Toronto might boast the most legal cannabis sales of any Canadian city, but its residents lag far behind those in Calgary and even Quebec City when it comes to per capita spending on recreational products.

Data from Canada’s federal statisticians offers early insights into how much legal cannabis is being sold in some of the country’s largest urban centers and how effectively provinces are opening new stores to reroute illegal sales to regulated channels.

The data reveals which cities are underperforming compared to other large cities, where illicit sales still rule and where the best potential opportunities might remain for aspiring retailers in underserved markets – provincial legal frameworks and regulations notwithstanding.

The data also sheds light on previously unreported trends, including:

- Cities that experienced the heaviest cannabis stockpiling as coronavirus pandemic lockdowns took effect in 2020.

- Interprovincial shopping trends stemming from Quebec raising its minimum age to buy cannabis from 18 to 21.

- Legal cannabis spending per capita in Canada’s biggest cities.

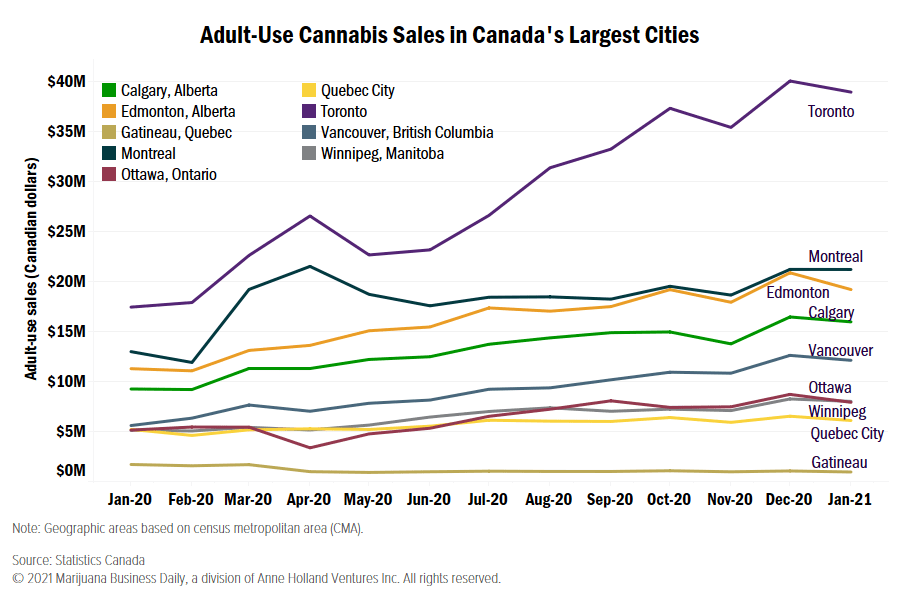

From a raw data perspective, Toronto led the country in sales in January 2021 at 39 million Canadian dollars ($31 million), according to the most recent Statistics Canada figures.

Montreal and Edmonton were a distant second and third, respectively, with cannabis store sales of CA$21.2 million and CA$19.1 million.

In all of 2020, Toronto was the clear leader with CA$334 million in sales – or 12.7% of all regulated recreational cannabis revenue in Canada.

Montreal was next with CA$217 million that year, while Edmonton saw approximately CA$189 million in legal marijuana sales.

The three cities accounted for 28.1% of Canada’s CA$2.6 billion of cannabis sales in 2020.

Statistics Canada discloses cannabis store sales in nine of the country’s largest census metropolitan areas.

The nine cities accounted for 52% of Canada’s estimated population in 2020 and 47% of all recreational cannabis sales in regulated channels in the nation that year.

