Innovative Industrial Properties is on a marijuana shopping spree, having spent $100 million since April to buy cultivation and distribution facilities around the nation while providing cannabis operators with sorely needed cash.

The San Diego-based real estate investment trust (REIT) now owns 61 cannabis industrial properties, more than double the 26 it owned a year ago.

And IIP shows no sign of letting up, despite the COVID-19 pandemic that has sent the global economy into a tailspin.

The company, like most REITs that focus on the marijuana industry, acquires buildings from cannabis businesses and then leases them back to the companies, which often are multistate operators.

In July, for example, IIP inked a $35 million sale-leaseback deal with MSO Curaleaf for a property in New Jersey.

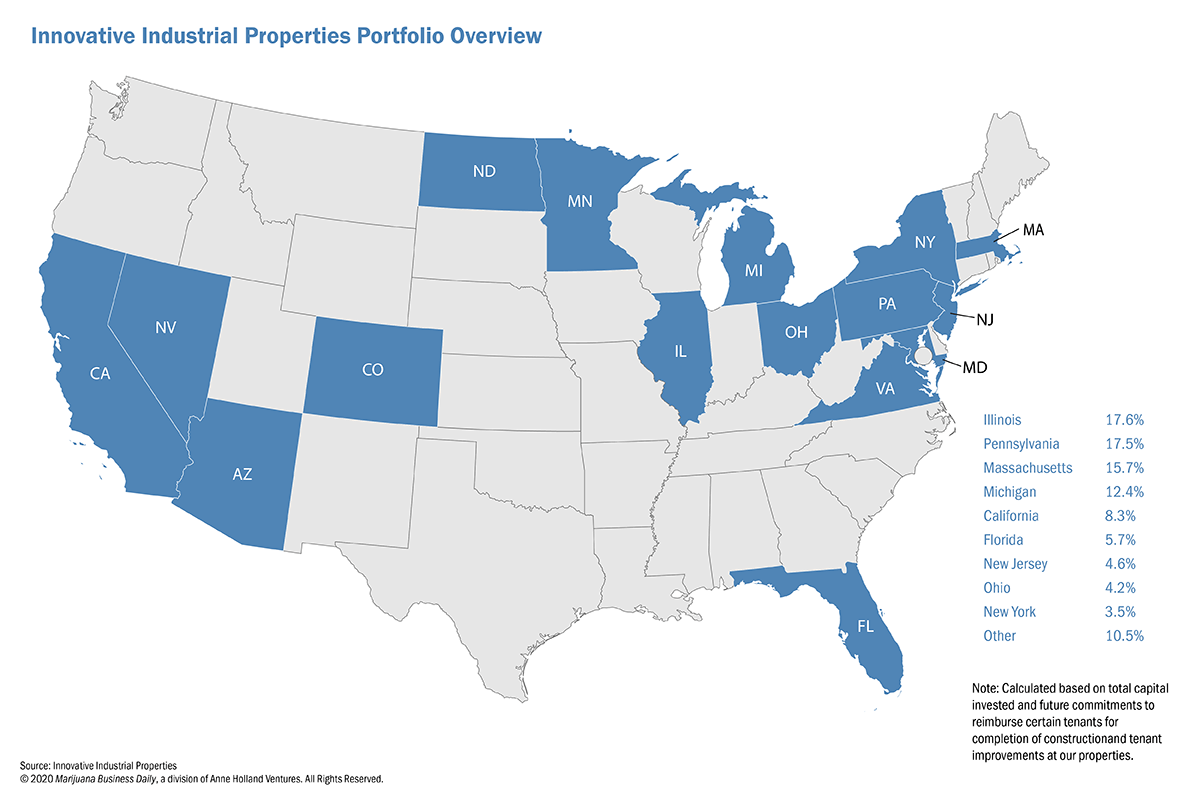

The REIT’s real estate portfolio spans the nation, with facilities in Illinois, Massachusetts, Michigan, Pennsylvania and elsewhere. (See map above.)

