(This story has been updated to reflect that the additional need is for cultivation sites, not necessarily cultivators, as sites may be operated by existing growers.)

New Jersey’s medical marijuana market will need at least 15 additional cannabis cultivation sites in the next three years – even under a conservative growth scenario, according to information provided by the state’s MMJ regulatory agency.

The New Jersey Department of Health’s Division of Medicinal Marijuana (DMM) submitted its biennial report to the state Legislature in early April, assessing supply and demand for medical marijuana.

In addition to the need for additional grow sites, DMM found average retail prices to be prohibitive to patients whose treatment plan requires greater volumes of marijuana.

For example, a patient purchasing 1 ounce per month – half the maximum allowed – would pay nearly $6,000 out of pocket over the course of a year.

By comparison, based on recent prices, 1 ounce per month would cost an Oregon patient $2,820 and an Illinois patient $4,500.

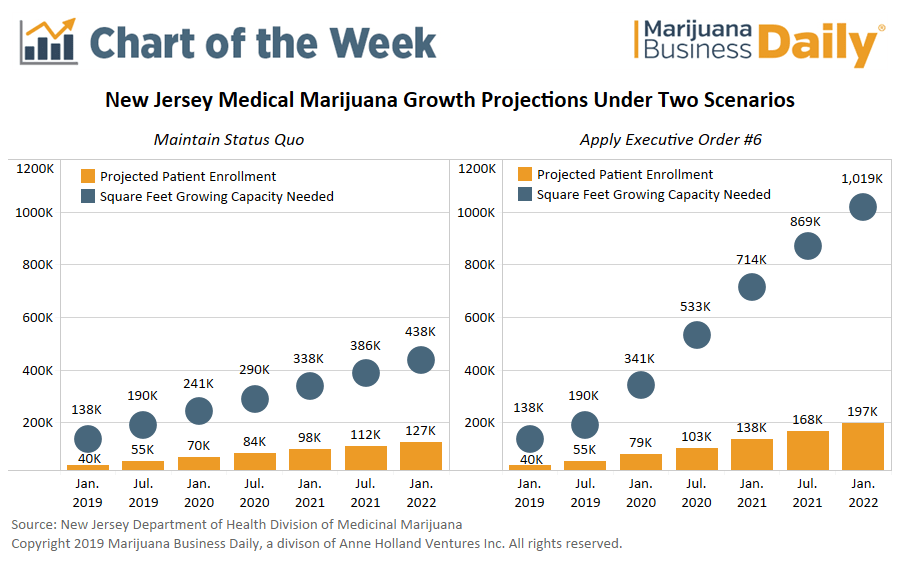

To determine future levels of supply and demand, DMM assessed two patient-growth scenarios:

- Maintaining current growth rates – or status quo.

- Increasing growth rates over time by applying patient-driven recommendations from Gov. Phil Murphy’s so-called Executive Order No. 6.

The governor’s order directed the health department to review the state’s medical marijuana program and develop ways to expand patient access to MMJ.

Under the order’s conservative status quo scenario, by January 2022, New Jersey would have 127,000 patients – more than three times the 40,000 patients in the program as of January 2019 – requiring 438,000 square feet of cultivation space and 15-25 additional cultivation sites (depending on cultivation area).

Under the scenario with expanded patient access, by 2022, New Jersey would have 197,000 patients requiring more than 1 million square feet in cultivation space. At least 34-58 additional cultivation sites would be needed to meet this level of demand.

Here’s what else you need to know about the situation:

- Dispensary revenues in New Jersey nearly doubled between 2017 and 2018, from $29 million to $53 million.

- Although six dispensaries currently are in the licensing process, the report determined the state will need even more retail outlets to meet demand, particularly those offering nonsmokable products.

- The report does not address impacts to the medical marijuana program if adult use is legalized in New Jersey.

Maggie Cowee can be reached at maggiec@mjbizdaily.com