(You can have cannabis finance content such as this delivered directly to your inbox. Simply sign up here for our weekly MJBizFinance newsletter.)

Deal of the Week / In partnership with Viridian Capital Advisors

Cost of debt continues downward trend for MSOs, as Verano upsizes debt facility

The cost of debt continues to decline for the largest multistate operators, as evidenced by Verano Holdings Corp.’s recent loan amendment.

Verano (CSE: VRNO; OTCQX: VRNOF) amended and upsized its senior secured term loan to $250 million, adding an incremental $120 million.

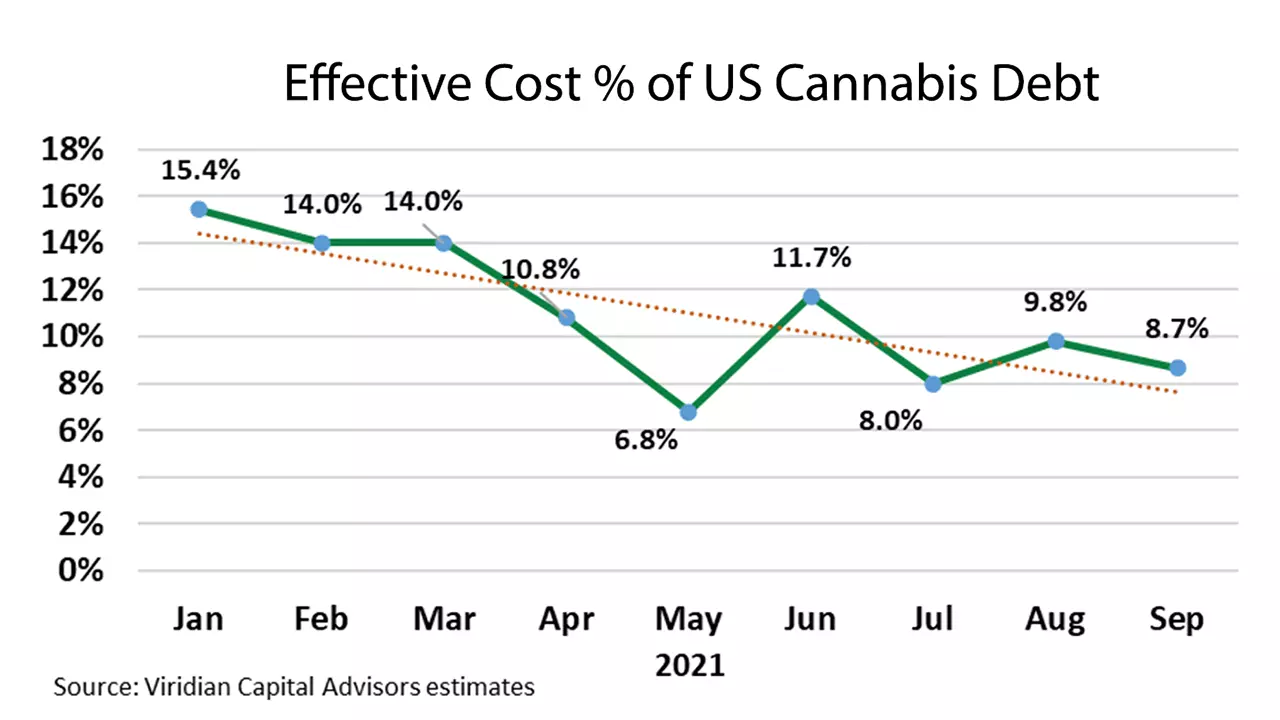

Viridian Capital Advisors first highlighted this downward trajectory in cost of debt in its weekly Viridian Capital Graph of the Week on Sept. 6. Since then, the trend line has continued downward (see above).

Details of Verano’s incremental facility illustrate this shift:

- 8.5% interest rate with no equity-linked features.

- 18-month maturity.

- Senior secured debt position.

- Option for an additional $100 million in term debt at the same terms.

The reduced cost of debt stands in stark contrast to the reception cannabis firms have seen in the equity market, where prices (as indicated by the AdvisorShares Pure US Cannabis ETF) have declined by 45% from their February peaks.

- What’s driving the decline in debt costs?

- Improvements in issuers’ credit quality.

- Increased presence of well-funded institutional lenders, such as the participants in the Verano deal. Chicago Atlantic Advisors served as the lead administrative and collateral agent on the agreement, and AFC Gamma was a significant participant.