Per capita sales

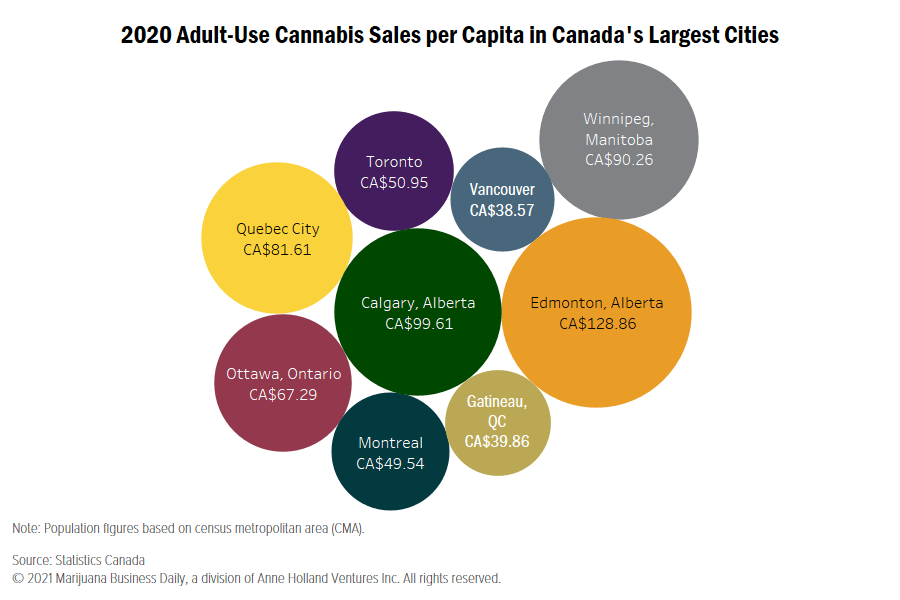

While Toronto is the leader in Canada when it comes to nominal cannabis sales, the nation’s largest city by population is nowhere near the top when it comes to per-person spending on recreational marijuana.

Torontonians spent CA$50.95 per person on legal cannabis products last year on average, ahead of Montreal, Gatineau, Quebec, and last-place Vancouver, British Columbia.

Edmonton and Calgary in Alberta were the leaders with per-person cannabis spending totaling CA$128.85 and CA$99.61, respectively.

Winnipeg, Manitoba, was third at CA$90.26 per person.

The cannabis sales and per capita spending in the largest census metropolitan areas were:

The cannabis sales and per capita spending in the largest census metropolitan areas were:

- Edmonton: CA$189.3 million (CA$128.85 per person)

- Calgary: CA$153.7 million (CA$99.61 per person)

- Winnipeg: CA$76.7 million (CA$90.26per person)

- Quebec City: CA$67.9 million (CA$81.60 per person)

- Ottawa: CA$74.8 million (CA$67.28 per person)

- Toronto: CA$334 million (CA$50.95 per person)

- Montreal: CA$216.2 million (CA$49.53 per person)

- Gatineau: CA$13.9 million (CA$39.86 per person)

- Vancouver: CA$105.6 million (CA$38.57 per person)

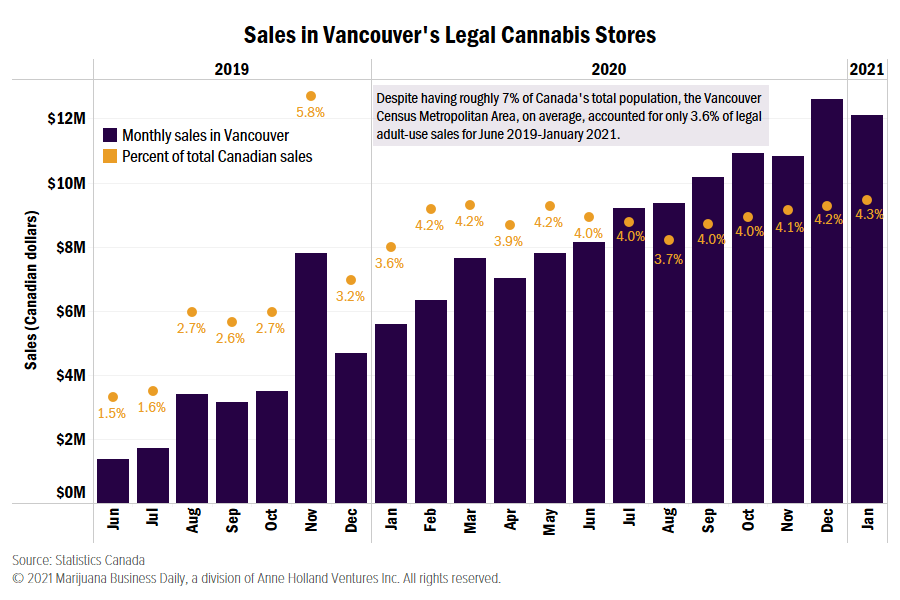

Lucas McCann, a former Health Canada employee who is now a regulatory expert with Toronto-based cannabis licensing consultancy CannDelta, suggested lower per-person spending generally shows where the legal market has the most ground to make up against illicit sellers.

