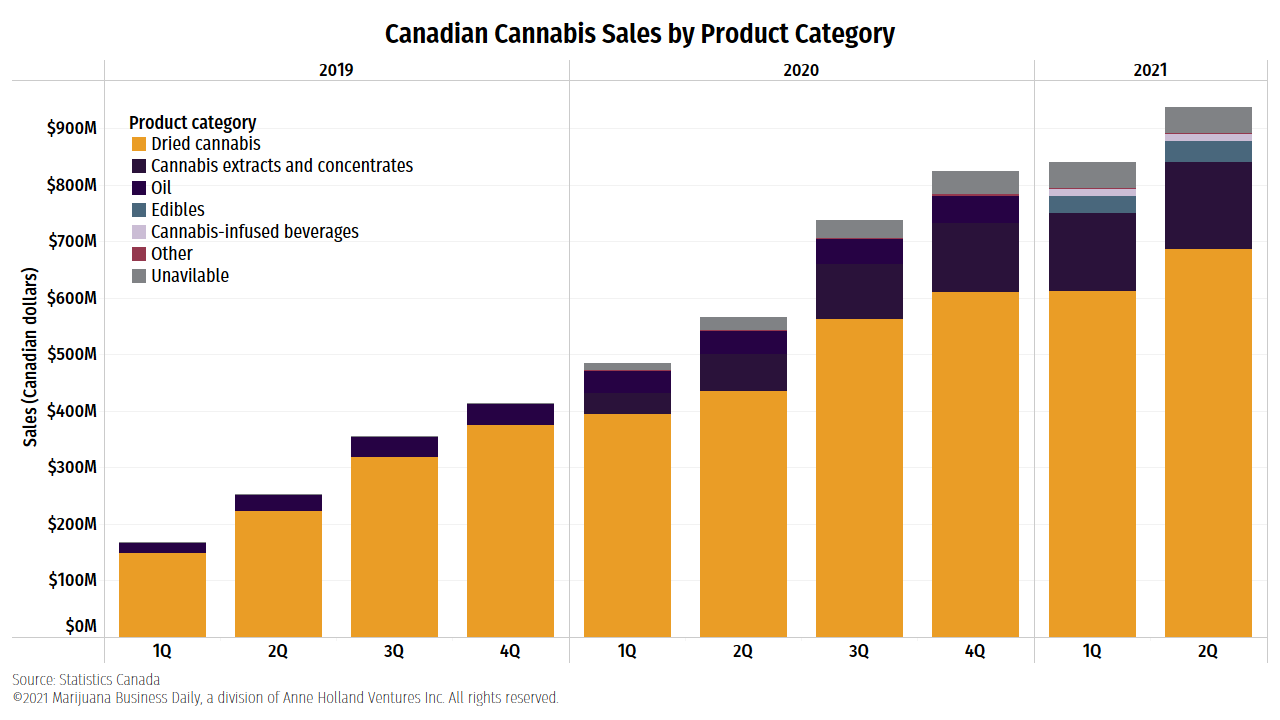

Dried cannabis still rules Canada’s regulated recreational market, but its dominance over other categories is waning, new data shows.

Spending on dried cannabis amounted to approximately 1.3 billion Canadian dollars ($1 billion) in the first half of 2021, according to Statistics Canada’s sales figures, or about 73% of spending in all categories.

That’s down from 80% in the previous half and closer to 90% in early 2020, when edibles and vapes hadn’t fully been rolled out in the market.

Of the CA$1.8 billion in spending on legal cannabis from January through June:

- Extracts and concentrates sales at retail were CA$291.7 million, or 16.4% of total spending.

- Spending on edibles (minus beverages) reached CA$68.1 million, or 3.8% of total spending.

- Beverages spending was $23.6 million, or 1.3% of total spending.

- Spending on dried cannabis reached CA$1.3 billion, or 73% of total spending.

