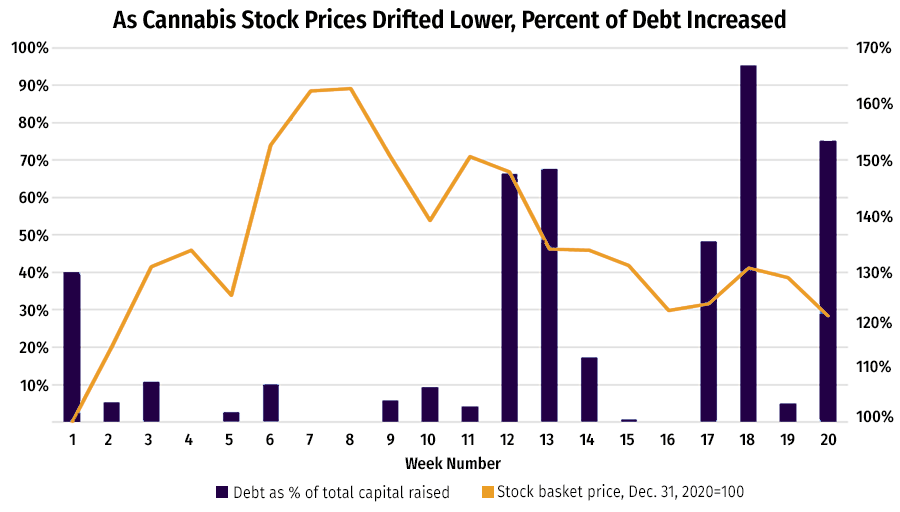

As cannabis prices have fallen since mid-February, a higher percentage of total capital raises have taken the form of debt. Learn more about this trend in Deal of the Week below.

The May 10 announcement that Florida-based Trulieve would acquire Arizona-headquartered Harvest Health & Recreation for $2.1 billion could indicate that big marijuana mergers are making a return.

The deal almost certainly signals more industry consolidation to come and pressure on rivals to follow suit.

It’s part of the long game, even if federal legalization isn’t around the corner, said Morgan Paxhia, managing director of San Francisco-based Poseidon Asset Management.

He said a big deal such as Trulieve-Harvest “just makes sense for operators trying to get scale and significant market share.”

Viridian Capital Advisors noted: “Given the strong capital position of many of the top MSOs following capital raises in late 2020 and earlier this year and the arms-race nature of this industry, we expect larger-type acquisitions like the Trulieve-Harvest deal to become more common in the near term.”

Most likely targets, as identified by Viridian, include Ayr Strategies, Jushi Holdings, Planet 13 Holdings and TerrAscend.

Other industry insiders and observers have thrown the likes of Cresco Labs and Green Thumb Industries into that pool as well.

If the Trulieve-Harvest deal closes as expected, the combined marijuana company will operate 22 cultivation and processing facilities and 126 medical and recreational cannabis stores in 11 states.

The merger will provide Trulieve, No. 1 by a long shot in Florida’s hot medical cannabis market, an instant market leader in Arizona because of Harvest’s strong position there.

But, notably, the combined entity won’t have a presence in New York or New Jersey, both of which recently legalized recreational marijuana.

In the months before the Trulieve-Harvest announcement, mergers and acquisitions were smaller and more narrowly focused.

For example, the sizzling Pennsylvania medical cannabis market has attracted $400 million worth of M&A activity just since March.

Expect those deals to continue for high-potential and underdeveloped markets.

But the climate for big M&As certainly looks better than it did a year or two ago, thanks to the easing of global pandemic restrictions and the loosening of capital markets.

– Jeff Smith

Deal of the Week / In partnership with Viridian Capital Advisors

On May 11, Verano Holdings Corp. (CSE: VRNO; OTCQX: VRNOF) entered into an amended and restated senior secured term loan with Chicago Atlantic Advisers, increasing the total size of the facility to $130 million at a rate of 9.75%. This transaction is the second sub-10% deal in the past three weeks (following a $217 million, 9.1% effective cost Green Thumb Industries deal). Verano ranks among the top five MSOs in debt/market cap, a key leverage indicator utilized in the Viridian Capital Credit Tracker.

The tightening of debt spreads combined with the cooling of the cannabis equity market is producing a shift in financing strategy. When enterprise value to forward EBITDA multiples were more than 18X, as they were in January through early February, it made sense to issue as much equity as the market would bear. Now that prices have retreated significantly, corporate CFOs have started to more carefully consider the dilutive impact of issuing additional stock.

Suppose you are a top-tier MSO such as Verano with incremental debt capacity and the ability to issue relatively low-cost debt. It makes sense to issue debt now and wait for better equity-market conditions, possibly induced by favorable regulatory or legislative announcements.

The graph below illustrates this strategy shift: As cannabis prices have fallen since mid-February, a higher percentage of total capital raises have taken the form of debt. Viridian expects this trend to continue.