(You can have cannabis finance content such as this delivered directly to your inbox. Simply sign up here for our weekly MJBizFinance newsletter.)

Marijuana multistate operator Parallel and special acquisition corporation Ceres Acquisition Corp. recently called off their $1.9 billion blockbuster merger.

Even without confirmed specifics about why the deal fell apart, the collapse highlights a few key things that operators need to keep in mind when looking at this mechanism for expansion.

Keep it real

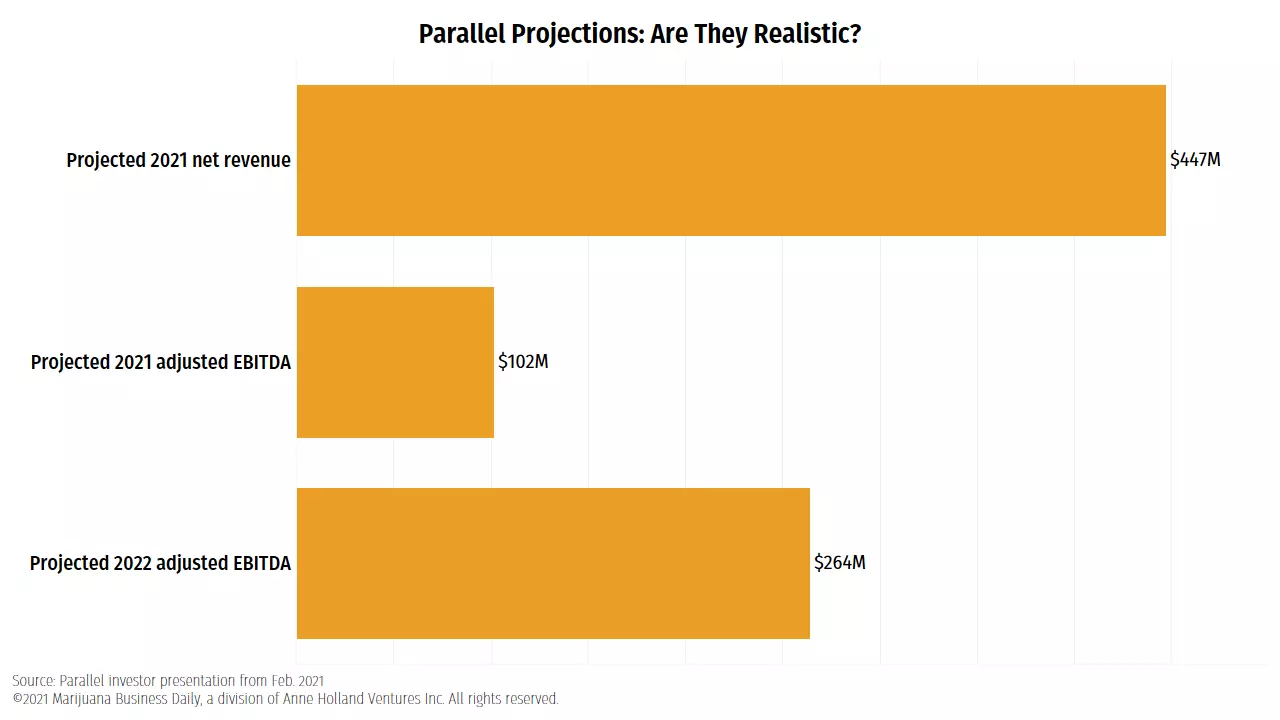

According to anonymous sources cited by Reuters, the deal fell apart because “several investors had lost confidence in Parallel’s ability to deliver on lofty financial projections it provided in February when the merger was announced.”

The cannabis industry has long been plagued by expectations that simply are not based in reality.

Operators make promises but have no history (often reasonably so) or documentation (less reasonable) as to how they plan to achieve their goals for their businesses.

Any good investor or acquirer will want to know not only where you want to go but also how you plan to get there.

Make sure you can provide a clear road map to support your expectations.

Get to ‘no’ quickly

One of the hardest things for an operator to do is to walk away from a deal they’ve already put a lot of time and effort into. But sometimes, the best option is to do just that.

As you go through the due-diligence process, if something seems unrealistic or just off, take a closer look. And if you can’t find a satisfying answer, walk away.

It’s far better to end a deal in the early stages than to face a catastrophic effort to integrate entities that simply won’t work well together.

Want to learn more about how to attract investors? Check out the latest issue of MJBizMagazine.

Prep yourself for intense due diligence by attending the MJBizFinance Forum in Las Vegas, part of MJBizCon Week!

