Canadians purchased 109 million Canadian dollars ($87 million) worth of recreational cannabis edibles in 2020, the first full year they were available in the country, according to data recently published by Statistics Canada.

While that’s only 4.2% of all regulated cannabis sales last year, experts see significant growth happening in the coming year as inventory and selection improve and prices continue to fall.

“The more options consumers have, that changes things,” said Jennifer Dianne Thomas, CEO of cannabis food and beverage technology company Province Brands.

“We’re still far away from having a product able to hit every consumers’ different interests, and their different interests at different times.”

Cannabis edibles growth outpaced industry growth throughout the year, accounting for a growing portion of overall sales, according to data from Statistics Canada’s retail commodity survey.

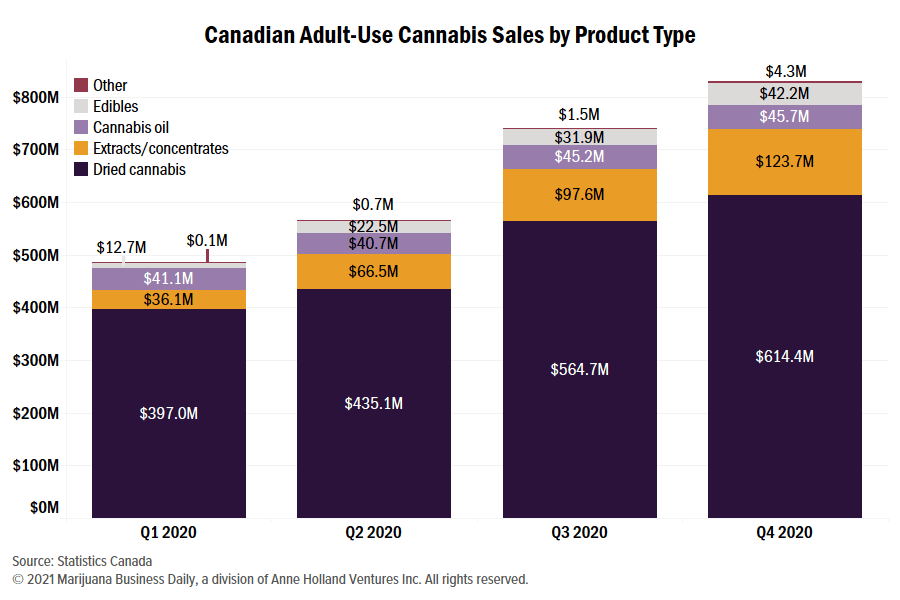

Edibles sales, and their overall market share by quarter:

- CA$12.7 million in Q1. (2.6%)

- CA$22.5 million in Q2. (3.9%)

- CA$31.9 million in Q3. (4.3%)

- CA$42.2 million in Q4. (5%)

The Statistics Canada data, however, shows that edibles sales lagged those of other products such as extracts.

Edibles accounted for a 4.2% share of the CA$2.6 billion regulated recreational cannabis market last year.

Extracts and concentrates, by comparison, accounted for 12.3% of overall sales.

Dried cannabis sales made up the bulk, with 76% of all sales. But that share waned throughout 2020.

Toronto investment firm ATB Capital Markets sees this as just the beginning of an increase in market share for edibles, extracts and topicals, known as Cannabis 2.0.

“The Canadian recreational cannabis sales mix in 2020 was similar to Colorado in its first year of legalization and, based on (first quarter 2021) sales, cannabis 2.0 products continue to gain share in Canada,” ATB analyst David Kideckel wrote in a note to investors.

“The Colorado cannabis market presents evidence that cannabis 2.0 products may rise to 50% of the overall Canadian cannabis market over the next few years.”

Kideckel estimates the Canadian adult-use and medical markets will see CA$10 billion in sales in 2025, with cannabis 2.0 accounting for for 50% of the overall market.

Thomas of Province Brands expects products like beverages will be a natural entry point into legal cannabis consumption.

“Some cannabis consumers can feel safer with products that are a little more accessible, products mincing things they’re already familiar with, and I think (cannabis) beverages and edibles do that,” she said in a phone interview.

“As time goes on, the consumer base will get more sophisticated when it comes to Cannabis 2.0, edibles and beverages, and there will be an opportunity for products steeped in craftsmanship, health, all of their distinguishers.

Thomas suggested that the beverage category, currently languishing with a tiny share of the market, is being held back by a lack of selection.

Beverages “don’t have much variety and availability yet, and I do think it is variety that will push the category. We’re still early on,” she said.

Matt Lamers is Marijuana Business Daily’s international editor, based near Toronto. He can be reached at matt.lamers@mjbizdaily.com.