A global pandemic, record job losses and massive budget shortfalls all contributed to what California Gov. Gavin Newsom called “no normal year” in his May budget revision – and cannabis tax revenues are just one of the victims of the serious “rainy day.”

Whether in good times or bad, tax revenues are a good indicator of consumer trends in the legal market – and cannabis business operators will be keeping an eye on how the industry reacts to recession.

- A lack of access to banking services.

- A younger, more recession-prone customer.

- Continued competition from the illicit market.

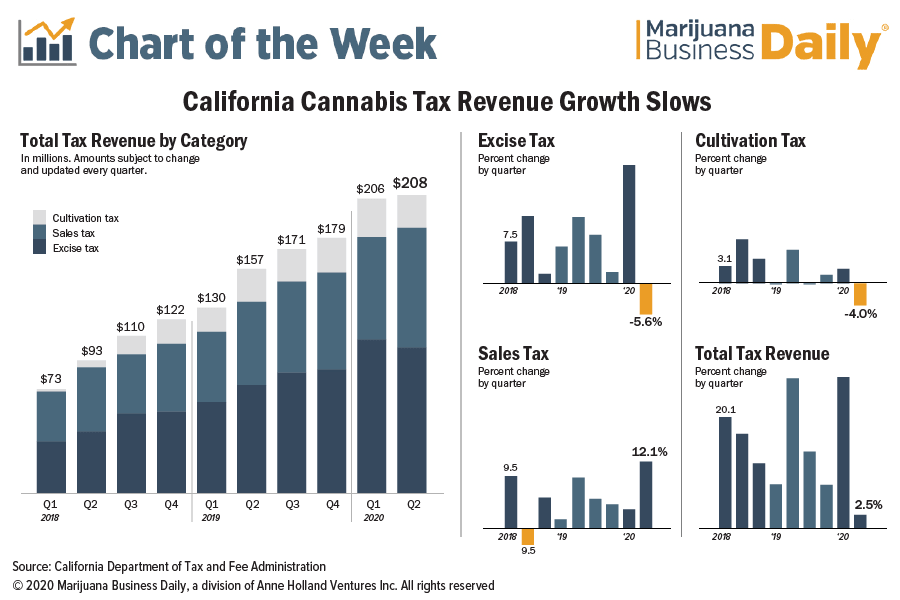

California took in a record $208 million in excise, sales and cultivation taxes from the cannabis industry in the second quarter of 2020, but growth stalled at 2.5% over the previous quarter – the lowest rate of increase since marijuana tax collections in the state started in 2018.

Cannabis sales taxes were the bright spot with 12.1% quarter-over-quarter growth; excise and cultivation tax revenue fell 5.6% and 4%, respectively.

The state raised tax rates in January to adjust for inflation, setting the new cultivation rates at $9.65 per ounce of flower, $2.89 per ounce of trim and $1.35 per ounce of fresh cannabis plant.

The tax on retail purchases remained at 15%.

Cannabis taxes have added almost $1.5 billion to the state’s coffers since 2018 and were on track to bring in $1 billion a year if growth had held out.

California collected $397 million in 2018 and saw 60% growth in 2019 with $636 million last year.

The state has collected $414 million so far this year.

California revised marijuana revenue predictions downward for 2019 and 2020 after sales failed to meet expectations.

The new forecast assumes continued growth of more than 15% annually but also notes the “significant” uncertainty in the market.

Andrew Long can be reached at andrew.long@mjbizdaily.com