Dr. Priyanka Sharma had a thriving global business in chemical pharmaceuticals, traveling the world setting up factories extracting fish oil for nutritional supplements.

But Sharma and her husband, Pulak, left their home outside Chicago and moved to Colorado for the same three letters that have cannabis entrepreneurs, pharmaceutical companies and even mainstream grocers seeing dollar signs: CBD.

If it seems as if you’re seeing CBD everywhere these days, you are. CBD products are in grocery stores, convenience stores and chiropractic offices. The letters are splashed across storefronts even in the most cannabis-averse jurisdictions – places like Kansas and South Carolina. CBD also is grabbing headlines: In a landmark decision, the U.S. Food and Drug Administration in June approved a naturally derived CBD drug to treat two kinds of epilepsy.

Unlike THC, cannabis’ most famous cannabinoid, CBD doesn’t intoxicate users but offers a tantalizing array of health benefits. It’s a proven anti-inflammatory agent and can bind to the body’s cannabinoid receptors to induce feelings of calm and relieve pain.

Moreover, CBD offers much less regulatory and tax baggage than THC-laden marijuana – particularly if it’s derived from hemp, like the Sharmas’ CBD. Products containing CBD can be sold across state lines, for example, and are available in non-marijuana markets. And, in the case of hemp, growers are free of seed-to-sale tracking requirements and the onerous 280E section of the federal tax code.

Throw in growing consumer interest in all things CBD, and it’s no surprise the market is exploding.

“It’s kind of a movement,” Sharma said of the CBD market. “It’s like everybody wants to use CBD – from elderly people who have arthritis to young people who want to vape and want a recreational way to relax. It’s transcending all age groups.”

But navigating the CBD market has its own complexities, particularly if you’re coming from the marijuana industry. Selling CBD products, for starters, requires a different approach than marijuana retailing. Federal laws governing CBD are confusing, and the legal landscape is changing rapidly. Moreover, a boom in CBD products has fanned worries that the market may be overheating.

Marijuana Business Magazine gathered the following tips and information to help companies capitalize on the current CBD boom.

An Emerging Market

Hemp-derived cannabinoids account for the lion’s share of the CBD market versus marijuana-derived CBD products. According to cannabis research firm Brightfield Group, the hemp-derived CBD market in the United States will total nearly $600 million this year. Looking ahead, Brightfield projects the market will total more than $11 billion by 2020 and top $21 billion by 2022. Other market projections are nowhere near as bullish. Brightfield assumes passage of the 2018 Farm Bill will pave the way for the outright legalization of hemp extracts and an “explosion” in CBD product sales.

CBD is now driving growth across the cannabis industry and giving companies opportunities that never existed for marijuana. CBD has moved cannabis beyond dispensaries and head shops and into coffee shops, pet stores and even hotel minibars.

But how much growth can the CBD sector maintain? And how long will it be before regulation changes the market and potentially closes it to cannabis startups?

For Priyanka and Pulak Sharma, there’s no end in sight for the CBD boom.

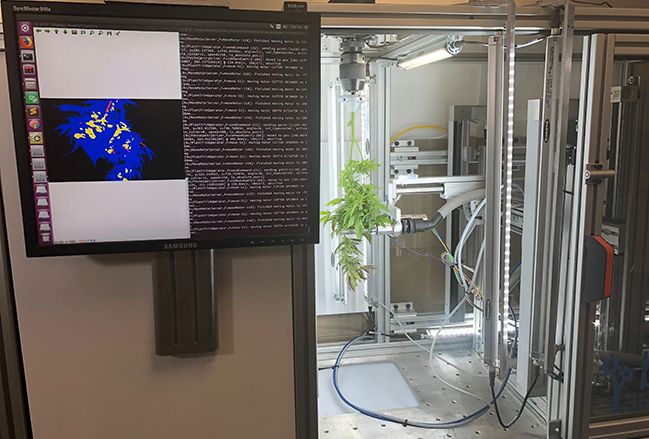

Their company, Kazmira, located east of Denver, set up shop in 2017 to extract CBD from hemp – and quickly found more customers than it could handle. Kazmira started in a 55,000-square-foot facility. A year later, the Sharmas are planning to expand to 185,000 square feet.

“It seemed like the perfect storm,” said Pulak Sharma, Kazmira’s co-CEO.

Getting Started

The booming CBD sector generally attracts two types of investors: traditional entrepreneurs who may not oppose marijuana but aren’t keen to take on the plant’s legal risks, and longtime marijuana entrepreneurs who have discovered CBD’s medical promise and want to bring the compound’s health benefits to new audiences.

The sector took off in 2014, when Congress allowed states to experiment with hemp production.

That law didn’t say how states could experiment with hemp, freeing them to permit hemp cultivation for CBD-rich flower.

Suddenly, cannabis growers had a route to producing cannabinoids within the law. The formula:

- Find a state that allows hemp.

- Find a hemp variety rich in CBD but low in THC.

- Grow the hemp.

- Extract CBD and make lots of money.

It has proved a tempting pathway for entering the cannabis market.

“It’s very different from the THC market,” said Janel Ralph, CEO of Palmetto Harmony, a South Carolina company that makes CBD tinctures, topicals and vape pens.