Aside from Toronto having more legal stores, he said the illicit market might be more entrenched in Vancouver than it has been in Toronto.

“The numbers suggest that a lot of folks in B.C. are still shopping in illicit stores or purchasing in the illicit market,” he said.

Krista Raymer, co-founder of cannabis retail consultancy Vetrina Group in Toronto, said retailers generally need to do more to lure customers from the illicit market.

“If you’re going to be in any of these cities, you as a retailer are facing a requirement to be more specific and drill into a customer base. Simply being a cannabis store isn’t good enough any more,” she said.

“You have to have a unique selling proposition and an opportunity to create relationships with customers, but also the inventory to support that.”

Pandemic effect

Cannabis stockpiling gripped some Canadian cities more than others as the pandemic took hold of the country in early 2020, the data suggests.

Cannabis pantry loading appears to have gripped Montreal more than other cities.

Montreal’s cannabis sales went from CA$11.9 million in February 2020 to almost CA$20 million in March 2020, a 61% jump, suggesting that people were stockpiling cannabis as the pandemic took hold.

In response to the pandemic, the Québec government declared a public-health emergency in mid-March 2020.

The city’s sales rose further in April, to CA$21.5 million.

New stores probably were a factor, but not the only one. Three new stores opened in the city in March 2020, a modest number given the size of the city.

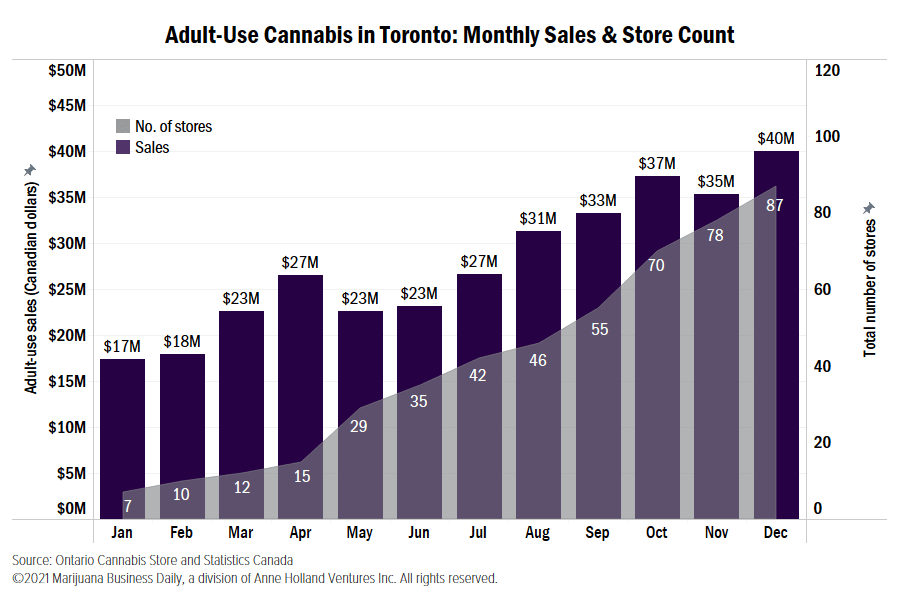

In Toronto, sales rose from CA$17.9 million in February 2020 to CA$22.6 million in March and then CA$26.5 million in April, an increase that can be partly explained by consumers stocking up on cannabis as the pandemic took hold of the city.

Stores matter

When it comes to participating in the legal cannabis market, consumers have demonstrated a strong preference for brick-and-mortar shopping.

In particular, provinces with the most stores reported the highest overall sales figures since legalization took effect in late 2018.

The latest data is the first to show a link between regulated city-wide monthly cannabis sales and newly opened stores.

Toronto started 2020 with only seven cannabis stores serving the city’s entire legal market. Figures provided by the Ontario Cannabis Store – the monopoly wholesaler for the province’s industry – show that number gradually rising through the year, ending 2020 with 87 stores.

Over the same period of time, Toronto’s monthly sales rose from CA$17.4 million to start the year to CA$40 million in December.

Ottawa experienced a similar trend. The capital city started last year with only three stores and CA$5.1 million in sales.

By the end of the year, the city had 15 stores and CA$8.7 million in sales.

Matt Lamers is Marijuana Business Daily’s international editor, based near Toronto. He can be reached at matt.lamers@mjbizdaily.com.