Acreage Holdings pulled its 2020 targets – the largest of which was positive-adjusted EBITDA in the second half of 2020 – because of the coronavirus outbreak and delayed its 10K filing to May 14 at the latest.

Presumably the 10K will be filed before May 13, when the New York-based company plans to hold its first-quarter earnings call.

Acreage’s abandonment of the targets outlined only a month ago on its fourth-quarter call (the transcript is available here) shows how rapidly the COVID-19 situation is affecting the company.

However, we wonder if it is not merely operational but financial as well, as the coronavirus outbreak has driven an overall market correction.

It seems Acreage is having trouble funding the remaining portions of the complex capital raise it announced in February (our detailed analysis is available here).

If Acreage can’t raise another $65 million by June, the company owes $20 million of the $50 million intellectual property loan back to the lenders (including CEO Kevin Murphy).

The plan was for Acreage to raise another $20 million on March 16 (there has been no additional announcement regarding this) and another $45 million between March 16 and June 7.

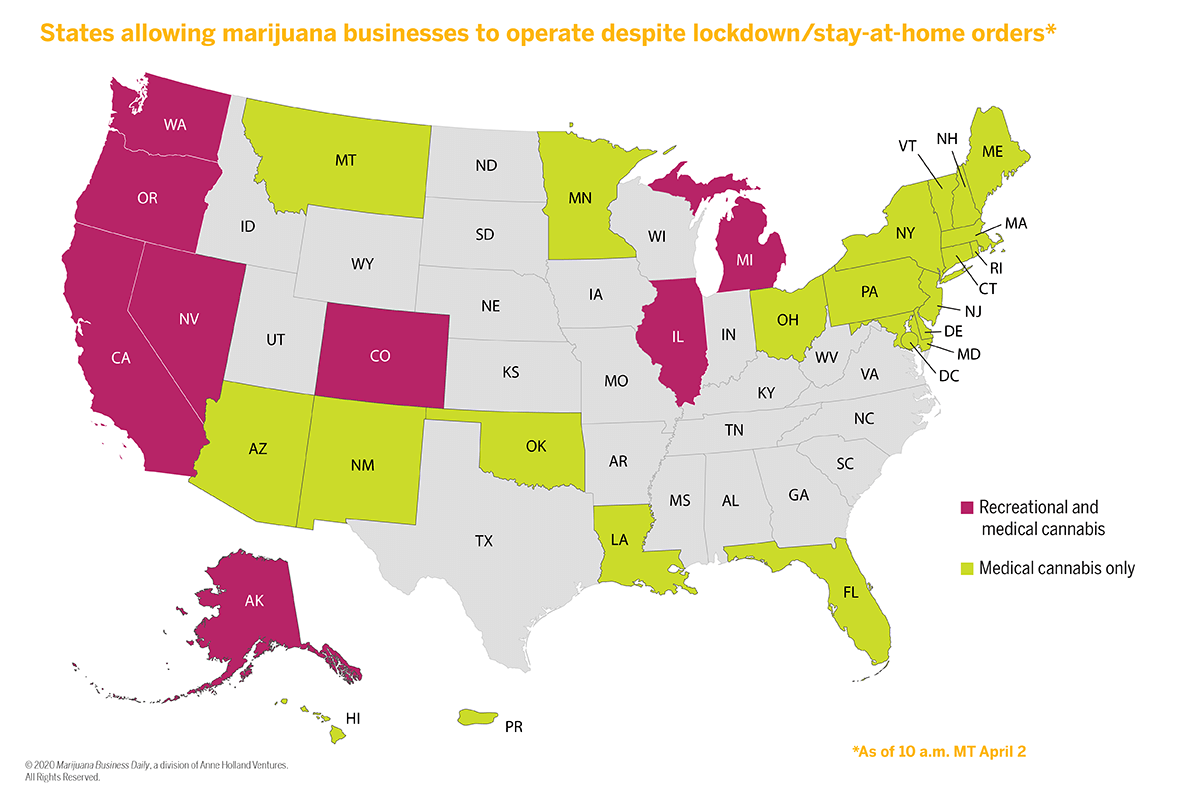

With coronavirus lockdowns pressuring both store openings and operations and the financial markets delaying funding options, Acreage probably cannot open the additional 10-15 dispensaries needed to scale to positive EBITDA.

During the 2008 financial crisis in the United States, the market correction and general need for liquidity led to a financial contagion well beyond subprime mortgages.

Unrelated assets all traded down as everyone sourced liquidity by selling whatever they could and delaying planned outlays. We wonder if something similar is happening now.

Deep Roots acquisition saves $20 million and 4.1 million shares

Another 2019 cannabis deal died Friday, with the company calling off its acquisition of Deep Roots, citing regulatory delays, though the benefit of forgoing this deal will avoid an outlay of $20 million in issuance of 4.1 million shares.

Originally announced a year ago, this deal had been expected to close in 2Q19.

This is yet another failure of a deal done in a different time, following in the footsteps of the Harvest-Verano and Harvest-Falcon deals, and we recently questioned the risk of the Tryke-Cresco transaction.

Were exec resignation, 122 employee furloughs already planned?

Acreage furloughed 122 employees (24% of its 508-employee count as of April 2019), and Acreage’s chief people officer, Steve Hardardt, resigned effective immediately, with no replacement announced.

It is unclear if this furlough is incremental to the $7 million in annualized general and administrative savings announced by the company on its February call or if some of these furloughs were already being contemplated in February.

Hardardt joined Acreage only eight months ago, so we wonder if this implies he does not agree with the furlough or if he improperly executed it, or if the company believes other remaining executives can shoulder his duties.

Pulled guidance specifics

For reference, the specific targets (which are now abandoned) outlined by CFO Glen Leibowitz in the Feb. 26 earnings call included:

- Plans to build out 10-15 new dispensaries to end the year with 48-53 operational or fully constructed dispensaries. Most of those new dispensaries were planned for Florida.

- Continued “outsized growth” in the wholesale segment, bringing segment revenue to roughly 20% for 2020 versus 16% in 2019.

- Continuing the cost-cutting program focused on G&A, including staff optimization and travel cuts, among other expense reductions.

- Delivery of about $7 million (12% of reported G&A in 2019) in annualized savings from the expense controls.

- Capital expenditures of $45 million-$50 million, most of which will be used to build new and expand existing facilities.

- Utilized sale-leaseback on certain facilities to provide additional cash and reduce need for additional capital.

“We expect the combination of these financial and operational targets to accelerate our pathway to positive pro forma adjusted EBITDA in the second half of 2020,” Leibowitz said.

Mike Regan can be reached at miker@mjbizdaily.com.