Though access to capital for public cannabis companies improved in early 2021, liquidity remains low for the U.S. plant-touching operators in comparison to the Canadian licensed producers.

U.S. operators have access only to lower-volume exchanges, such as the Canadian Securities Exchange (CSE) and the over-the-counter-market, which allow “touching the plant” in the U.S., because the Nasdaq and Toronto Stock Exchange (TSX) don’t allow this type of operator because it breaks federal American laws.

How much could liquidity increase for U.S. cannabis companies if they could “uplist” to higher-volume stock exchanges?

Most investment cases for cannabis equity mention uplisting to higher-volume stock exchanges with wider access to more institutional investors and liquidity. We quantify that qualitative positive below.

By our math, the liquidity as a percent of valuation would increase about 3X for stocks that move to the TSX from the CSE.

Moving to the higher-volume Nasdaq offers a 2.5X-5X improvement in liquidity from the TSX and a 12.5X-25X improvement from the OTC markets, as seen in the chart above.

Higher liquidity results in greater access to capital at a lower cost (which, in turn, means higher valuation).

Investors require a discount for illiquidity, which is typically why private companies transact at a discount to public companies. The more liquid a public company’s stock, the smaller the discount applied by investors compared to fair value.

We have written about the higher valuations and trading volumes of the public Canadian LPs compared to the public U.S. multistate operators, which we believe stems in part from greater liquidity and access to institutional investors.

Uplisting to these higher-volume exchanges would happen either as federal laws change or if the exchanges themselves change their policies (as is currently rumored at the TSX).

Our analysis scales the trading volumes for the size of the companies involved.

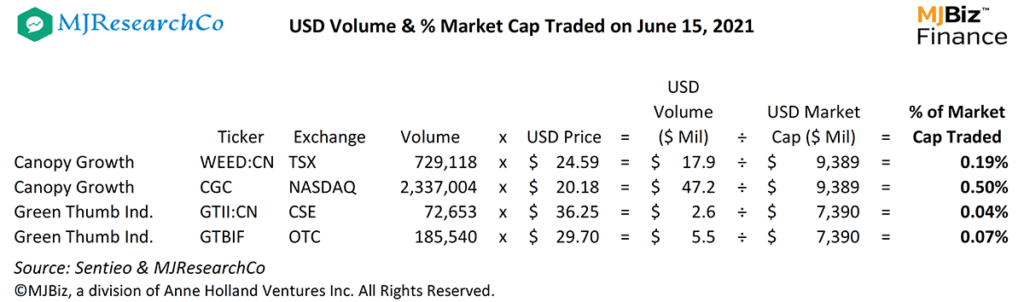

For example, on June 15, the Nasdaq traded 0.50% of Canopy Growth’s market capitalization (or $47 million of $9.4 billion) and the TSX traded 0.19%. The same math for Green Thumb Industries shows that the OTC traded only 0.07% ($5.5 million of $7.4 billion) and the CSE traded only 0.04%, as shown below.

We did this same calculation on 25 cannabis companies with 51 ticker symbols for the 858 trading days from Jan. 1, 2019, through June 15, 2021, to get the average percentage of each company’s market cap traded each day on each exchange to arrive at the figures in the chart above.

We provide a range for the Nasdaq volume because the exchange’s reported volume can be double-counted depending on how the trade is routed, but even in the most conservative routing assumption the volume is more than 12X higher than the OTC and 2.5X higher than the TSX.

Regardless of the range, the conclusion stands that uplisting to either the TSX or the Nasdaq would bring a significant increase in liquidity, which has historically shown an increase in valuation.

– Analysis by Mike Regan and Colin Ferrian, MJResearchCo (mikeandcolin@mjresearchco.com)

Deal of the Week / In partnership with Viridian Capital Advisors

Cronos eyes U.S. market via PharmaCann

On June 18, Toronto-based Cronos Group (Nasdaq: CRON; TSX: CRON) announced a strategic investment of $110.4 million for an option to acquire 10.5% of privately held U.S. multistate operator PharmaCann. The deal values the company at roughly $1.05 billion.

The exercise of Cronos’ option is subject to the status of federal cannabis legalization and regulatory approvals from the states where it operates.

As a U.S.-listed company, Cronos currently is prevented from investing in American plant-touching operations.

PharmaCann operates six production facilities and 23 dispensaries across six states.

The strategic investment signals a continuation of the trend whereby Canadian operators are looking for inroads into the more profitable and faster growing U.S. market once federal legalization occurs.

Cronos has made very little operating progress since receiving a C$2.4 billion investment from Altria in December 2018.

