Multistate marijuana operator 4Front Ventures said it netted $18 million from the sale of its stake in cannabis retail licenses in Maryland and Pennsylvania and raised an additional $4 million through a private placement of convertible debt.

The Arizona-based company said in a news release it expects the transactions will result in the company becoming cash-flow positive in the second half of this year.

4Front added that it plans to use the proceeds to retire existing debt and focus on operations in California, Illinois, Massachusetts and Michigan.

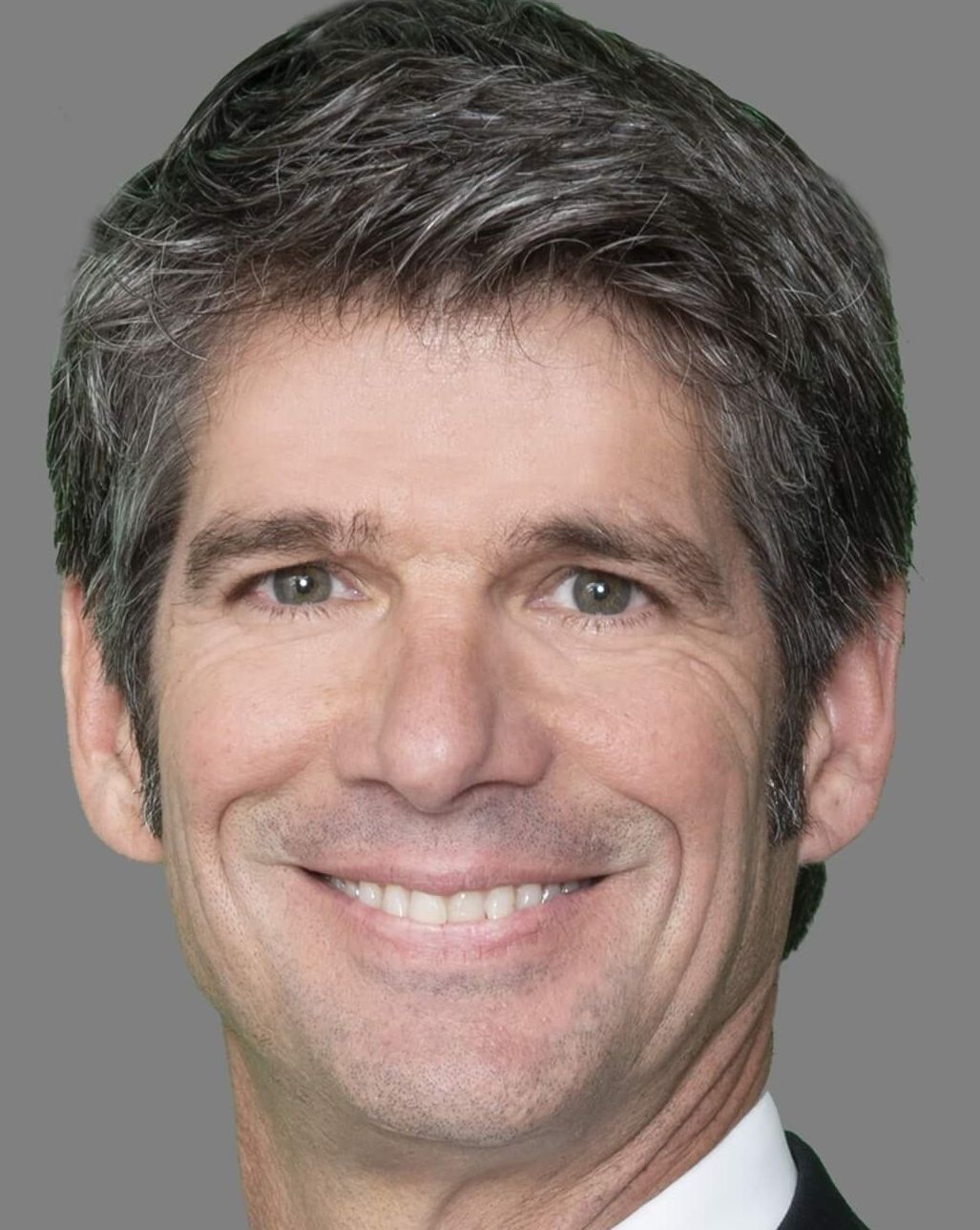

The transactions come just weeks after 4Front Ventures cut its corporate workforce by almost 40%, sold some Arizona assets and promoted Leo Gontmakher to CEO.

Gontmakher, who had served as the company’s chief operating officer, replaced Josh Rosen, who became 4Front’s executive chair.

The company trades on the Canadian Securities Exchange as FFNT and on the U.S. over-the-counter markets as FFNTF.

The company recently disclosed it is delaying the announcement and filing of its financial statement for the year ended Dec. 31, 2019, because of the coronavirus pandemic and logistical issues.