Sales of cannabis extracts and concentrates tripled between the first and final quarter of last year, ending 2020 with roughly 324 million Canadian dollars ($265 million) in retail sales, according to new Statistics Canada data.

It was the first full year of sales for products such as cannabis vaporizers, which started their slow rollout at the end of 2019.

Extracts and concentrates, which can also include anything from hash to softgels, was the second-most-popular category in 2020. Dried flower was the top seller.

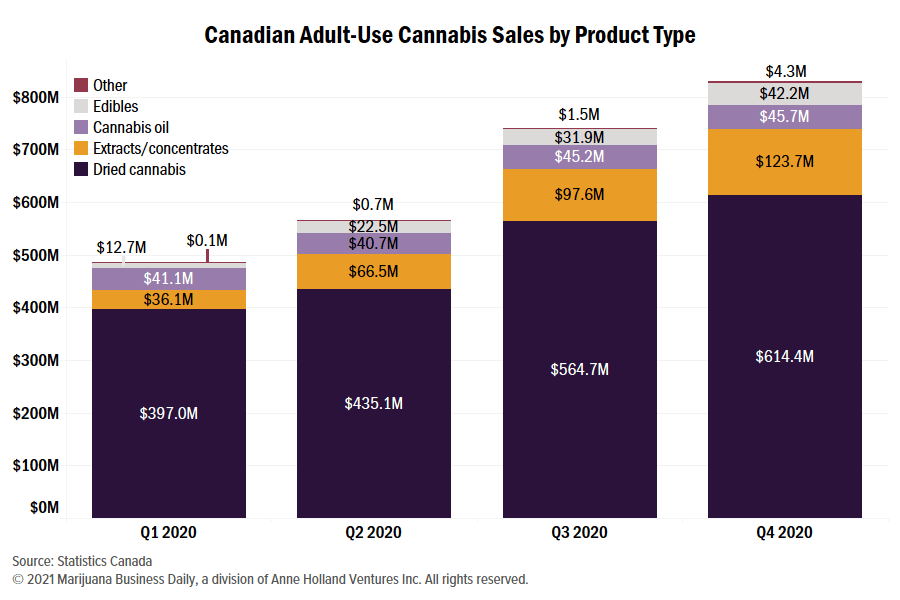

Extracts sales by quarter were:

- CA$36 million in the first quarter.

- CA$66.5 million in the second quarter.

- CA$97.6 million in the third quarter.

- CA$123.7 million in the fourth quarter.

The Statistics Canada data shows that extracts and concentrates accounted for a growing percentage of total sales throughout the year.

In the January-March period, those products made up 7.4% of sales.

By the end of the fourth quarter, they were at 14.9%.

Dried flower accounted for 76.6% of all sales in the year.

Mario Naric, CEO of Aylmer, Ontario-based Motif Labs, an extraction company, sees more room for growth.

“For the foreseeable future, it’s going to be vaporizers that really dominate that sector, and you can see that in the states that are several years ahead of us,” he said.

“Vapes are going to continue to be the lion’s share of the concentrate market. You’re able to make them at scale, you’re able to make high-end value vapes with high potency and quality with low cost inputs.”

Naric sees two trends playing out this year:

- More product “with intention” – i.e., products aimed at specific consumer segments.

- More products with a broader ratio of cannabinoids.

“In the last year, we’ve seen people launch an endless amount of SKUs without a lot of intention. … There are so many SKUs out there, a lot of them not moving,” he said.

Naric said companies need to ask themselves why they made a specific brand, why they chose a certain flavor profile, who the target demographic is and what their price point is.

“What we’re going to start seeing, and we’re already seeing it, that massive amount of product has backed up the system to the point where buyers are denying it, which is forcing people to think about what they’re launching and why,” he said.

Matt Lamers is Marijuana Business Daily’s international editor, based near Toronto. He can be reached at matt.lamers@mjbizdaily.com.