Wholesale prices of marijuana and hemp oil have fallen from a year ago, according to industry executives, reflecting rising oil production nationwide that has more than offset an uptick in cannabis sales amid the coronavirus pandemic.

The drop in wholesale oil prices reflects multiple market factors working simultaneously – and sometimes at odds with one another.

In response, cultivators have been growing plentiful supplies of raw cannabis, from which oil is derived.

That, in turn, has put downward pressure on oil prices – despite robust demand for oil-derived products such as concentrates, edibles and vape pens.

Michelle Jun, head of sales at Green Mill Supercritical, a marijuana supercritical CO2 extraction equipment company based in Pittsburgh, said extracted products made from oil are taking up more and more market share.

“The demand for oil in general is increasing,” Jun said – though clearly not enough to offset the drop in prices.

Jun credits the increase in demand to a steady migration of consumers moving to concentrates and vape products to achieve more precise dosing when using cannabis for medicine and recreation.

Healthy supply

San Francisco-based Backbone, a supply chain-management software provider for marijuana and hemp producers, is seeing steady demand on the THC side for wholesale cannabis oil.

In California, a kilogram of cannabis distillate oil is selling for around $5,000 per kilogram, down from about $5,600-$6,000 per kilogram before the COVID-19 outbreak in the United States in March.

On the hemp-derived CBD side, THC-remediated crude oil is selling for less than $1,000 a kilogram in California, said Peter Huson, chief of operations at Backbone. Prior to the outbreak it sold for more than $1,000 a kilogram.

Hemp-derived CBD crude oil that still contains THC is selling for below $200 a kilogram, down from $400-$500 a kilogram before the coronavirus outbreak.

Huson attributes much of this increase in supply to marijuana being deemed an essential business when the pandemic first hit the United States.

“Cannabis is thriving right now,” he said.

Marijuana oil

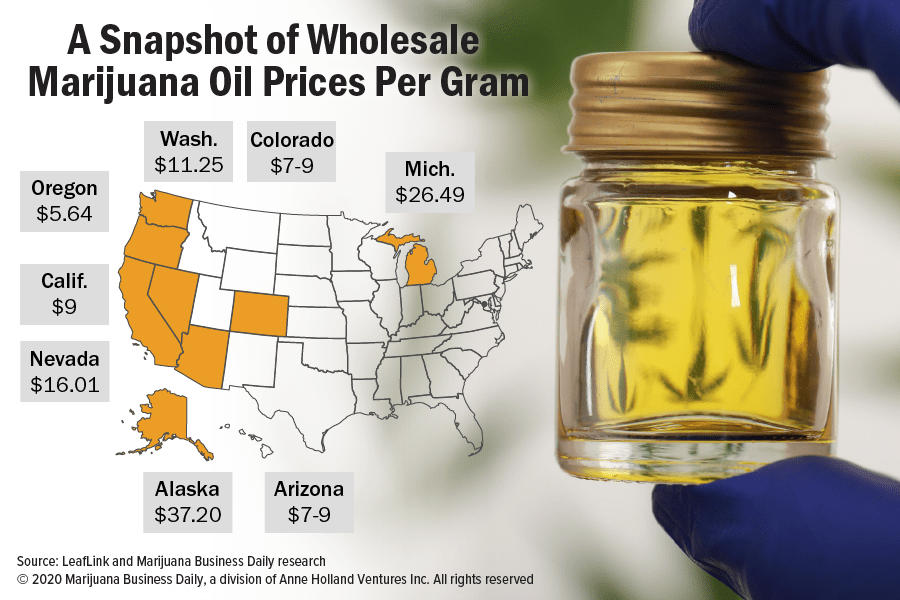

Data from Confident Cannabis, a Palo Alto, California-based software company that tracks wholesale marijuana markets, shows the following average price for a combined category of cannabinoid isolate, distillate, full extract cannabis oil and vape oil:

- California: $9 a gram.

- Oregon: $5.64 a gram

James Granger, general manager of Denver-based Clear Colorado Group, a cannabis-extract maker with products in several states, said that a gram of marijuana distillate oil testing at 90% THC is selling in Colorado for around $7-$9 a gram.

That’s down from 2019, when a gram was selling for around $11-$12, he said.

The price can fluctuate depending on the season and how much outdoor-grown marijuana is on the market.

Marijuana distillate oil in Oregon is “much cheaper,” Granger added, selling for around $5 a gram.

The cheaper price reflects a glut of raw marijuana because of overproduction across the state, a situation that is beginning to take hold in Oklahoma.

Granger said medical marijuana distillate is selling for around $7-$9 a gram in Oklahoma, a market that is younger and less established than Oregon.

Like Oklahoma, prices in Arizona for MMJ distillate are around $7-$9 a gram, he said.

Hemp oil

Hemp-derived CBD oil has more of a national pricing structure, given that the crop is federally legal, unlike marijuana.

Shannon Kaygi, CEO and co-founder of Denver-based CBD-products company Eossi Beauty, breaks the oil segment into categories.

For example, hemp-derived CBD crude oil is selling for around $400-$500 per kilogram wholesale. The oil has a cannabinoid content of around 65% and includes fats and lipids and “looks like the stuff on the bottom of a lake,” according to Kaygi.

For all of the different categories of hemp-derived CBD oil, a kilogram would on average sell for about $1,000 more last year, Kaygi said.

More hemp farms are coming online all the time, producing more biomass and forcing down oil prices.

If the crude oil has gone through the decarboxylation and winterization process to activate the cannabinoids and remove the fats and lipids, the crude oil is selling for around $700-$1,000 wholesale.

For hemp-derived CBD full spectrum oil – which is around 80%-85% cannabinoid content and still contains THC – a kilogram sells for around $700-$1,500 wholesale.

Hemp-derived, broad-spectrum CBD oil is selling for $1,500-$2,500 a kilogram wholesale. The broad-spectrum oil has a range of cannabinoids beyond CBD, including CBG, CBN and others, but the THC has been removed.

The extra cannabinoids help to boost the price, according to Kaygi.

As it stands now, Kaygi’s not having any trouble finding wholesale oil, though she admitted that if she was making larger orders – say, a thousand kilograms at a time – it could be more difficult.

Bart Schaneman can be reached at barts@mjbizdaily.com