Cannabis users usually scrutinize their bud — its size, its structure, its dankness — before grinding it up for consumption.

In Canada, though, a growing number of cannabis consumers have a different ritual: opening up a bag of pre-ground flower that’s ready to roll into a joint or pack into a pipe or vaporizer.

Growth in the ground-cannabis segment appears to be propelled by convenience-seeking, value-conscious consumers, although the Canadian trend hasn’t reached U.S. cannabis markets.

Milled marijuana shoppers are so devoted that Ontario cannabis store proprietor Jennawae Cavion calls them “Shredheads,” referencing the popular Shred brand of ground cannabis from Canadian grower Organigram Holdings.

Based on past experience, Cavion associated ground cannabis with poor quality, and at first she didn’t stock it.

“We were, in my opinion, probably a month too late jumping on that trend, even though customers were asking us for it,” said Cavion, founder of two Calyx + Trichomes stores in Kingston, Ontario.

“It’s been a total force, and honestly the Shred in particular. … We have a town full of bong-smokers, so these Shredheads just love it.”

Grinding open an opportunity

Although ground flower remains a niche, value-oriented segment, its growth in Canada over three years merits attention.

At the beginning of 2020, ground-flower sales were near-zero in the four Canadian provinces tracked by Seattle-based cannabis analytics firm Headset: Ontario, Alberta, British Columbia and Saskatchewan.

By December 2022, ground flower comprised 7.3% of all flower sales in the four Headset-monitored provinces, which include Canada’s three biggest provincial cannabis markets.

“That’s very, very much a significant portion of the highest-revenue category,” Headset Analytics Manager Cooper Ashley said.

Organigram’s Shred brand leads the ground-cannabis segment in the provincial markets tracked by Headset.

Shred launched in September 2020 as a ground-cannabis offering, but the brand has since been extended to include pre-rolled joints, edibles and vapes.

Organigram Holdings CEO Beena Goldenberg said Shred’s core ground-flower product revolves around convenience and consistency.

Unlike the potential stereotype of ground-cannabis flower as an industrial byproduct – shake and trim left over from processing whole cannabis buds – Goldenberg described Shred as deliberate blends of different cannabis cultivars formulated for specific aroma profiles, without using added terpenes.

“We have a team of R&D people making sure that, depending on the input materials, the amount, the mix of the blends is going to be different so that we always get the same output flavor and aroma,” she said.

Goldenberg said Shred consumers tell Organigram they get “the same experience every time – they know what they’re going to get, they know what to expect from it.”

Aleafia Health, whose Divvy brand held the ground-cannabis segment’s No. 2 spot in 2022 in Canadian markets tracked by Headset, touted “tremendous success in its pre-ground milled offering” in a regulatory filing this week.

British Columbia grower Pure Sunfarms held third place in ground flower in 2022, according to Headset.

“In the early days of legalization in Canada, I don’t think the perception was there for milled flower – I think it was seen as maybe inferior to other products,” said Maria Guest, Pure Sunfarms’ vice president of brand.

“And that was probably because people thought it was shake and trim,” she added.

But over time, Guest said, consumers have grown to trust “that there was quality product out there with pre-ground.”

