(You can have cannabis finance content such as this delivered directly to your inbox. Simply sign up here for our weekly MJBizFinance newsletter.)

Deal of the Week / In partnership with Viridian Capital Advisors

Goodness Growth executes focused-growth strategy

In November, Goodness Growth Holdings (CSE: GDNS; OTCQX: GDNSF) closed its acquisition of Charm City, a medical cannabis dispensary in Baltimore.

It’s the latest move by Goodness Growth to refocus the Minneapolis-based company’s efforts on markets where it sees stronger opportunity to be an effective competitor.

Goodness Growth has been strategically adding to assets in locations such as Maryland, a limited-license, medical-only state with an increasing likelihood of legalizing adult use.

At the same time, the company divested its operations in Arizona and Pennsylvania, where it lacked the scale to be an effective competitor.

Deal details

- The Charm City acquisition includes total consideration of $8 million, consisting of $4 million in cash, $2 million of GDNS stock and a $2 million note.

- The acquisition adds retail to Goodness Growth’s portfolio in Maryland, which likely will expand the company’s margins in the state.

Why Maryland?

Goodness Growth acquired a 110,000-square-foot greenhouse facility in the state in June 2020 for a relatively low cash outlay of $1.3 million, which positioned GDNS as one of the largest wholesalers in Maryland and allowed the company to introduce new products to a growing market.

Several factors also point toward Maryland being on the path toward approval of a recreational cannabis market.

Maryland has experienced rapid patient-count growth since 2017 and has a broad list of qualifying conditions that includes chronic pain, a leading sales driver.

Maryland also is surrounded by states that have already authorized adult use, including New Jersey, New York and Virginia, which likely will add economic pressure for Maryland to make such a shift.

Making an attractive target

Taking all of Goodness Growth’s recent activity into consideration, Viridian Capital Equity Research believes the company is one of the most attractive takeout candidates by an MSO.

The crown jewel in the company’s portfolio is its New York permit, one of only 10 legacy licenses.

Ascend Wellness’ February agreement to purchase an 87% stake in MedMen Enterprise’s New York operations for $73 million demonstrates the value of such licenses. GDNS’ entire market cap currently is around $210 million.

Likely acquirers of GDNS include Ayr Wellness, Jushi Holdings or TerrAscend, which have strong positions in neighboring states and are known to covet a New York license.

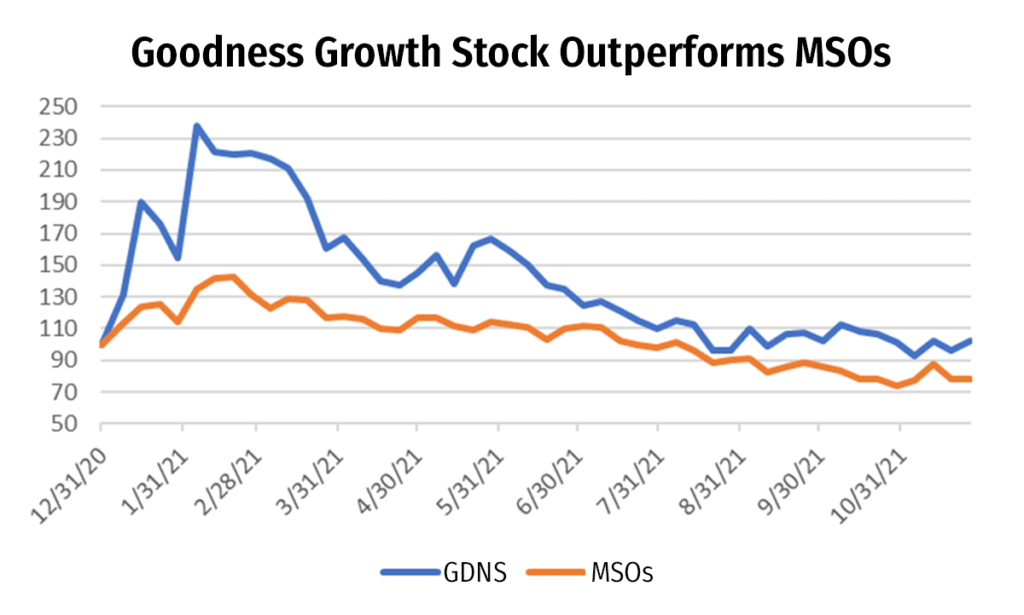

Goodness Growth is not particularly cheap, however. The company’s stock has outperformed the cannabis market this year.

