Step aside, 4/20. There’s another unofficial marijuana-related holiday that retailers can take advantage of.

7/10, or “Dab Day,” is dedicated to cannabis users who prefer concentrates such as live resin, shatter or hash rosin, to name a few.

The name for the unofficial holiday – which falls on a Sunday this year – comes from the word “OIL” turned upside down, forming the numbers 7/10.

According to Seattle-based business intelligence platform Headset, concentrate sales increased by 67.4% on July 10, 2021, while rosin sales increased by 213% versus the preceding four Saturdays.

“7/10 tends to be the third-biggest sales period of the year, particularly as awareness around the day and interest in the concentrates category grows,” said Steven Jung, chief operating officer of San Francisco-based vape pod maker Pax.

“This is especially true in more established markets like California.”

4/20 and Cyber Week, tied to the Thanksgiving holiday, are the respective first- and second-biggest sales periods of the year, according to Jung.

Many retailers across the cannabis sector are running promotions for 7/10, including C3 Industries, an Ann Arbor, Michigan-based multistate, vertically integrated cannabis company.

“It’s a holiday that I think every cannabis retailer needs to take advantage of,” said Jason Berkenstock, vice president of retail for C3 Industries.

“The folks that we look at as competition are absolutely participating.”

While not nearly as many cannabis users celebrate 7/10 as they do 4/20, it still offers a good opportunity for retailers to run promotions, provide consumer education and sell more concentrates.

“It’s not as aggressive as the spike we see on 4/20, but we definitely see a nice uptick, a nice increase in sales on 7/10,” Berkenstock said.

By the numbers

According to Brightfield Group, a Chicago-based emerging-markets research company, about 25% of all cannabis consumers have used concentrates within six months of the survey date, which varied as the report covered a compilation of data going back to the first quarter of 2020.

That number has stayed relatively consistent from before the COVID-19 pandemic until now.

“Which is quite interesting as we’ve seen other things increase, like vapes and gummies,” said Maddie Scanlon, cannabis insight analyst for Brightfield.

“Another thing to consider here is that cannabis users as a whole have been increasing.”

In other words, concentrate users tend to consistently make up about a quarter of a cannabis retailer’s consumer base, even as the market expands.

While only 7% of cannabis users told Brightfield that celebrating 7/10 was important to them, compared with the 20% that said the same for 4/20, it can still make for a sizable jump in sales volume.

