Learn more about the state of the marijuana industry at MJBizCon 2020.

Even during tough economic times, marijuana consumers are turning to higher-priced flower products – a signal that cannabis users are increasingly willing to spend more money on such merchandise.

The trend could be mirroring the beer and wine sectors, where enthusiasts are turning to higher-priced products as their tastes become more sophisticated.

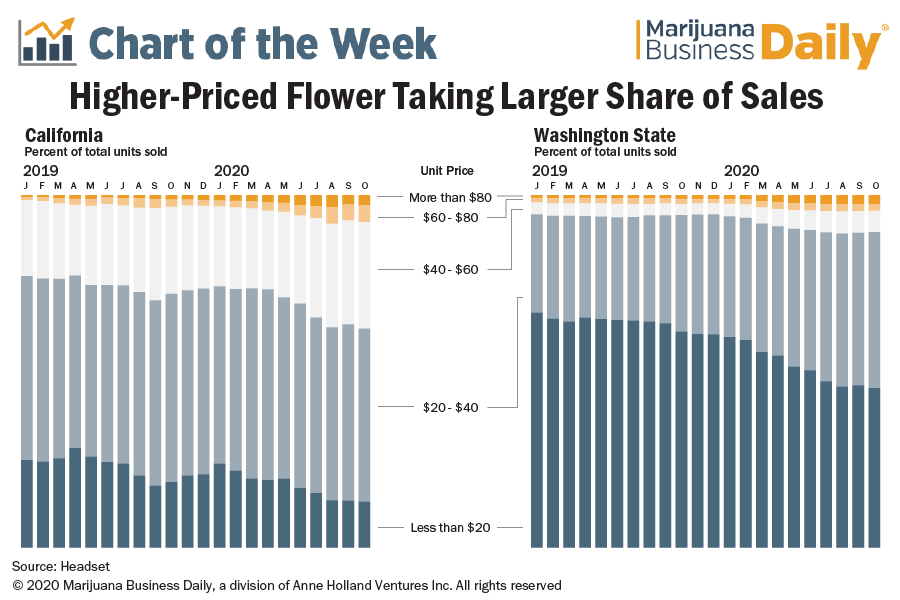

Analysis of pricing data from five Western states provided by Headset, a Seattle-based cannabis analytics firm, show flower products priced at $40 or more have accounted for an increasing percentage of overall flower sales since January 2019.

By contrast, the number of units sold at prices below $40 stayed the same or declined.

Flower products end up in the high-price bands for one of two reasons:

- Consumers are buying a larger quantity of the products at any one time.

- Consumers are purchasing premium or specialty items that have a higher base price.

In California, flower products priced under $40 accounted for 76% of sales in January 2019. That declined to 63% in October 2020.

The pattern is also evident in Colorado, Nevada, Oregon and Washington state.

For example, in Washington state, flower products priced at $40 or less accounted for 90% of sales in October 2020, down from 95% in January 2019.

Some of the shift could be attributed to overall rising prices. As prices rise, product purchases move from one price band to another.

According to Headset, the average item price in the flower category rose $5.18 in California from this time last year.

Washington state experienced a $5.25 rise in price.

As a result, a $35 product in 2019 would be categorized as a $40 product this year.

The COVID-19 pandemic has accelerated the trend, which has been gaining since 2019 as consumers stock up to avoid multiple trips to retailers.

California saw the percentage of $40-plus flower product purchased grow three percentage points in the months after Gov. Gavin Newsom imposed a stay-at-home order last March.

However, while higher-priced products are increasing their market share, the bulk of sales still come priced below $40.

Andrew Long can be reached at andrew.long@mjbizdaily.com