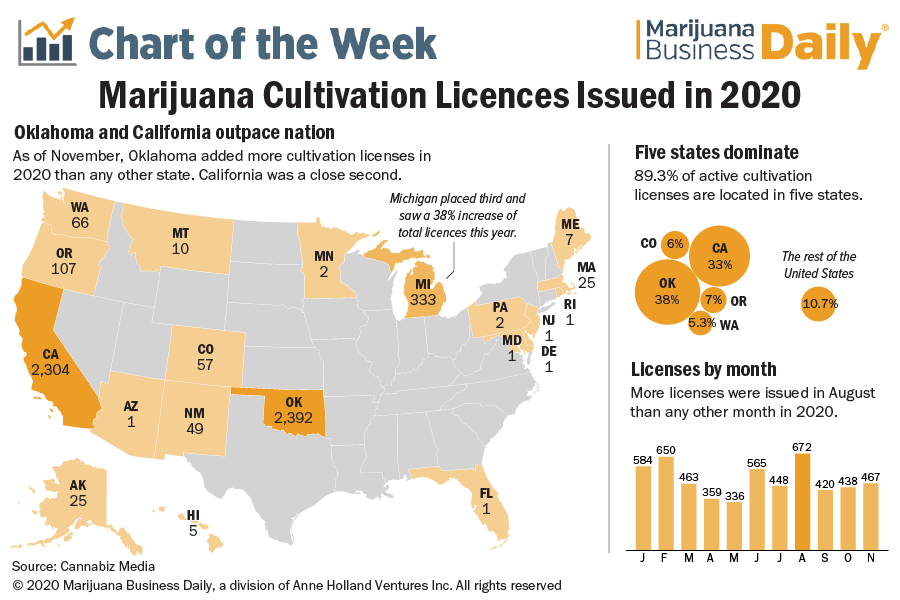

While California is widely touted as the largest legal cannabis market in the world, analysis of cultivation license data from Cannabiz Media shows that Oklahoma narrowly surpassed the West Coast state in issuing commercial growing permits this year.

Oklahoma’s Medical Marijuana Authority issued 2,392 new permits through November 2020, outpacing California by 88 licenses.

Five states – Oklahoma, California, Oregon, Colorado and Washington (in rank order) – combined for 89.3% of the total active cultivation licenses held by marijuana businesses in the United States.

That means that all other legal markets in the country account for only 10.7% of permits, led by Michigan’s 498 active growing licenses.

License fees can be a boon for strained state budgets.

Oklahoma added $6 million to its state coffers through cultivation licenses alone.

As of Nov. 7, the state collected $25 million from all commercial cannabis licenses, double what Oklahoma collected in 2019.

But not all licenses are created equal, said Ed Keating, Connecticut-based Cannabiz Media’s co-founder and chief data officer.

Most states, including California, issue a variety of license types that restrict everything from plant count, facility size and grow type, while Oklahoma has taken a more laissez-faire attitude that does not include limits on plant numbers.

Unlike Oklahoma, California allows cannabis companies to own more than one license.

For example, Santa Barbara County in California has 1,301 licenses but only 201 facilities.

“Our data team has been working to understand these dynamics by aggregating the farms and the total number of licenses they have” in order to better understand the impacts on canopy size and vertical integration, Keating said.

Andrew Long can be reached at andrew.long@mjbizdaily.com