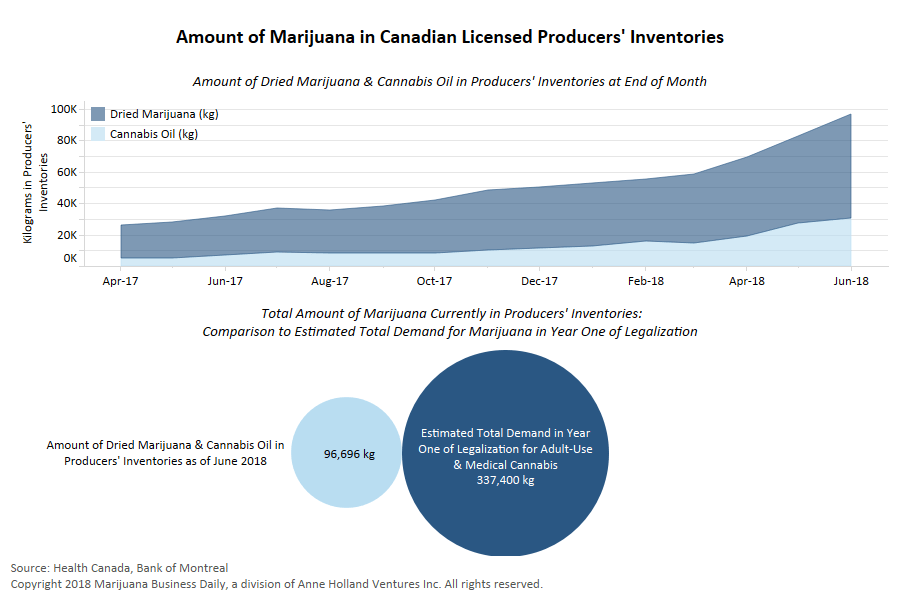

On the eve of Canada’s historic launch of its recreational marijuana program, the global cannabis industry appears poised for explosive growth thanks to the confluence of a host of market developments.

“The well-capitalized cannabis industry has been evolving rapidly and looks to address a far larger (market) than we had originally forecast,” Wall Street analyst Vivien Azer of Cowen wrote in a recent report.

She noted that Canada’s move to legalize cannabis across its 10 provinces “is the first step” in establishing marijuana as “a key functional ingredient” that will disrupt a group of consumer product categories collectively worth up to $500 billion.

The new view lands as the legal cannabis industry continues to log record rates of growth, fueled in part by the following transformative moments in the past year:

- Cannabis capital raise craze: Marijuana companies across the globe are on pace to raise a record $8 billion by the end of 2018, as more companies go public and scale to meet demand. Meanwhile, the Canadian Marijuana Index, a roundup of top cannabis stocks operating in Canada, is up more than 200% over the past year.

- Big brands are getting in: The Coca-Cola Co., the world’s largest beverage maker, confirmed last month it’s looking at a line of CBD beverages. In August, global liquor giant Constellation Brands – maker of Corona and Robert Mondavi – increased its ownership stake in Canada’s Canopy Growth with an industry-record $3.8 billion investment. Tobacco titans are getting in too, with investments inked this year by Pyxus International (formerly Alliance One International) and Imperial Brands.

- Big hits at U.S. federal level: Last month, the U.S. Drug Enforcement Administration gave Tilray its stamp of approval to export marijuana to the U.S. for medical research. That same month, the agency rescheduled some cannabidiol, a move that allows the sale of the first nonsynthetic, cannabis-derived medicine to win federal approval. That decision came three months after the U.S. Food and Drug Administration approved Epidiolex, a CBD preparation for rare types of epilepsy that is made from cannabis grown in the United Kingdom.

All this adds up to a “big-picture view of cannabis (that) goes beyond adult-use launch in Canada,” Azer wrote.

Disruptive innovations

The rapid evolution has moved Azer to a more bullish outlook for the publicly traded cannabis companies that Cowen covers, which include Tilray (Nasdaq: TLRY) and Canopy Growth (New York Stock Exchange: CGS; Toronto Stock Exchange: WEED).

