McVey contributed to this report.