From McDonald’s to Marriott, from Subway to Century 21, franchise businesses are as American as apple pie.

In the U.S. marijuana industry, however, retail franchising has yet to take off on a national scale.

Now, as a new group of franchisers enters the industry, the stage is being set for potential growth in franchised cannabis stores across the country.

Dispensary franchisers told MJBizDaily that the franchise model can benefit franchisees by:

- Bolstering local business ownership.

- Providing the recognition of a common brand.

- Offering business-development support.

- Boosting socially disadvantaged entrepreneurs.

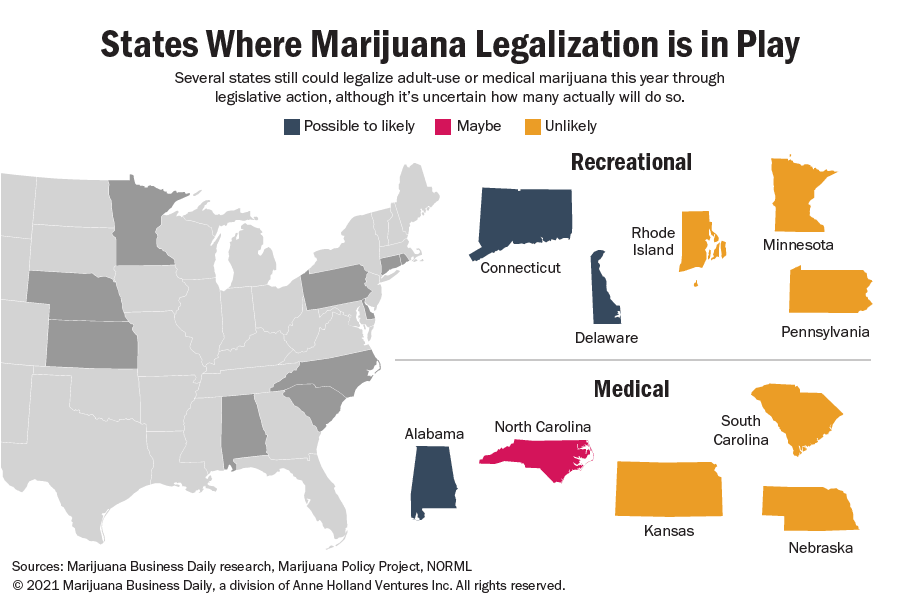

However, the regulated nature of both franchising and marijuana, combined with the limited number of cannabis business licenses in many jurisdictions, means the initial growth of franchised retailers might not match the proliferation of franchises in more mainstream industries, particularly while MJ remains illegal at the federal level and in some states.

The case for dispensary franchises

Cannabis retail franchising pairs well with states and municipalities that prioritize local ownership of marijuana businesses, according to Mike Weinberger, chief franchise officer of Phoenix-based Item 9 Labs, which acquired One Cannabis Group of Denver and its Unity Rd. franchise model in March for an undisclosed amount.

“There’s an opportunity here to keep the money in the community, to grow the community and to do better by people who have maybe never had those opportunities,” said Weinberger, a former CEO of franchiser Maui Wowi Hawaiian Coffees & Smoothies.

“The caveat is, these are million-dollar (or more) businesses,” he added. “A lot of these people who deserve the right to own them, it’s hard for them to operate.

“How would you operate a cannabis business if you’ve never been in the business?”

Unity Rd. franchisees must have liquid capital of $1 million. The one-time franchise fee is $100,000, and Unity Rd. charges a 5% royalty fee and a 2% marketing fee based on gross sales, paid monthly.

“We’re like any other franchise concept, we just happen to be cannabis,” Weinberger said.

“We help them through licensing, we take care of their branding, their construction, their real estate, all their education, ongoing support, (point-of-sale system) selection, supply chain – we do everything, so they can work on their business instead of in it.”

Unity Rd.’s first franchisee is in Boulder, Colorado, where the franchisee acquired a marijuana retail outlet in January and will rebrand the store to the Unity Rd. banner in June.

Weinberger said Unity Rd. has more than 30 franchise agreements and is working with partners in states such as Illinois, Maine, Michigan, New Jersey, South Dakota and West Virginia.

Like other cannabis businesses, Unity Rd.’s future growth will depend on rollouts in new state markets and the possibility of federal legalization, Weinberger said.

“But right now, we forecast that we will have 300 Unity Rd. stores open in the next 36 months.”