Her bolstered take on the industry follows a review of the monthslong volatility recorded among Canada’s publicly traded cannabis firms, which she said prompted Cowen “to take a step back and revisit our views around disruptive innovation across our coverage and near decade” coverage of the consumer packaged goods industry.

“In the fast-evolving cannabis sector, dynamics can change quickly,” she wrote. “The most recent example is beverage companies taking stakes in cannabis companies.

“While that dynamic was not completely unexpected, the timing of it perhaps was, and served as a fresh catalyst for the stocks.”

She also called out a recent investor event in which top industry executives shared short- and long-range views on the potential for cannabis to disrupt a host of traditional consumer packaged goods categories, including “adult use, sleep aids, appetite stimulus, athletic recovery, arthritis, fibromyalgia and pet care,” she wrote.

Azer raised her one-year forecast for Canadian cannabis producer Tilray to $172 (U.S.) – almost three times her original target of $62.

She also hiked her outlook for Canopy Growth to 82 Canadian dollars ($63) from CA$74 ($57).

$500 billion market opportunity

Azer noted her new forecast “should be able to withstand the inherent volatility that comes with quarterly earnings reporting and news cycles,” adding the numbers are “rooted in (a) multidecade analysis of consumer trends.”

The entry of big-name brands into marijuana is a strong signal that veterans of consumer packaged goods “are embracing the broad market potential for cannabis as a global, multidimensional category,” according to Azer.

She identified four key consumer product categories, collectively worth $500 billion, where cannabis could become a bigger player, including:

- Adult use: “We continue to view cannabis a substitute social lubricant to alcohol, as evidenced by declining reported alcohol incidence among 21- to 25-year-olds, and rising cannabis incidence,” she wrote.

- Beauty and nutraceuticals: “Health and wellness consumers are beginning to find value and use cases from CBD-based oil extracts, tinctures, topicals and capsules to improve everyday life. We expect to see CBD used as a functional ingredient in nonalcoholic beverages.”

- Over-the-counter pain and sleep aids: “While currently at early stages of development, we believe pain management and insomnia have high incidence levels among adults and are two focus medical indicators by cannabis companies’ (research and development) teams today.”

- Pharmaceutical: “Today there is an ever-expanding array of use cases for cannabis as a form of treatment for chronic and severe conditions, shown through increased clinical trials, patents and international acceptance through medical cannabis legalization.”

Azer didn’t offer insight on how much of that $500 billion market cannabis might claim, although she referenced estimates of at least $200 billion cited by executives at Constellation Brands.

Looking ahead: U.S. opportunities

Meanwhile, cannabis investor demand has already begun to shift from Canada to the U.S.

Just Monday, Canopy Growth announced a CA$429 million deal to acquire the assets of Colorado-based hemp firm Ebbu for research and development.

The megadeal joins a growing list of multimillion-dollar investments made by Canadian firms in U.S. cannabis companies.

During the first three quarters of the year, at least 40 U.S. cannabis firms have been acquired by Canadian companies, more than double the 17 deals inked during the same period in 2017, according to data from New York-based Viridian Capital Advisors.

“Our view is that now is the time to really take off the safety belt and begin acquiring market share in the U.S.,” said Paul Rosen, CEO at Tidal Royalty.

The British Columbia-based company raised more than $40 million as it pursues U.S.-based investments in cannabis cultivation, manufacturing and retail operations.

Rosen also is the co-founder and former CEO of the Cronos Group, one of Canada’s most well-known marijuana companies, valued at more than $1 billion and one of the few plant-touching companies to trade on the Nasdaq (CRON).

“This really has been a huge year for cannabis, and not just in Canada,” Rosen said. “Based on what we’ve done in Canada, the time to invest in the U.S. is now.

“To the latecomers are left the bones.”

Lisa Bernard-Kuhn can be reached at lisabk@mjbizdaily.com