Statistics Canada said it did not disclose spending on cannabis oil, seeds or plants to meet certain requirements of the Statistics Act.

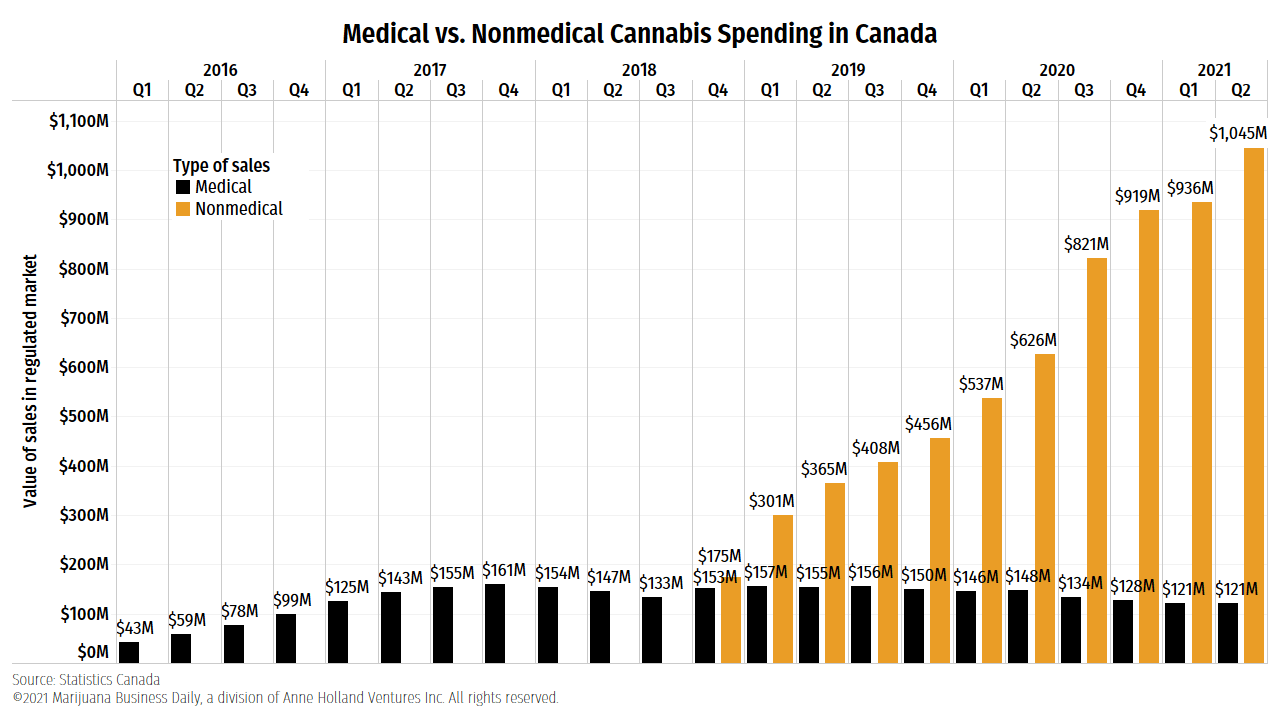

Medical cannabis spending was also omitted, but MJBizDaily previously reported that Canadian medical cannabis spending was CA$242 million in the first half of this year.

According to cannabis analytics firm HiFyre’s most recent monthly report, British Columbia-based Pure Sunfarms ruled the Canadian flower market in September, followed by Organigram and Canopy Growth Corp.

Business leaders need reliable industry data and in-depth analysis to make smart investments and informed decisions in these uncertain economic times.

Get your 2023 MJBiz Factbook now!

Featured Inside:

- 200+ pages and 50 charts with key data points

- State-by-state guide to regulations, taxes & opportunities

- Segmented research reports for the marijuana + hemp industries

- Accurate financial forecasts + investment trends

Stay ahead of the curve and avoid costly missteps in the rapidly evolving cannabis industry.