From restaurants to marijuana

Experienced restaurant franchiser Kathryn Blackwell is co-founder and CEO of Scottsdale, Arizona-based marijuana retail franchiser The Open Dør.

Blackwell believes franchising provides a path for independent store operators to “benefit from a common brand” without sacrificing ownership.

“If they get frustrated, or hung up, or stumble or end up having struggles, their only option is to maybe sell out to one of these big (multistate marijuana operators),” she said.

“So a franchise is a really great in-between step, where they can have that support and maintain their business and maintain ownership of their business and their license.”

The Open Dør launched its franchise offering last December, and Blackwell said the company is working with several groups in at least seven states to open its first franchised locations.

Blackwell said potential franchisees need a “strong financial background” and their own dispensary license.

“Really, our business model is helping those license holders get their dispensary open and be profitable,” she said.

Franchising to boost diversity and inclusion

Another aspiring player in cannabis retail franchising, the Curio WMBE Fund, has linked its business plan to the push for diversity and inclusion in the cannabis sector.

The fund – launched in December by Timonium, Maryland-based medical cannabis firm Curio Wellness – plans to lend franchise funding to underrepresented entrepreneurs such as women, minorities and disabled veterans who will acquire full franchise ownership over time.

For franchisees who “can bring at least $40,000 to the table, we’ll provide the remaining necessary capital, the direct equity investment and financing arrangements, (and) we’ll give them a loan to round out the capital structure,” said Jerel Registre, the fund’s managing director.

“The ultimate goal is to create a scenario where, at the outset, the franchisee owns 60% of the business and the fund would own 40%,” Registre continued.

“So we’re setting that entrepreneur up to be the majority owner from Day One and then providing a path for them to pay down the dollars they had to borrow to make up their 60% ownership.”

The fund is about two-thirds of the way through raising $30 million in capital funding and is focusing on franchising in Florida, Illinois, Maryland, Massachusetts, Michigan, Missouri, New Jersey, Ohio, Pennsylvania and Virginia. Registre expects opportunities in New York as well.

Registre believes the equity-franchising concept aims to remove barriers to success by providing back-office support such as bookkeeping and regulatory compliance, allowing the franchisee to focus on growing the business.

Registre said the fund hopes to have its first Curio franchise open for business in early 2022, most likely in New Jersey or Ohio, contingent on licensing.

The regulated franchise model has another benefit for entrepreneurs, Registre added.

“There’s significant protections in place to make sure that the franchisee’s rights, and ability as a business owner to succeed, are protected.”

Slow start for national-level franchises

As retail franchisers aim for brand representation in multiple state markets, they’re entering an industry where franchising has been slow to roll out at a national scale.

Miami-based medical marijuana clinic franchiser Miracle Leaf Health Centers has 40 operating stores in Florida, including four corporate-managed locations, according to Director of Operations Travis Wright.

Miracle Leaf locations currently sell CBD and delta-8 THC products, said Wright, but not cannabis containing delta-9 THC.

The franchiser plans to expand into Georgia and has its eye on other states, Wright added, and is considering switching to a cannabis dispensary model in some of those markets.

The wait for a national marijuana retail franchise might be partly due to the fact that franchising and cannabis are both regulated industries.

“The intersection of that is really complicated,” said Elissa Deitch, an attorney who leads the corporate department at Drumm Law in Denver.

Federal franchise law always applies to U.S. franchisers, Deitch explained.

On top of that, a number of states require franchisers to register with state authorities, adding another regulatory burden that varies between jurisdictions, not to mention the challenge of complying with different state cannabis laws.

“I think a lot of companies don’t dive in until they see how other businesses have dealt with the various issues,” Deitch said.

Registre of the Curio WMBE Fund expects marijuana retail franchising to become more popular, although he also sees potential for entrepreneurs developing their own retail brands.

“But the truth of it is, it’s not going to be a wildfire scenario because of the time delays between licensing award opportunities,” he said.

With many states doling out cannabis business licenses in limited numbers, Registre said, “it’s not like you’ll have (a situation like franchise restaurant) Wingstop, which is opening a couple hundred stores a year.”

“The cannabis industry, historically, has maybe bucked tradition a little bit, and coming in with a traditional franchise model may not be as appealing as it is in other industries,” The Open Dør’s Blackwell said.

“I just think that the industry will accept a traditional franchise model much more quickly in a future where they realize the benefits of the ongoing support and being able to bypass the learning curve. … That kind of value is irreplaceable, priceless.”

Solomon Israel can be reached at solomon.israel@mjbizdaily.com.