(Editor’s note: This story is part of a recurring series of commentaries from professionals connected to the cannabis industry. Naomi Granger, CPA, MBA, is the co-founder of Dope CFO.)

(Editor’s note: This story is part of a recurring series of commentaries from professionals connected to the cannabis industry. Naomi Granger, CPA, MBA, is the co-founder of Dope CFO.)

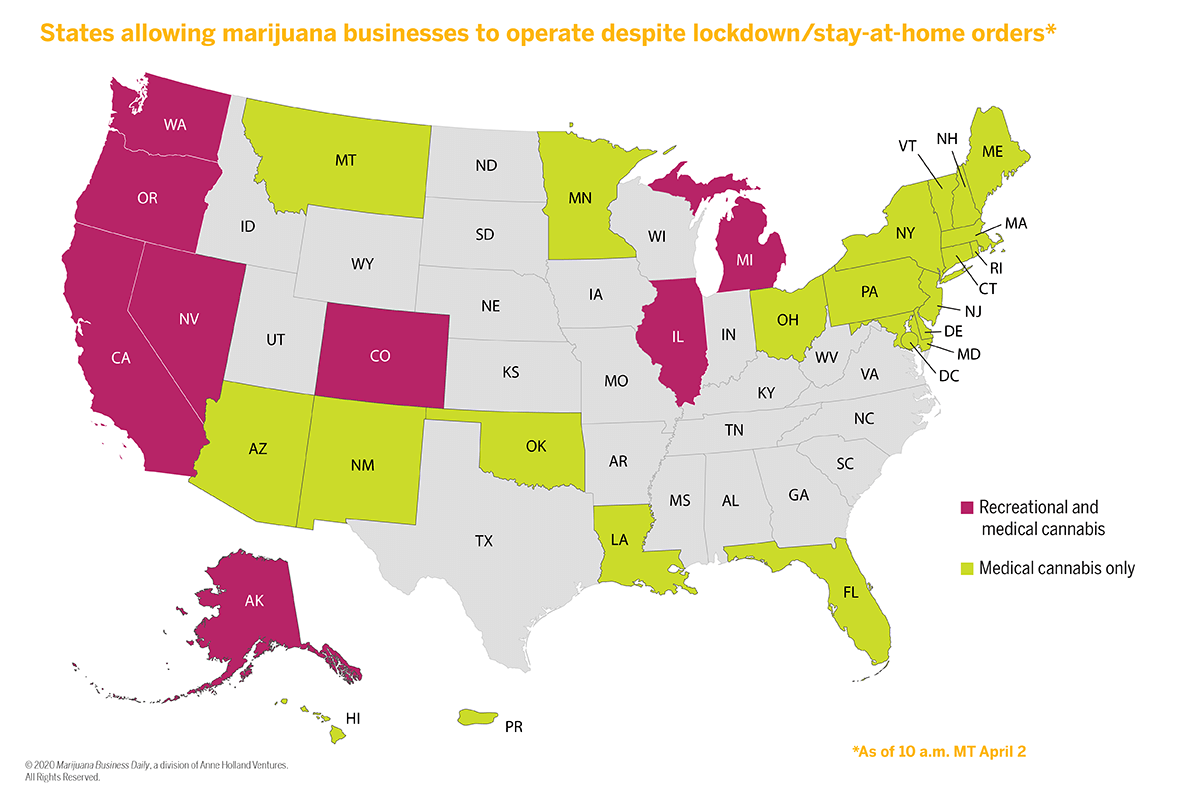

Although many states have deemed marijuana an essential business and allowed retailers and other MJ businesses to remain open during the coronavirus pandemic, cannabis companies are beginning to feel the effects of the COVID-19 financial fallout.

That means cannabis companies need trained accountants more than ever.

The pandemic is causing many business owners to keep a closer eye on expenses as well as risks related to significant back taxes, penalties and the potential loss of investors or acquisition opportunities.

Audits

Cannabis companies are experiencing audits regularly, and noncompliant businesses face years of litigation, significant legal fees and back taxes.

In more extreme cases, significant penalties have been handed out for lack of accuracy, such as in the Alterman-Gibson court case, with a $78,000 accuracy penalty, and the Northern California Small Business Assistants case, with a $250,000-plus accuracy penalty.

Marijuana companies need a cannabis accountant trained in keeping sound books and records.

Every number in the books should be supported and properly recorded. Organized books not only reduce risk but can result in cost savings during an audit.

It should be as easy as handing over a folder with all this support to the auditors.

Valuations

Cannabis companies must think about the following long-term goals:

- Are you building a legacy to be passed down from generation to generation?

- Do you want to show as much growth as possible to take advantage of buyouts and acquisitions that will occur once this industry goes federally legal?

If it’s the latter, executives must think about how the company will be able to get the highest valuations in the event of a merger or acquisition.

Buyers will be looking for cannabis companies that:

- Maintain clean books and records.

- Comply with Section 280E of the IRS tax code.

- Have a reputable brand and market share.

- Can grow and vertically integrate.

Recent headlines report many companies being sued by their investors.

As this news surfaces, it’s going to get increasingly more difficult for cannabis companies to secure funding if they don’t have a clean set of books.

Cannabis business owners should not only consider their long-term goals for valuations but also their short-term goals for bringing on new lenders and investors.

Banking

Since cannabis remains classified as a Schedule 1 drug, its illegal status makes banking a challenge.

It is not easy to pay wages, insurance and taxes when you are working with an all-cash business.

Having massive amounts of cash on your premises also puts your business at an extremely high risk of internal and external theft, so more security is necessary to protect personal and professional interests.

The good news for cannabis businesses is that there are banks that will take your money.

Most of the banks that will do business with cannabis businesses tend to have a lengthy application process, including documentation such as financial statements.

Many of these banks also perform quarterly reviews of these financial statements, so marijuana companies need a cannabis-trained accountant to keep their books and records up-to-date for submission to the bank.

The banks do not just look at the quarter in total, they also look at each month leading into the quarter. So monthly financial records must be prepared and ready to go.

If a bank sees huge fluctuations month-over-month, the account will be flagged and the banker will ask about those discrepancies.

If your company does not have a solid reason for such inconsistencies – other than not having great accounting systems in place – your account might be shut down.

Cannabis specifics

With all the federal and state regulations to navigate, accounting for cannabis is very complex.

Section 280E is one sentence in the tax code with major implications when it comes to accounting.

To account for 280E expenses properly, the person handling the books for a cannabis company must understand:

- Cost accounting.

- Accrual accounting.

- Generally accepted accounting principles (GAAP).

- Absorption accounting.

Cannabis business owners will find it hard to find a generalist accountant who understands a lot of these concepts, largely because an understanding of GAAP and cost-based accounting is not required for most small- to medium-sized businesses.

GAAP is actually required for publicly traded companies overseen by the U.S. Securities and Exchange Commission, so it requires an extra skill set beyond everyday small business accounting.

Include an accountant in your budget from inception.

Maintaining meticulous records will help ensure you are able to maintain your license, banking and funding. It also will keep you out of hot water with the IRS.

Naomi Granger is co-founder of Dope CFO. She can be reached at naomi@dopecfo.com.

The previous installment of this series is available here.

To be considered for publication as a guest columnist, please submit your request here by filling out our form.

For more of Marijuana Business Daily’s ongoing coverage of the coronavirus pandemic and its effects on the cannabis industry, click here.