The sale-leaseback deals give cannabis companies a source of quick cash at a time when more traditional sources of funding such as debt and equity deals have receded.

In a sign of investor confidence, IIP recently raised about $225 million in a stock offering, making the nation’s largest cannabis REIT that much bigger.

The company’s shares (IIPR) are trading near their 52-week high on the New York Stock Exchange, having surged 18% last month alone.

Paul Smithers, CEO and president of Innovative Industrial Properties, said he wouldn’t characterize the company’s recent acquisitions as a “buying spree” but, rather, a “continuation of the activity we have seen throughout 2019, carrying into 2020.”

The $225 million that IIP raised will allow the company to grow its footprint.

But Smithers said the company is being selective where it plants its flag.

“We continue to gravitate toward states that have a highly competitive process to award a limited number of licenses to operators,” Smithers said, noting the company entered the New Jersey market in July by “establishing new relationships” with Curaleaf and Columbia Care.

Sale-leasebacks proliferate

IIP’s purchases come as sale-leaseback real estate deals are becoming increasingly common in the U.S. marijuana sector.

From April 1 through Aug. 5, the company paid $101.5 million for eight properties with a total of 775,000 square feet in California, Massachusetts, Michigan, New Jersey and Pennsylvania.

The 61 properties IIP owns represent a total of 4.5 million square feet, more than double the 2 million square feet the company owned a year ago.

Smaller cannabis investment companies also have inked some acquisitions in 2020:

- In February, Chicago-based NewLake Capital Partners announced a $19.7 million deal with Illinois-based Grassroots Cannabis for 10 marijuana properties with 60,000 square feet of retail space in six states.

- In May, Power REIT, a small company based in Old Bethpage, New York, announced a $4.9 million investment for the construction of a cannabis greenhouse in Maine for medical marijuana provider Sweet Dirt.

Charles Alovisetti, a Denver-based partner of the cannabis-focused law firm Vicente Sederberg, said he believes IIP has been the most active REIT since the coronavirus crippled the economy, noting most of its competitors are small players.

“I haven’t seen a lot of activity this year” other than from IIP, said Alovisetti, who is licensed to practice law in Colorado, Massachusetts and New York.

COVID impact

IIP, like many businesses, has been challenged by the coronavirus.

“This severe nationwide economic disruption is really the first recession that the regulated cannabis industry has faced,” Smithers noted.

He said he has been impressed by how fast the company’s tenants responded to the crisis.

“Although these businesses have always operated in highly controlled, highly sanitized environments, our tenants quickly took additional steps to protect the health of patients, customers and their employees,” he said.

He cited extra safety steps taken by the MJ industry, including:

- Enhanced cleaning protocols.

- Additional personal protection equipment.

- Shift staggering.

- Social-distancing protocols.

From April through June, IIP collected 100% of the rent due from tenants.

But the company did enter into a “deferral program” for three of its 23 tenants, which allowed a portion of their security deposits to pay April rent in full and defer rent in May and June. Repayments were to take place over an 18-month period starting July 1.

“We are really pleased overall with our rent collections, and more importantly, the ability of our tenants to adapt to this new environment,” during which, Smithers noted, most states deemed cannabis “essential.”

Serving as a funding source

Companies such as IIP “have filled the void left by tight equity and debt markets, providing asset-backed capital at rates in the teens for 15-year terms,” said Mike Regan, an equity analyst and managing member of Denver-based MJResearchCo.

He added that while “having cash to survive is always paramount,” a sale-lease agreement saddles a company with long-term and higher operating costs.

Regan advises cannabis firms leasing properties to “look for flexibility to renegotiate” their lease term in the event of nationwide legalization.

Looking ahead to the November presidential selection, lawyer Alovisetti is even more bullish on what a Democratic sweep of Congress and the White House could mean for the cannabis industry, including REITs, and federal legalization.

“Anything that benefits the underlying tenants should be good for REITs,” Alovisetti said, “as it creates better capitalized tenants and increases the demand for cannabis-specific real estate.”