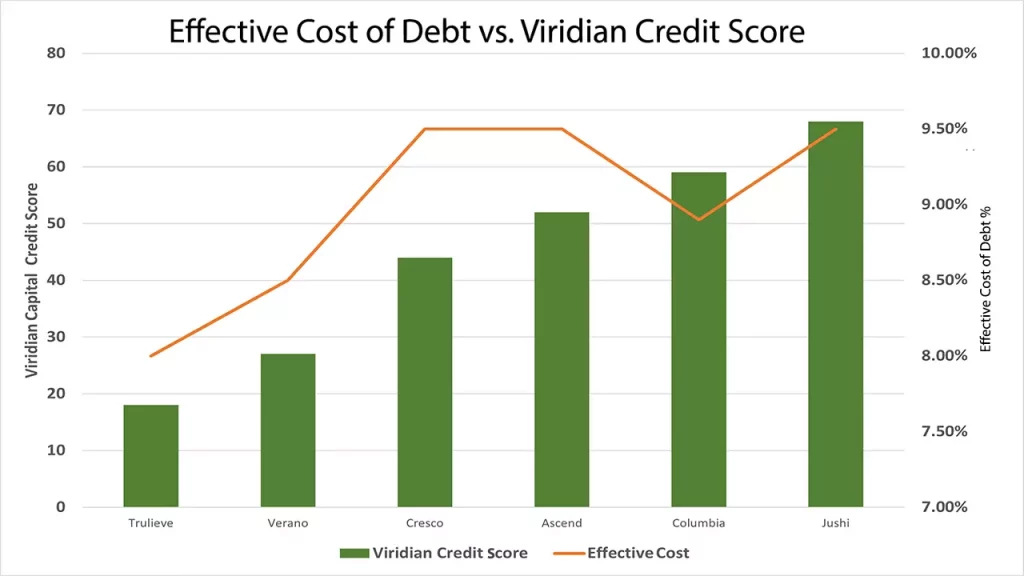

This week’s Viridian Capital Graph of the Week (below) shows evidence that the market is rationally pricing the credit quality of MSOs.

This chart highlights the effective rates of recent transactions against the issuer credit ranking in the Viridian Capital Credit Tracker. (Note: This graph contains data only on companies that have recently completed significant debt issues.)

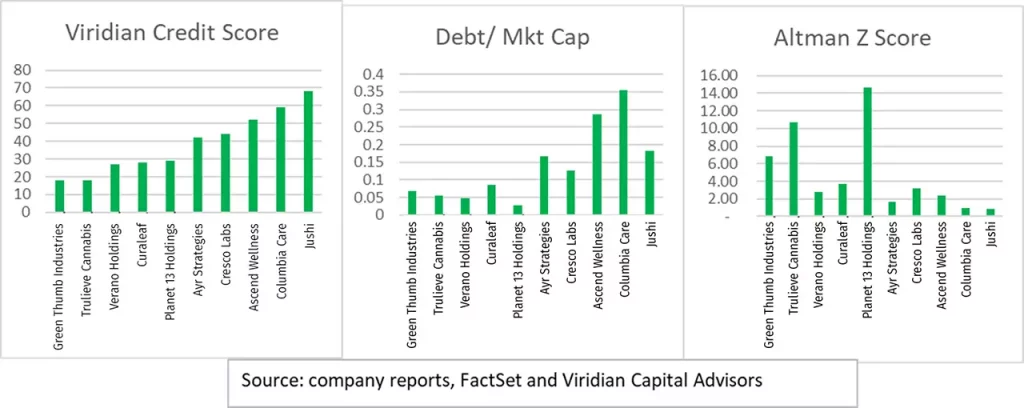

Below is a more comprehensive look at the credit quality of the public MSOs with more than a $750 market cap, placing Verano in context.

Verano ranks as the third-best credit of the group, consistent with the pricing of its upsized credit facility. It has the second-lowest debt-to-market cap and the group’s highest analyst consensus 2022 EBITDA margin.

Viridian expects to see continued debt issuance from MSOs as they fund build-outs of newly acquired licenses and pursue accretive acquisitions.

Business leaders need reliable industry data and in-depth analysis to make smart investments and informed decisions in these uncertain economic times.

Get your 2023 MJBiz Factbook now!

Featured Inside:

- 200+ pages and 50 charts with key data points

- State-by-state guide to regulations, taxes & opportunities

- Segmented research reports for the marijuana + hemp industries

- Accurate financial forecasts + investment trends

Stay ahead of the curve and avoid costly missteps in the rapidly evolving cannabis industry.

Are you ready for outside funding? Chances are, you aren’t

Needing funding is one thing, getting funding is another – especially when you start looking outside your family and friends.

But there’s one critical question you need to ask yourself if you want to be successful in this endeavor: Are you ready for funding?

It might seem like a silly question: Who isn’t ready for funding?

But, according to speakers at the recent MJBizFinance Forum, most small cannabis companies aren’t ready.

What does it mean to be ready for funding?

- Get your files in order. Auditors will want a detailed record of what your company has been doing over the past two years, so start collecting the paperwork now, said Melissa Diaz, partner at Arizona-based Rebel Rock Accounting. This includes receipts, tax returns, seed-to-sale records and, well, pretty much everything that can provide a foundation for the strength of your business. Seem daunting? There are simple, inexpensive technology platforms – Diaz recommends Hubdoc – that can help you create that paper trail and set you up for success.

- Engage partners early. You can go it alone, but your chances for success are much better if you find partners who have the expertise to guide you through. This includes accountants, legal counsel, IT professionals … the list can go on and on. But the core message is, don’t try to do what you don’t know how to do just because you’re the founder.

- Don’t wait too long. If you’re feeling the crunch, it’s already too late to start – and you might find yourself having to accept less desirable funding – such as very high-interest loans – to bridge you to a better funding source. Kevin Goldberg, president of Maryland-based Green Leaf Medical, was faced with that choice when he began seeking money for expansion. Accepting the higher-interest funding gave him the time to get his house in order to secure a better deal. “It always takes more time than you think, but we needed the money,” he said.

– Jenel Stelton-Holtmeier