(Angèle Poirier is a master’s student in economics at the University of Regina in Saskatchewan, Canada. She researched the Saskatchewan and Colorado regulated cannabis markets two years into legalization under the supervision of Jason Childs, associate professor of economics at Regina.)

Regulated cannabis markets in Canada’s 13 provinces and territories are coming into their own more than two years after legal recreational products started hitting shelves in significant numbers.

In Saskatchewan, 2.5 million Canadian dollars (US$2 million) of adult-use cannabis was sold in October 2018 – the first month of legal sales. That rose to CA$13.7 million two years later.

Saskatchewan is one of the Canadian provinces that has allowed private retailers to sell recreational cannabis and private businesses to be involved in wholesaling.

In fact, Saskatchewan is the only province that has never had a government choke point in the supply chain, making it comparable to Colorado’s recreational cannabis market.

These two jurisdictions may now be compared to see how their respective recreational cannabis markets fared two years after legalization.

As a master’s student in economics at the University of Regina in Saskatchewan, I’ve researched the two markets to compare them two years in.

It turns out that Saskatchewan, as well as other provinces, may yet have something to learn from Colorado in terms of pricing and policy to foster competition and eliminate the gray market.

Data from 2016 shows how Colorado fared two years post-legalization; by comparing this to Saskatchewan’s current data, we have a case study for recreational cannabis.

What follows are some of the business takeaways from our research:

1. Saskatchewan lags Colorado in sales per capita

Two years into legalization, Saskatchewan’s per capita sales were an average of CA$16, whereas Colorado’s were CA$220 ($183). (See illustration “Cannabis Legalization: The First 2 Years.”)

Some factors may have contributed to Colorado’s early success, including being surrounded by states that banned recreational cannabis sales.

Saskatchewan, by contrast, borders provinces that offered the same legal cannabis products.

Nonetheless, Saskatchewan per capita sales should be expected to continue rising, given the steady gains since legalization plus the removal of barriers for legal retailers.

2. Government revenue per capita is low for Saskatchewan

Saskatchewan’s government revenue was actually negative CA$2 per person, whereas Colorado’s was CA$18 ($15). (See illustration “Cannabis Legalization: The First 2 Years”.) In other words, the province spent more on cannabis regulation than it received in taxation revenue.

This cannot be blamed entirely on tax rates. Saskatchewan’s extremely low government revenue is likely due to slow sales growth in the first two years.

As barriers to industry growth are removed, Saskatchewan should begin to see greater government revenues.

Saskatchewan continues to remove these barriers in various ways, such as eliminating the minimum population required for towns to have stores, lifting the cap on the number of retailers per city and reducing business license fees.

3. Saskatchewan’s retail density shows room for growth

Saskatchewan issued 48 cannabis retail licenses by Oct. 27, 2020, for a retail density of 4.07 stores per 100,000 population.

Colorado achieved a retail density of 7.78 stores per 100,000 people after the first two years. (See illustration “Cannabis Legalization: The First 2 Years”.)

4. Saskatchewan had cheaper legal cannabis compared to Colorado

As pictured in the illustration, “Cannabis Legalization: The First 2 Years,” the average price of 3.5 grams of dried cannabis in Saskatchewan’s largest city, Saskatoon, was CA$11.08 per gram compared with CA$13.24 ($10) in Colorado’s capital city, Denver.

A common gripe in Canada is that legal cannabis is too expensive, especially compared to illicit-market options.

To remain competitive, Saskatchewan producers formed the Weed Pool in 2019.

Now with 14 members, this cooperative buys product in large volumes at lower prices, passing on the savings to customers.

5. Legal prices closer to illicit prices in Colorado

Shortly before legalization, 3.5 grams (1/8 of an ounce) of illicit cannabis in Denver sold for an average of $9.84 per gram (based on three different prices: high, medium, and low).

Two years after legalization, legal cannabis in Denver was an average of $10 per gram, according to PotGuide.com, or 2% higher than illicit.

In Saskatoon, illicit cannabis before legalization was CA$8.92 per gram for the same size package, according to research by Hammond & Mahamad.

Two years after legalization, legal cannabis in Saskatoon was CA$11.08, or 24% more expensive than on the illicit market. (See illustration “Cannabis Legalization: The First 2 Years”.)

However, prices in Canada’s regulated market have been falling consistently since legalization in late 2018.