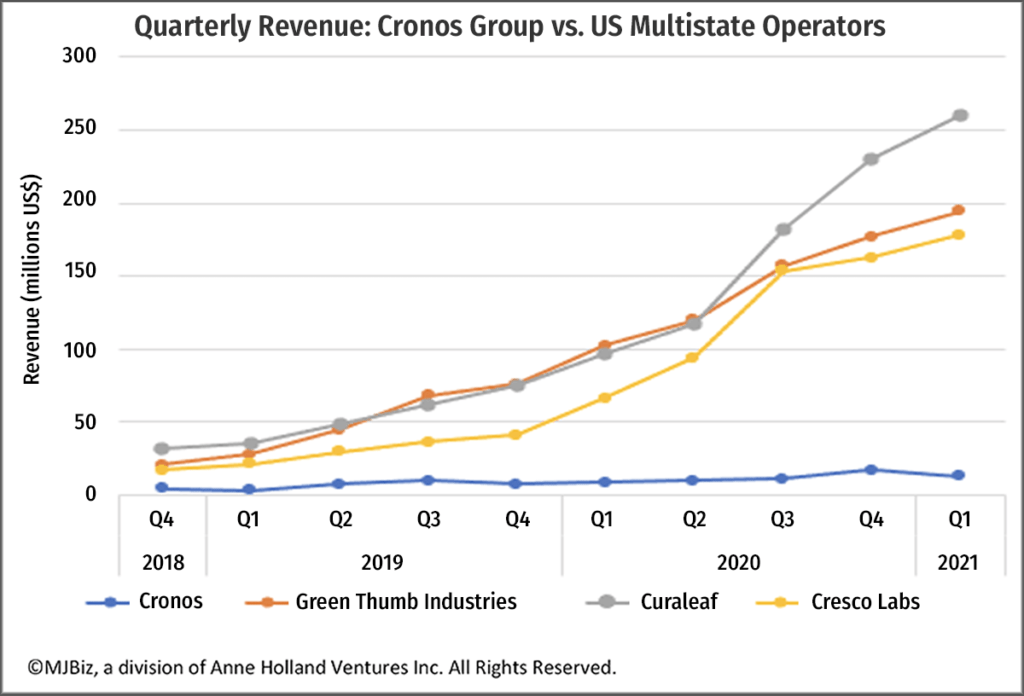

The graph below shows Cronos’ quarterly revenue, which has only increased from US$4.2 million in the fourth quarter of 2018 to US$12.6 million in the first quarter of 2021.

Three top multistate operators – Curaleaf, Green Thumb Industries and Cresco Labs – are placed on the same graph to show the relative growth of the U.S. operators versus Cronos.

It is no wonder that Cronos is placing its chips on the U.S. side of the table.

Cronos has bet big on the U.S. before.

In August 2019, Cronos acquired CBD company Lord Jones for about $300 million.

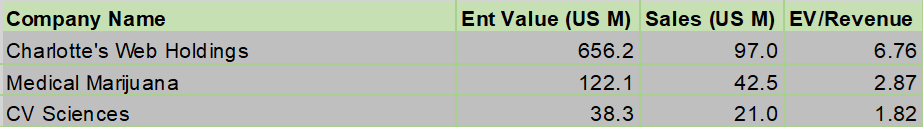

Subsequent disclosure in Cronos’ fourth-quarter report revealed that Lord Jones had brought in $2.7 million for the full quarter, meaning Cronos paid approximately 28X sales. The chart below reveals how significantly Cronos overpaid.

PharmaCann is a private company and has not released any information on revenues or profitability, so we cannot comment on the valuation implied by the option transaction.

However, there is one similar feature to both deals: insider ownership. Lord Jones was 40% owned by Gotham Green Partners (GGP).

Cronos’ CEO at the time, Mike Gorenstein, co-founded Gotham Green, and GGP is managed by Cronos board member Jason Adler. PharmaCann is also partially owned by Gotham Green, requiring the company to form a special committee of independent directors to evaluate the deal.

Cronos is overvalued in its current configuration:

- Its $1.9 billion enterprise value represents 14.2X 2022 consensus revenues relative to its peer group multiple of 9.9X.

- It has had negative gross margins for the past seven quarters and has racked up $149 million negative cash from operations in the past 12 months.

- Financial break-even is not on the near horizon as consensus EBITDA estimates for 2022 are -$79 million.

Perhaps the most troubling fact about Cronos is that it doesn’t seem to have much ambition to become a major Canadian cannabis company.