Auxly Cannabis had the No. 1 market position in vapes, while Indiva topped the edibles market.

Hexo Corp. controlled the lion’s share of the still-small cannabis beverage segment that month.

Pure Sunfarms tops flower

Pure Sunfarms CEO Mandesh Dosanjh isn’t surprised flower’s dominance is waning, given the emergence of increasingly popular 2.0 products, referring to cannabis products such as edibles and vapes.

He said other jurisdictions with mature cannabis markets provide a window to future sales.

“We knew that was going to take a bite out of the apple from Years One and Two, as (edibles, vapes and other) segments grew and as people started to understand those products,” he said in a phone interview.

Dosanjh said dried flower accounting for 80%-90% of overall sales was unsustainable.

“(Flower sales) are falling to levels we’re very comfortable with, and where we expect it to be. When you look at flower and pre-roll together, could it go lower than 70%? It could. The overall market, however, continues to grow,” he said.

Dosanjh expects the flower segment to continue to grow in absolute dollars, even if the share of overall sales falls, as the overall regulated market continues to see monthly records.

Pure Sunfarms has steadily gained market share in Canada while large competitors spent billions on mergers and acquisitions, only to lose share.

Dosanjh attributed the success of Pure Sunfarms to applying sound, fundamental business practices.

“Understand the consumer. Try and do a couple of things, if not one thing, very, very well, before you start to think about spreading yourself thin,” he said.

“We really did that on the flower side of the business.

He said the company focused on the cannabis consumer, especially regular ones, by offering quality products at “prices that people should expect to pay for cannabis.”

“We just told our story,” he said. “The consumer is smart. They understand what we’re doing.

“We knew that, by winning over (consumers) with our product, we’d win over the hearts of budtenders and store operators.”

“That’s what allowed us to lay down the train tracks of organic growth and come behind it and build out our team nationally, to continue that momentum.”

Indiva leads edibles

Sales of edibles and beverages remain relatively low compared to other mature markets, but they’ve steadily gained share despite stringent packaging regulations.

A package of cannabis edibles is currently capped at 10 milligrams of THC.

Niel Marotta, CEO of Canadian market leader Indiva, told MJBizDaily that edibles are doing slightly better than the data suggests because Quebec still mostly bans the products. (Quebec, the second-biggest consumer market in Canada, banned the sale of recreational cannabis edibles before legalization.)

The only way to legally sell edibles in the province is through medical channels.

Edibles and beverages were about 5% of the market in the first half of this year.

“We think it will be much bigger. The category itself should continue to outpace the growth in the market, which it is currently doing,” Marotta said.

Indiva is another instance of a licensed producer that gained dominant market share in an important cannabis category without spending hundreds of millions of dollars on M&A.

“We’ve always had capital discipline. Having the right team in place,” Marotta said. “CPG experts run our facility in London. They know how to make food products at scale. They know what it takes. We don’t get infatuated with shiny equipment.”

Licensing agreements also were key for Indiva.

“The second piece of the puzzle is very different from the other LPs,” Marotta said. “We did licensing agreements, primarily with U.S. brands. Mainly Bhang and Wana (Brands).

“We didn’t necessarily need to reinvent the wheel. Our operations, procedures, the way we make the products, the recipes, that’s all part of the licensing agreement.”

The MJBizDaily interview with Marotta was conducted before Canopy Growth ponied up $297.5 million in cash for the right to buy U.S. marijuana edibles maker Wana Brands once the United States legalizes marijuana.

Canopy is not among the top-five producers of edibles and vape brands in Canada.

“Anyone can make a chocolate. Anyone can make a gummy. But will it meet the consumer’s needs and desires? Will it delight the customer? Will people recommend it to their friends? I think that’s what we have with Bhang and Wana. They’re great products,” he said.

“By dominating in the edibles space, it’s made us a very relevant LP.”

Matt Lamers can be reached at matt.lamers@mjbizdaily.com.