6. Prices differed from town to town in Saskatchewan

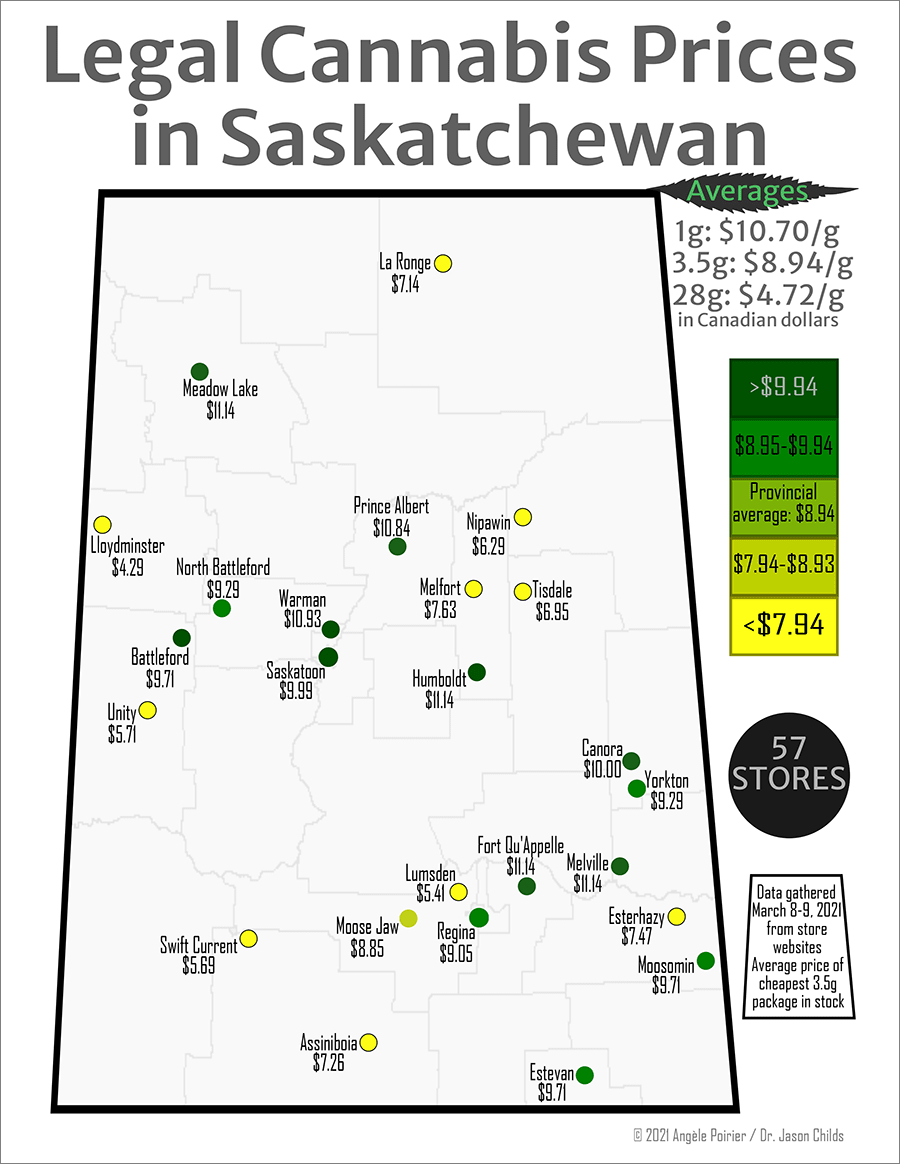

Prices varied across Saskatchewan for legal cannabis: from CA$4.29 to CA$11.14 per gram for 3.5-gram packages with at least 12% of THC. (See illustration “Legal Cannabis Prices in Saskatchewan”.)

While large Canadian cannabis corporations tend to operate in cities, this does not guarantee low prices.

In fact, none of Saskatchewan’s four largest cities – Saskatoon, Regina, Prince Albert, Moose Jaw – had extremely low prices.

Aside from city size, other factors that would likely affect retail prices are wholesale cost, overall demand and competition from the legal and gray markets.