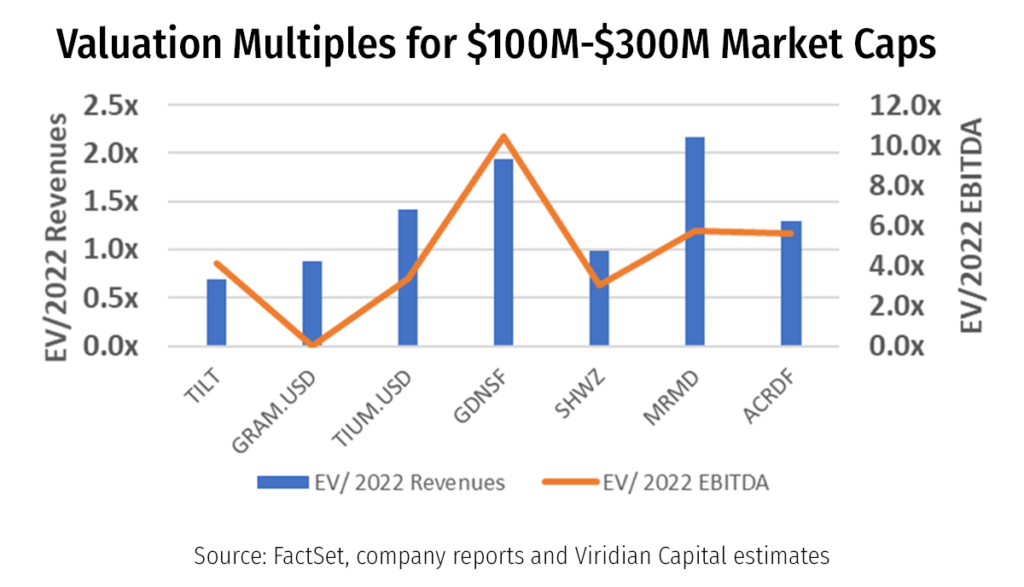

And it trades at enterprise value/2022 multiples that are on the high end of its market-cap group.

The chart below is arranged to show cannabis companies with market caps ranging from $100 million to $300 million, in ascending enterprise value order.

Despite its relatively high valuation multiples, Goodness Growth’s positioning in attractive markets and its relatively low market cap make it a readily digestible acquisition candidate for any of the major MSOs.

Are you a social equity cannabis license holder or applicant?

The MJBizCon team is now accepting 2023 Social Equity Scholarship Program applications.

The mission of this program is to provide social equity cannabis license holders or applicants access to the #1 global cannabis industry conference + tradeshow in Las Vegas.

Who can apply?

- Students currently enrolled in a cannabis-related program at an accredited university or college.

- Cannabis executives at licensed social equity cultivation, extraction/processing, retail, manufacturing/brand businesses (or awaiting application approval).

Don’t miss out on this potentially life-changing opportunity.

Apply to attend MJBizCon today – The application period will close on July 24!

Do you know who owns your company?

What are you willing to pay in the long term to get cash now?

That’s a question that most cannabis operators face when looking for capital to expand their operations.

The decision usually boils down to a choice between high interest rates from private debt holders or giving away some of the equity in your company.

The former is a pretty clear-cut option that most people are already familiar with. The latter can be more complex, especially as more equity grants are made.

“We’ve gone into companies during the due diligence process and found emails and notes giving a brother, a friend, a neighbor shares in the company … and that affects your ownership and your value,” Melissa Diaz, partner at Rebel Rock Accounting, told the MJBizFinance Forum in Las Vegas in October.

Investors will want to know exactly how many shares have been issued and who owns what in your company before they agree to provide additional funding. They need to know who might be influencing the decisions being made going forward.

Outside investors in any industry are taking a risk by putting their money with you, so they want as clear a picture as possible of your company to be able to effectively assess that risk.

Every time you make an equity grant – which, for private companies, often means creating additional shares – you dilute your ownership stake.

You might be keeping what you think is the same size slice of the pie, but you’re changing the size of the pie.

How are you tracking overall ownership in your company? What risks are you taking when you grant others equity? What are you promising others?

And how are you tracking each of these moves?

If you want others to invest in you, you’d better have clear answers to these questions.