(This story is part of an occasional series on the international medical cannabis industry. The previous installment, on Denmark, is available here.)

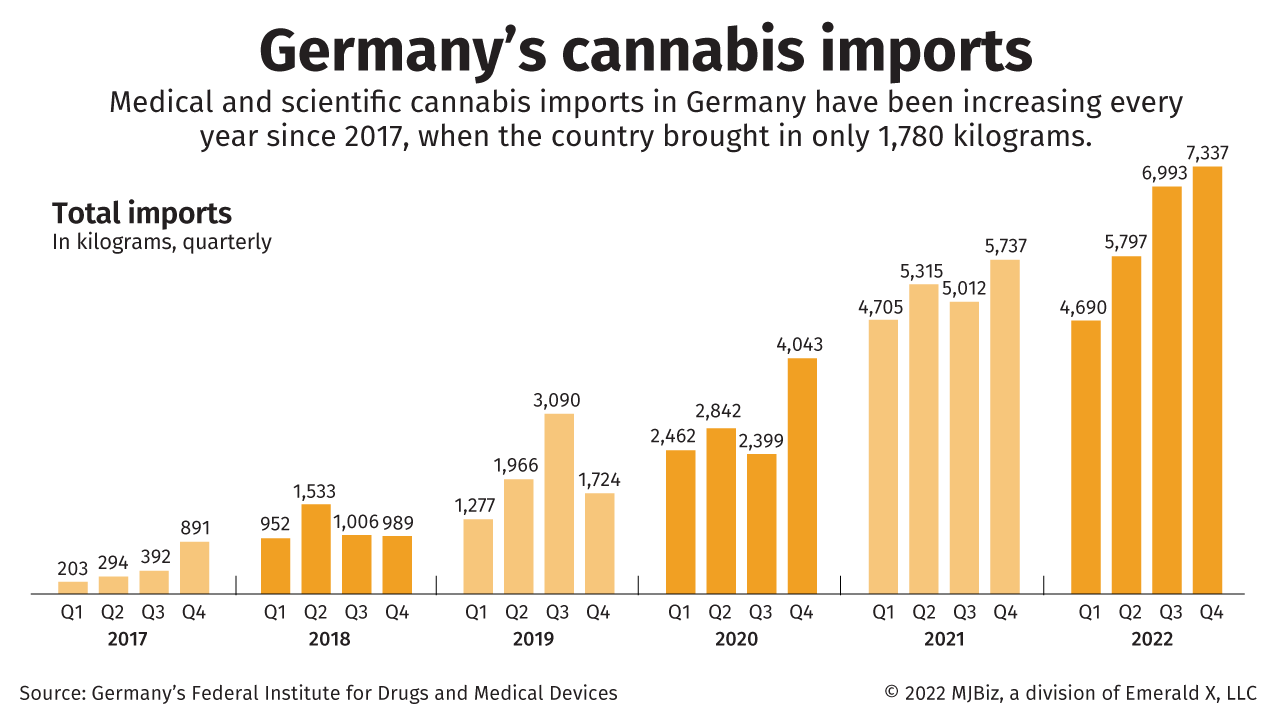

Germany imported a record amount of marijuana for medical and scientific use in 2022, according to fresh data from the country’s Federal Institute for Drugs and Medical Devices (BfArM).

While the top-line number suggests the import business is booming, a deeper look shows that 2022 posted the slowest annual growth since the BfArM started reporting cannabis import data in 2018.

Moreover, a good chunk of those imports appears to have never reached patients, possibly because of poor quality or product being reexported to another country, experts suggest.

In 2022, nearly 25,000 kilograms (27.6 tons) of cannabis were imported into Germany for medical or scientific purposes, an increase of 19% over the 20,769 kilograms imported in 2021.

In 2021, Germany’s imports rose 77% over 2020.

The growth rates for 2020 and 2019 were 46% and 80%, respectively.

Industry sources say the data doesn’t paint a full picture of the cannabis industry in Europe’s largest economy. They point to:

- Data on government reimbursements for medical cannabis products, which have not been rising at the same pace as imports.