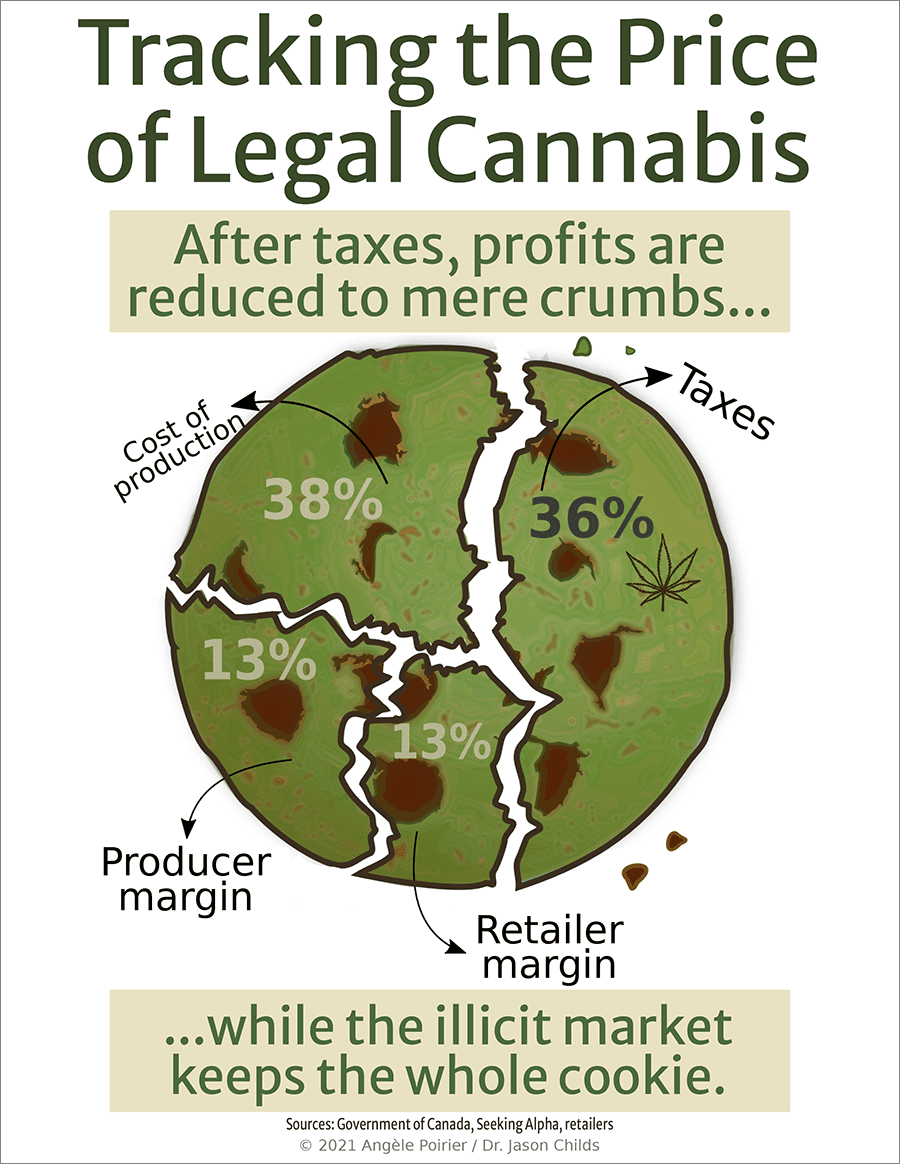

7. Cannabis duty accounts for more than one-third of final price

Dried flower in Saskatchewan is subject to a cannabis duty of CA$1 per gram. When combined with sales tax, cannabis duty makes up 36% of the final price paid by the consumer. (See illustration “Tracking the Price of Legal Cannabis”.)

Some of the pressure from the illicit market comes from lower overall costs, as illegal producers are unfettered by cannabis duty tax.

8. Cannabis duty eats up as much as production costs in Saskatchewan

The cost of production represents 38% of the final price of a gram of cannabis, while cannabis duty is 36%. (See illustration “Tracking the Legal Price of Cannabis”.)

The final price has to cover costs of inputs, producer profits and retailer profits.

These slim margins are incentives for further innovations in the legal cannabis industry, such as automation and product differentiation.

9. The 3.5-gram package is the most popular in Saskatchewan

Despite the per-gram savings in the 28-gram (1-ounce) packages, the most popular format among consumers in the province is 3.5 grams.

This may be because the cost of the 3.5-gram packages are more affordable compared to the larger format.

Angèle Poirier can be reached at apoirier@uregina.ca.