Business leaders need reliable industry data and in-depth analysis to make smart investments and informed decisions in these uncertain economic times.

Get your 2023 MJBiz Factbook now!

Featured Inside:

- 200+ pages and 50 charts with key data points

- State-by-state guide to regulations, taxes & opportunities

- Segmented research reports for the marijuana + hemp industries

- Accurate financial forecasts + investment trends

Stay ahead of the curve and avoid costly missteps in the rapidly evolving cannabis industry.

Deal of the Week / In partnership with Viridian Capital Advisors

Akerna gets creative with corporate finance – and it’s all aboveboard

Akerna Corp. (Nasdaq: KERN), a leading enterprise software company, entered into a $20 million convertible debt financing agreement last week that will fund the company’s acquisition of 365 Cannabis.

Viridian Capital Advisors was the sole M&A adviser to 365 on the deal.

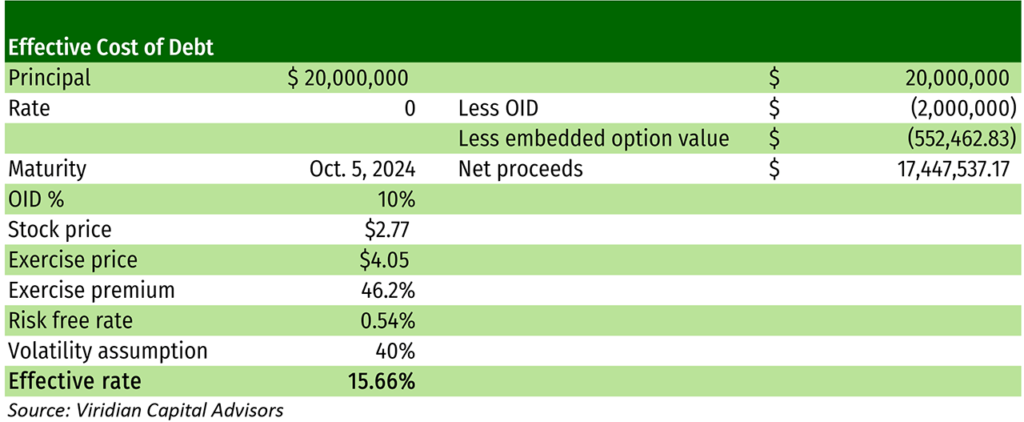

The transaction, which Viridian calculated to have an effective cost of 15.7%, appears expensive for a Nasdaq-traded, non-plant-touching company.

However, it also looks like innovative corporate finance.

Transaction details:

- Senior secured convertible notes mature on Oct. 5, 2024.

- The notes are issued at a 10% discount and do not bear interest.

- The conversion price of the notes is $4.05 per share (a 46% premium to the $2.77 stock price at the transaction date).

- The notes have monthly amortization payments of $1.1 million beginning in January 2022. Amortization payments increase to $1.2 million per month in April 2022. Akerna has the option to make installment payments either in cash or stock at the lower of the conversion price ($4.05) or 90% of volume-weighted average price for the trading day preceding the payment.

- Change-of-control provisions provide for payment of the greater of 115% of outstanding principal or 115% of the conversion value of the stock of outstanding notes.

- Akerna can prepay the notes at the greater of 121% of the principal or 115% of the conversion price applicable to installment payments.

Why is this transaction interesting?

As noted above, the agreement appears to be expensive. The effective cost is the internal rate of return (IRR) of the cash flows after subtracting the original issue discount (OID) and the value of the embedded options from the proceeds.

Viridian calculated a total value of approximately $552,000 for a series of options corresponding to each amortization payment. The chart below shows the assumptions.

- The IRR without the conversion option value would be approximately 12.15%, reflecting the OID and aggressive amortization schedule.

- The conversion option was calculated using a 40% volatility. Increasing the volatility assumption to 50% would increase the IRR to 18.3%

The deal is cleverly structured to give Akerna the right to prepay the notes at costs that essentially are the same as issuing equity at a 10% discount at each installment payment.

The investor locks in an attractive IRR with substantial equity upside.

How does Akerna look as a credit?

The Viridian Credit Tracker model ranks Akerna as the seventh-best credit out of the 12 software/media companies the firm tracks with more than $125 million market cap.

- The company’s ranking is hurt by higher than median debt/market cap and analyst estimates showing negative 2022 and 2023 EBITDA. The analyst estimates do not yet reflect any view on the impact of recent acquisitions.

- One mitigant is Akerna’s strong liquidity with pro forma cash of approximately $20 million.