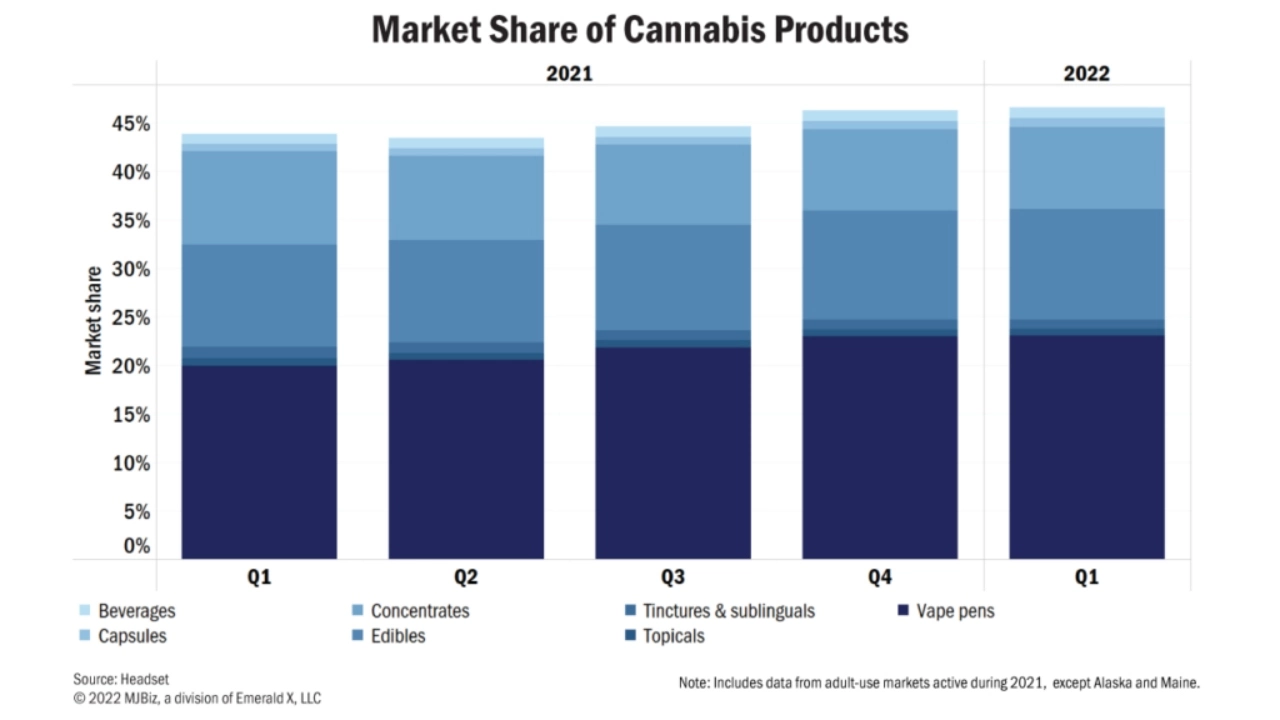

Headset also reported that concentrates take up 8.3% of the U.S. cannabis market share.

Gen Z and millennial males tend to be the biggest concentrate consumers, at 14.4% and 11.6% of the total wallet share, respectively.

It is also important to note, according to Headset, that U.S. consumers vastly prefer live resin to other types of concentrates at 34% of users compared with:

- Rosin, 12%.

- Shatter, 7%.

- Hash, 2%.

Are you a social equity cannabis license holder or applicant?

The MJBizCon team is now accepting 2023 Social Equity Scholarship Program applications.

The mission of this program is to provide social equity cannabis license holders or applicants access to the #1 global cannabis industry conference + tradeshow in Las Vegas.

Who can apply?

- Students currently enrolled in a cannabis-related program at an accredited university or college.

- Cannabis executives at licensed social equity cultivation, extraction/processing, retail, manufacturing/brand businesses (or awaiting application approval).

Don’t miss out on this potentially life-changing opportunity.

Apply to attend MJBizCon today – The application period will close on July 24!

Promotional strategies

Besides being an opportunity to sell more products through discounts and promotions, 7/10 can be an opportunity to create new concentrate users by educating consumers who are coming in to buy flower or edibles.

“We take the opportunity to educate customers around the holiday, and if they’ve never dabbed before, educate them on where would be the best place to start, what concentrate form would make the most sense for them,” Berkenstock said.

While concentrates traditionally appeal to more seasoned cannabis users, new extraction technology and improved processing methods have evolved to the point where a user does not need the traditional torch-and-nail dab rig setup to use concentrates.

Those consumers can opt to use products such as vape pens and distillate cartridges, which can be much easier to use.

“For a lot of customers, they may be uncomfortable with it, because they’re not familiar with the dab rigs, all the tools needed to enjoy a concentrate,” Berkenstock said.

That was one reason C3 decided to make its own in-house dab cartridges ahead of 7/10, something retailers who are vertically integrated with cultivation arms can take advantage of, he added.

Additionally, consumers can be introduced to concentrates through products such as infused pre-rolls or rosin gummies.

7/10 “is an opportunity day to get someone to try concentrates through our lens,” Brightfield’s Scanlon said.

It should also be noted that as perishable products, concentrates do go bad and lose taste, especially if they are improperly stored.

So 7/10 can be a good opportunity for retailers to offload older products before their expiration dates.

“Someone is being left behind if they’re not participating in 7/10,” Berkenstock said.

Patrick Maravelias can be reached at patrick.maravelias@mjbizdaily.com.