(You can have cannabis finance content such as this delivered directly to your inbox. Simply sign up here for our weekly MJBizFinance newsletter.)

There is a disconnect between fundamental performance and stock performance for U.S. cannabis companies, resulting in compressing valuations for those operations.

But multiples for 2022 are nearing past trough levels. Strong second-quarter earnings have not yet driven realignment.

The stocks of U.S. cannabis operators are down 9% on average since the sector reported good second-quarter results and reiterated guidance for 2021 and 2022.

None of the stocks are positive except those of The Parent Co., which announced a buyback after its stock dropped 69% from its high.

Public U.S. cannabis stocks are down 36% on average from their highs in February. Meanwhile, the index of U.S. small-capitalization stocks, the Russell 2000, is 7.4% off its high, achieved March 15.

Yet, the fundamentals of the cannabis stocks for the second quarter were generally good. Estimates were mostly achieved or beaten, and guidance for 2021 and 2022 was generally reiterated or raised.

However, even those stocks that beat, such as Cresco Labs, Curaleaf and Green Thumb Industries, have all experienced declines in the high-single digits; those that missed declined in double digits.

The weakness in the broader small-cap index explains some of the decline, as any drop in the Russell 2000 will lead to larger declines in U.S. cannabis stocks as well – no stocks trade in a vacuum. But it doesn’t explain all the decline.

What can we glean from the results and earnings calls?

Guidance reiterated, while estimates are higher – too optimistic or underpromising?

Both Curaleaf and Cresco reiterated their previous guidance, yet consensus estimates are already at the high end or above this guidance.

Curaleaf said it is “very, very comfortable” with its 2022 guidance for a “30%-plus” EBITDA margin; consensus estimates have 33.4% already.

Cresco guided to exit the fourth quarter of 2021 at $250 million in run rate revenue, yet consensus is already at $258 million.

Is such reiteration below consensus estimates disappointing for investors?

Perhaps for some, but MJResearchCo views the approach to underpromise and overdeliver as a smart plan. The cannabis investment case is a long-term strategy, not based merely on beating 2021 results.

Market expansion: Many large multistate operators are expanding operations in Florida as that limited-license market matures. Despite some pricing pressure, these companies generally have beaten expectations. As any market grows, there will be expansions of capacity and price fluctuations, and these operators seem to be managing that growth well.

Operating leverage: As these companies grow revenue, they are scaling into their fixed costs, which expands margins and offsets gross-margin pressure. Cresco noted that it sees upside to guidance in 2022 because of operating leverage.

What drives gains going forward?

Multiples on 2022 estimates are nearing trough levels, with the U.S. cannabis stocks trading at about 3X sales and 9X EBITDA.

A similar disconnect between fundamental and stock performance occurred in the coronavirus-driven decline in March 2020, when stocks bottomed at 2X sales and 8X EBITDA , which proved to be an excellent buying opportunity.

In April 2020, MJResearchCo analyzed this in the context of prior market corrections in 2008 and 2001 when consumer/tech/pharma stocks bottomed at 2X sales and 7.5X EBITDA.

The market will shift to 2022 multiples instead of 2021 in a few months.

In the meantime, companies are building a growing, profitable and proven legal industry and supply chain at increasingly attractive valuations.

– Analysis by Mike Regan and Colin Ferrian, MJResearchCo (mikeandcolin@mjresearchco.com)

Deal of the Week / In partnership with Viridian Capital Advisors

Greenlane capital raise could affect KushCo deal

Greenlane Holdings (Nasdaq: GNLN), one of the largest sellers of cannabis accessories, packaging and vape products, closed a sale of securities with gross proceeds of $31.94 million to selected accredited investors under its at-the-market program.

The deal is comprised of:

- 4.2 million Class A Units sold at $3.16 per unit, with each unit including one Class A share and 0.6 shares of five-year warrants with an exercise price of $3.55.

- 6.1 million prefunded warrants units ($0.01 exercise price with no maturity) with 0.6 shares of warrants identical to the Class A Units.

The attached warrants are valued at approximately 42 cents per unit for a calculated net share price of $2.73.

Greenlane’s stock price has dropped 18% since the Aug. 9 equity deal announcement, primarily because of the perceived dilution from the raise.

Impact on Greenlane-KushCo deal

One of the most interesting aspects of this deal is its impact on the Greenlane-KushCo Holdings transaction, originally announced in March.

The deal is an all-stock transaction in which KushCo shareholders receive a number of Greenlane shares (set initially at 0.2546) for each share of KushCo held.

The transaction makes excellent sense, combining KushCo’s relationships with the multistate operators and licensed producers and Greenlane’s branded offerings.

The merger also provides cost-saving synergies estimated to reach $15 million-$20 million over two years and eliminates competition between the companies.

One feature of the KushCo-Greenlane deal that appears to be less understood is the exchange ratio.

The complicated formula pictured below has a simple intent: Keep Greenlane’s ownership of the combined entity between 50.1% and 51.9%.

Thought of another way, the variable exchange ratio protects KushCo shareholders against dilution from Greenlane capital raises.

This ratio has stayed within a tight range – 0.25 to 0.2546 – since the deal announcement.

This ratio has stayed within a tight range – 0.25 to 0.2546 – since the deal announcement.

The deal has no antitrust challenges, and the shareholder vote is set for Aug. 26.

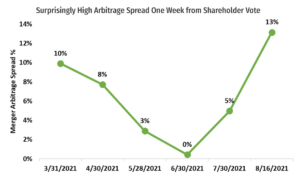

The graph below shows the risk arbitrage spread since the merger announcement. It narrowed to a low of 0.4% at the end of June and would be negative at Aug. 16 if the capital raise didn’t change the exchange ratio.

However, Viridian Capital Advisors believes the equity issue does change the exchange ratio to approximately 0.3.

We calculate the current spread at around 13%, quite wide for a deal that makes great economic sense and appears close to shareholder approval.

The only explanation we can come up with is that the mechanism to correct this spread would be to short Greenlane and buy KushCo, and there just are not enough investors willing to make that trade to eliminate the gap.