“If you’re looking at the THC market, you’re constrained to your state line. With hemp and CBD, you’re not constrained by your state line.

“Our products are mainstream products. They’re at mom-and-pop wellness stores. They’re at grocery stores. They’re at pop-up stores.”

Easier Than Marijuana?

Hemp’s business advantages over marijuana are obvious: Provided a state authorizes hemp production and CBD extraction from the plant, entrepreneurs there are free to grow many acres of low-THC hemp and turn the crop into a product that faces a fraction of the regulatory hurdles faced by marijuana.

Hemp producers don’t have to track their crop from seed to sale. Also, product testing in most states is required only to check the THC content of a CBD product.

And because hemp is legal under federal law, growers of the plant can seek organic certification by the U.S. Department of Agriculture, a market advantage not available to marijuana cultivators.

Perhaps most tantalizing to many marijuana entrepreneurs: A legal hemp business isn’t subject to 280E, the notorious section of the federal tax code that blocks cannabis companies from taking the standard deductions that traditional businesses use to lower the amount they owe the government.

The lure was enough to tempt Harold Jarboe to flee Washington state’s marijuana industry in 2015 to buy land outside Nashville, Tennessee, and start growing hemp for CBD.

“I started seeing people selling grams of CBD and other cannabinoids for $250 a gram. You’re like, ‘Oh, my god, that’s about six times what marijuana is going for,’” Jarboe said. “CBD isn’t that expensive anymore, of course, but it’s still pretty high.”

Hemp’s lower regulatory burden sealed the deal for Jarboe. He recalls his disbelief when querying Tennessee agriculture authorities about the rules for making CBD.

“I asked, ‘Is it all right if I grow it for CBD?’ And they were like, ‘As long it doesn’t go over 0.3% (THC), we don’t care.’ It was so different than the marijuana system,” he remembered.

Legal Challenges

CBD may have fans everywhere, but the legal landscape for the product isn’t as clear as CBD entrepreneurs might hope.

Federal laws about CBD are confusing and may be changing quickly.

The U.S. Drug Enforcement Administration said in 2016 that CBD is a controlled substance, same as marijuana. However, the ban doesn’t apply to CBD extracted from legal hemp.

And in July, the FDA approved a CBD treatment for epilepsy, throwing the cannabinoid’s legal status into further disarray.

That’s because even as the FDA lauded CBD’s use as a medical treatment, agency officials added a warning: “We remain concerned about the proliferation and illegal marketing of unapproved CBD-containing products with unproven medical claims.”

Confused? The mixed messages mean that cannabis entrepreneurs have to dodge legal landmines to capitalize on the boom.

“The main takeaway is compliance: You’ve got to follow all the rules and do everything right,” said Shawn Hauser, a Denver attorney who specializes in hemp law.

Bob Hoban, a Denver attorney who argued against the DEA’s rule on CBD in an unsuccessful challenge earlier this year, says CBD producers have a path to avoiding legal complications.

That is, hemp growers must follow state laws that allow CBD production for market research, all while keeping an eye on changing federal rules.

“This has never been legal in all 50 states,” Hoban explained of CBD.

“It’s federally legal under the Farm Bill. It pre-empts the Controlled Substances Act. But (the Farm Bill) gives states the rights to follow that federal lead or do their own thing.”

Too Good to Last?

Another challenge facing CBD producers is inevitable: competition as more companies rush CBD products to market and more states allow hemp production.

“A lot of farmers are seeing dollar signs,” said Scot Waring, lab and extraction director for The Vermont Hemp Co. in Montpelier, which makes CBD oils.

“It’s kind of the Wild West right now, everybody trying to find their little niche in this market. There’s a lot more CBD coming in, and no one knows where it’s all going to go.”

CBD prices already have fallen significantly from the $250 per gram that tempted Jarboe to enter the market in Tennessee. As more companies compete in the CBD market, prices are going to keep falling.

CBD producers also are keeping a nervous eye on Canada, which grew 10 times as much hemp last year as the United States.

Canadian hemp growers had been banned from using hemp flowers for CBD extraction. But Canada’s new marijuana law, which takes effect Oct. 17, ends that prohibition, unleashing a wave of Canadian CBD that will be legal to export to other countries.

“The game has changed with cannabinoids coming into this market,” said Russ Crawford, head of the Canadian Hemp Trade Alliance.

“It’s about supply and demand. As we produce more CBD in Canada, prices are going to go down globally.”

CBD entrepreneurs are gambling that consumer interest will grow as quickly as CBD production, keeping the CBD sector profitable for years to come.

“I don’t think we’re anywhere close to the peak for CBD,” said Blake Schroeder, CEO of Kannaway, a San Diego CBD producer and subsidiary of Medical Marijuana Inc.

“I can envision a time where we have a recommended daily allowance for CBD, just like we do with vitamin C. Our mission is to educate the world and bring CBD into the mainstream.”

Back in Colorado, the Sharmas aren’t worried that the CBD market is overheated.

“We get asked all the time, ‘Should I enter this space?’” Priyanka Sharma said. “I would say a resounding yes. There is still time.”