Demographics and pricing

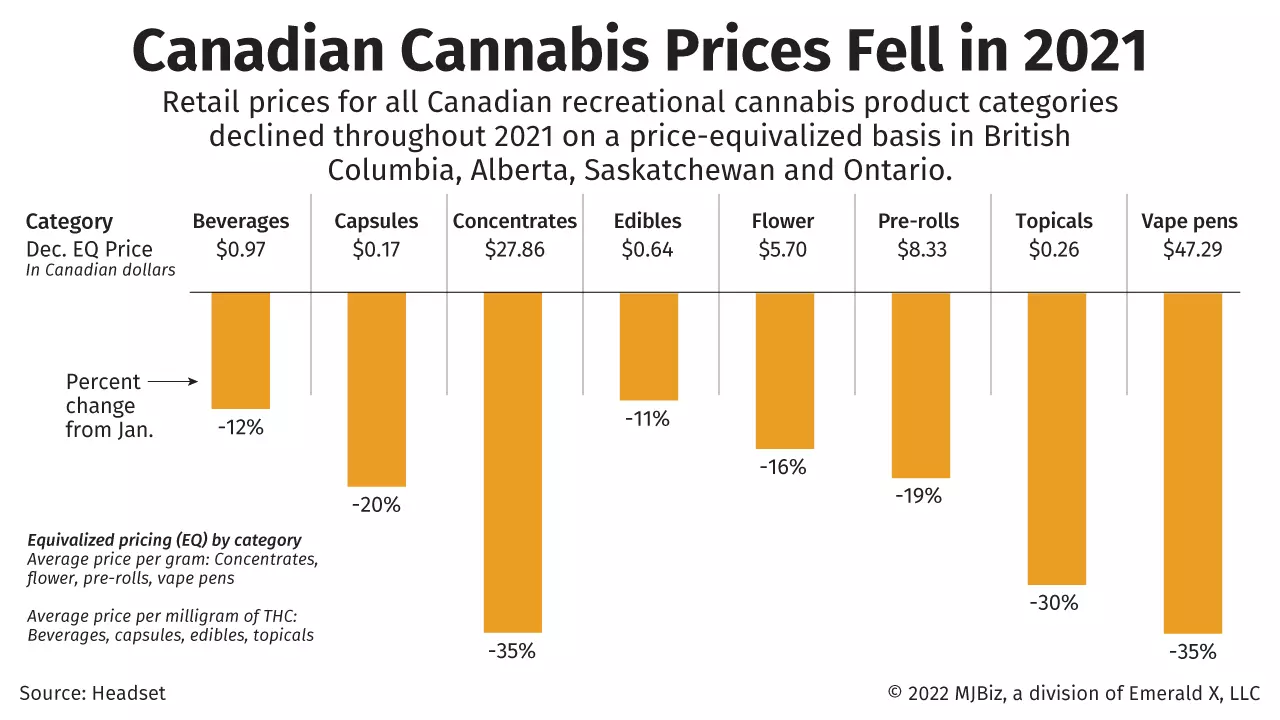

The price trajectory for milled cannabis mirrors the overall price compression trend in Canadian cannabis in recent years.

In early 2020, according to Headset data, the average retail price of a gram of milled cannabis flower was about 7 Canadian dollars (roughly $5.25) per gram on an equivalized basis, which adjusts for different package sizes.

These days, pre-ground flower costs closer to CA$4 per gram, or approximately 25% less than whole flower on average in 2022.

Retailer Cavion said ground-cannabis buyers tend to be “people that are on a budget and that just need a quick bong.”

“It completely removed the need even to have a grinder – some people are preferring to only look at pre-milled.”

Pure Sunfarms’ Guest said ground-cannabis enthusiasts are frequent buyers and consumers who skew slightly younger.

“Value plays an important role in their purchases,” she said.

Bulk-discount cannabis has already established itself as a key consumer trend in Canada’s highly competitive adult-use marijuana market.

Despite the lower price of ground cannabis, Pure Sunfarms’ Guest said milled marijuana “costs a little bit more” to produce, since additional processing is required.

Pure Sunfarms’ parent company, Village Farms International, cited milled flower as one of the “key branded formats experiencing growth” in 2022 in a recent regulatory filing.

Divergence from U.S. consumer trends

Ground-cannabis flower isn’t nearly as popular in U.S. legal cannabis markets covered by Headset, with 0.9% of the flower category in 2022 in California, Colorado, Massachusetts, Michigan, Nevada, Oregon and Washington state combined.

Even including the “shake and trim” segment, which Headset categorizes separately, 2022 sales in those states comprised only 2.3% of the overall flower category.

Different preferences between Canadian and U.S. cannabis consumers are nothing new, noted Headset analyst Ashley – for example, hashish is more popular in Canada than in the U.S.

“But this is definitely one of the bigger ones I’ve ever seen,” he said.

If pre-ground cannabis is premised on convenience, Ashley added, that concept is “either not resonating with American customers, or brands in the U.S. just haven’t given it a try yet.”

Organigram’s Goldenberg said the cultivator has “been approached by several different international customers trying to understand (the Shred) brand and understand what we have here.”

“So this isn’t going unnoticed,” she said, adding that Organigram has had discussions about potentially licensing the Shred brand and the associated technology and flavor formulations.

Goldenberg believes the ground-flower segment “will always have a backseat to whole flower, because there are people who want to see the bud and the bud structure.”

“But convenience will be a big driver, the consistent flavor will be a big driver – I think there’s room to grow.”

Solomon Israel can be reached at solomon.israel@mjbizdaily.com.