- An unknown amount of those imports that likely were reexported to other European markets.

- The amount of cannabis shipped to pharmacies appears to be well below the amount imported into Germany.

“This data does not in any way reflect or mirror sales to patients in Germany,” Deepak Anand, head of international consulting at Denver-based Gateway Proven Strategies, told MJBizDaily.

“All it does is point to the fact that the import of cannabis into Germany for medical and scientific purposes is increasing.”

Anand points out that reimbursements of medical cannabis in Germany have been relatively flat since 2020, according to data from the German National Association of Statutory Health Insurance Funds.

(Reimbursement data does not account for people who paid for legal medical cannabis out of their own pockets.)

“For companies interested in targeting the German market, patient and physician education is paramount,” Anand said.

“It is also interesting to point out that product innovation – apart from the focus on high-THC flower – will prove vital.”

As an example, Anand said cannabis extracts were the fastest-growing category in the German market, accounting for about 26% of market share in October 2022, up from 21% the previous year, based on market data provided by pharmaceutical data provider Insight Health.

Growth trend

Constantin von der Groeben, managing director of Berlin-headquartered cannabis company Demecan, said the import data isn’t surprising because it reflects a probable upward growth trend of the overall German medical cannabis market.

However, he told MJBizDaily via email that, as of September 2022, only 8.4 tons of medical cannabis had been delivered to German pharmacies, a far cry from the 19 tons of cannabis imported during the same time period the previous year.

The government disclosed the 8.4 tons figure in response to a question asked by a member of Germany’s parliament, the Bundestag.

“To me, it shows that a lot of cannabis that is imported cannot be sold, probably because it is poor quality,” von der Groeben wrote via email.

He said the disparity shows that Germany ought to rely more on domestically produced cannabis.

“It is such a waste to import excess quantities of cannabis, which cannot be sold, rather than relying on quality-controlled cannabis made in Germany,” he added.

Demecan is one of a handful of companies allowed to grow commercial medical cannabis in the country.

According to von der Groeben, some companies focus only on getting their cannabis into Germany and lack an understanding of the country’s domestic market.

Germany currently has a cap on domestic commercial cannabis production, meaning most medical cannabis needs to be imported.

More in this series

- Australia’s medical cannabis sales might surpass Canada’s in near future

- Israel’s medical cannabis patient growth slows as industry awaits major reform

- Denmark medical cannabis sales mostly on the rise, but pilot program sputters

“One should only import what can be sold,” he wrote, adding that it’s just a matter of time before the government lifts the cultivation limit.

“The moment the restriction on cannabis cultivated in Germany is lifted – i.e., Demecan would be allowed to cultivate more than just 990 kilograms per year – demand for imports will be reduced,” von der Groeben noted via email.

Import market challenges

Finn Hänsel, founder and managing director of Berlin-based Sanity Group, sees a strong case for continued cannabis imports, since cannabis produced overseas is comparable in quality to cannabis produced in Germany and has a lower cost base.

However, the executive foresees potential challenges to forecasting beyond one year.

For instance, potential recreational marijuana legalization in Germany could lead to patients migrating to the adult-use market, as happened in Canada after that country legalized marijuana in 2018, as well as in U.S. states that approved adult use.

Hänsel also said regulation involving dried flower might factor into the economics of the import market.

“For now, the (Federal Joint Committee, or Gemeinsame Bundesausschuss) G-BA decided to (keep) the regulation like it is, but we see a strong desire from the regulator to move away from flower toward finished pharmaceuticals,” he said.

Such a trend would be consistent with neighboring Denmark, where pharmaceutical medical cannabis accounts for a much bigger overall share of the market than unapproved medical cannabis products such as dried flower.

Consumer price could also affect the economics of the import market.

“Continuous price decreases, price pressure from health insurances and patients might lead to a strong shift in geographies, from (where) it is (economical) to import cannabis due to cost base,” Hänsel said.

Matt Lamers can be reached at matt.lamers@mjbizdaily.com.