Cannabis producer and retailer SNDL agreed to buy the shares it doesn’t already own of manufacturer The Valens Co. in a deal the Alberta-based business says will create “a dominant” vertically integrated operator in Canada.

The proposed all-stock deal is worth roughly 138 million Canadian dollars ($106 million), the companies announced in a Monday news release.

SNDL, which changed its name from Sundial in July, will pay Valens’ shareholders 0.3334 of a common share of SNDL for each Valens share they possess.

This isn’t the first time the two companies have come together for a deal.

In early 2021, SNDL acquired 16 million common shares of Valens, giving it a 10.1% stake in the British Columbia-based company.

In a 2021 financial filing, SNDL had said it “acquired the securities for investment purposes.”

According to the SNDL release, the deal to buy Valens outright would catapult the company into a top-10 player in the overall Canadian cannabis market (combined 4.5% share) as well as the market for so-called Cannabis 2.0 products (combined 5.2% share).

Cannabis 2.0 refers to categories such as cannabis-infused edibles, vape pens and topicals.

But the transaction carries risk, as competitors have mostly veered from vertical integration after suffering significant losses.

Aurora Cannabis, for instance, in 2020 sold off its large stake in Alcanna, at the time one of the largest retailers of alcohol and cannabis in North America.

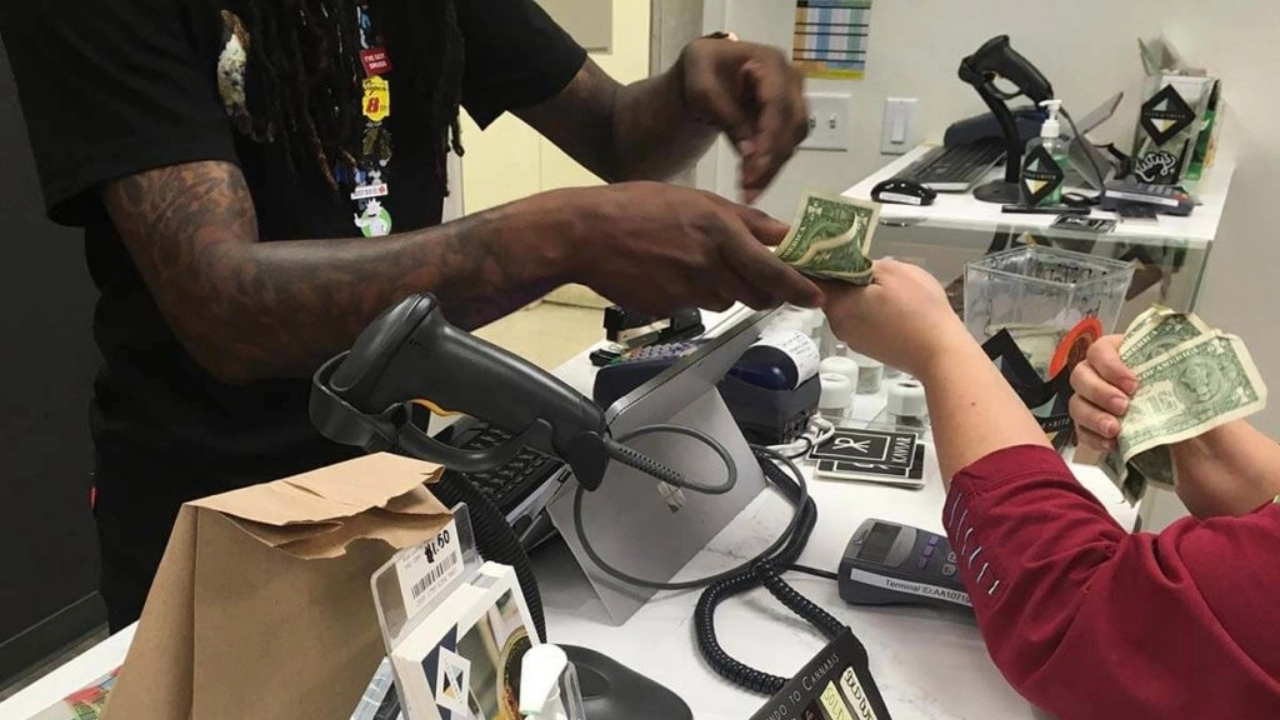

SNDL already has 555,500 square feet of cultivation and manufacturing space, according to the release, plus 185 cannabis stores under the Spiritleaf and Value Buds store banners.

As of the end of 2021, Valens employed 445 workers and SNDL employed 580, according to annual securities filings.

The combination is expected to bring more than CA$10 million of annual cost synergies, plus CA$15 million in additional earnings before interest, taxes, depreciation and amortization (EBITDA) annually.

“Through the combination of (a) diverse portfolio of brands, an extensive retail footprint, low-cost biomass sourcing, premium indoor cultivation and low-cost manufacturing facilities, SNDL will become one of the largest adult-use cannabis manufacturers and retailers,” the company said.

“With its retail insight and financial strength, SNDL will be able to adapt quickly to emerging consumer trends.”

In a recent U.S. Securities and Exchange Commission filing, SNDL admitted it has “yet to generate an annual profit,” even though it has been cultivating cannabis since 2012 and recreational marijuana was legalized in Canada in 2018.

The company’s cumulative losses total CA$788.5 million as of Dec. 31, 2021.

The proposed transaction requires the approval of Valens shareholders. A meeting is expected to be convened before the end of November.

Valens said its board of directors “has unanimously approved the transaction after receiving the unanimous recommendation of a special committee of Valens directors.”

The agreement, expected to close in January 2023, comes with an CA$8 million termination fee payable to SNDL if the deal is quashed under certain circumstances.

SNDL said it has approximately CA$314 million in cash and no debt.

Its shares trade as SNDL on the Nasdaq exchange.

Matt Lamers can be reached at matt.lamers@mjbizdaily.com.