You’d think that marijuana delivery executives would quake in their shoes after the head of a ride-sharing giant recently floated the idea of getting into their line of work.

But that apparently wasn’t the case after Uber CEO Dara Khosrowshahi told CNBC last month his company “absolutely” would explore cannabis delivery if the federal government legalizes marijuana.

Rather than fear such a declaration, cannabis delivery executives welcomed it as a sign there’s a national market for the services they’re building.

“When companies like Uber are talking about getting into cannabis delivery, it’s a really good market signal about how ubiquitous cannabis legalization is and also how ubiquitous customer demand is for delivered cannabis products,” said Elizabeth Ashford, senior director of corporate communications at California-based retailer and delivery company Eaze.

“So I think, in that sense, it’s a really good sign.”

But it’s not always been easy for delivery operators.

While state legalization of adult-use cannabis has unfolded at a rapid pace in recent years, distribution by home delivery has been slower, owing to a patchwork of regulations across the country and within states, among other factors.

Profits can be elusive.

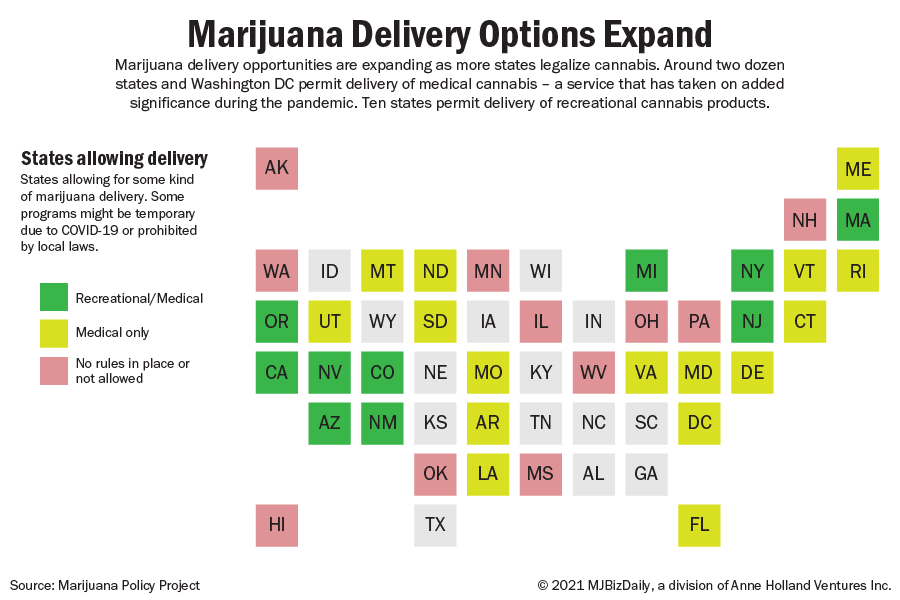

About two dozen states allow home delivery of medical cannabis, according to Marijuana Policy Project. (See chart above.)

By MPP’s count, 10 states permit adult-use delivery services – all with unique licensing and regulations.

“The delivery business is difficult to navigate, but there’s a massive amount of opportunity,” said cannabis industry veteran Jesce Horton, the CEO of Lowd, a cannabis production company in Portland, Oregon.

Horton pointed to brick-and-mortar retail’s limitations in the age of Amazon and the boom in online shopping and delivery.

“We see that’s just the way retail is going in general,” he said. “We can look at almost every industry and see how they’re moving more to the online sales type of market.

“And that’s just growing exponentially. I think there’s not going to be any difference with the cannabis industry.”

Adult-use delivery options by state

| State | Delivery allowed? |

|---|---|

| Alaska | No. |

| Arizona | Yes. Delivery by agents of registered marijuana businesses will be allowed starting sometime between January 1, 2023 and January 1, 2025. |

| California | Yes. Retailers may deliver to consumers, including retailers with no storefronts. |

| Colorado | Yes. The legislature and governor approved a law to allow delivery in 2019. Medical deliveries began in 2020, and adult-use deliveries can begin in 2021. |

| Illinois | No. |

| Maine | No. |

| Massachusetts | Yes. |

| Michigan | Yes. Retailers are allowed to transport marijuana, and the law gives regulators authority to issue additional types of licenses, including those for delivery services. Regulations for delivery have not been issued yet. |

| Montana | It is not yet clear if home delivery will be allowed. |

| Nevada | Yes. |

| New Jersey | Yes, the Cannabis Regulatory Commission will promulgate regulations. |

| New Mexico | Yes. Creates a license category for “couriers.” |

| New York | Yes. Retailers, microbusinesses, and delivery licensees are allowed to deliver to cannabis consumers. |

| Oregon | Yes, with no more than a $3,000 value in the vehicle. |

| South Dakota | Not specified in the constitutional amendment. The legislature or regulators could allow it. |

| Vermont | No. |

| Virginia | No, it is prohibited. |

| Washington | No. |

In fact, there are aspects to the cannabis shopping experience that could make delivery even more in demand, he said.

Some regions, for example, lack the number of cannabis storefronts needed to serve local consumers, and while marijuana stigma has been reduced, many shoppers prefer discretion, Horton noted.

But unlike ride-share services or food delivery, transporting cannabis is far from straightforward.

Here’s why:

Delivery still finding its footing

In February 2020, after Eaze made 5 million deliveries in California over the previous six years (7 million to date) and registered 600,000 users on its app, CEO Ro Choy announced the company was pivoting to a vertically integrated model, meaning it wouldn’t just service retailers, it would become one through a subsidiary.

“Verticalization is Eaze’s second act,” he said in a statement. “Until now, we’ve invested in proving our market fit, building an enormous and loyal customer base, and becoming California’s biggest marketplace for legal cannabis delivery.

“Now, we’re proving we can make this business work in a more sustainable and profitable way, while continuing to grow Eaze’s existing services.”

Owning a piece of the supply chain could be a path to profitability because the cost of doing delivery as a business is so high.

Uber’s current delivery model relies on gig workers, but cannabis delivery drivers in California must be W-2 employees, noted Eaze’s Ashford.

To complicate matters, there are both state and local licenses, which have evolved through the years and can differ from market to market – even the city of Los Angeles and Los Angeles County have different permits.

“The fact is that constantly changing regulations are difficult for businesses, period,” Ashford said. “And I think that that’s definitely been a challenge.”

Dutchie’s approach

Like Eaze, Oregon-based Dutchie deliveries arrive via W-2 employees (who work for the retailer) rather than Uber-like gig workers.

Also like Eaze, the company has expanded beyond delivery to developing what it hopes will be the industry’s leading point-of-sale (POS) solution – the software used to complete transactions, track inventory from seed to sale and compile sales data for analysis and reporting.

The POS system would be used whether products are bought in-store, picked up curbside or delivered.

Working with more than 30 partners, Dutchie aims to give retailers e-commerce solutions tailored to their needs.

The strategy helps the company overcome the patchwork of state-to-state regulations that make it difficult for technology companies to scale, according to Jon Bond, Dutchie’s director of partnerships.

“All of those little moving parts are all little barriers to entry for anybody that’s looking to get into the space,” he said.

A limited number of licenses

Dutchie’s POS software also gives the company access to markets where delivery is legal but licenses to deliver aren’t yet available.

In Massachusetts, for example, it’s taken some time for the state’s Cannabis Control Commission to settle on its adult-use delivery regulations, which are focused on promoting social equity.

The state offers two types of licenses, one of which bypasses brick-and-mortar retail entirely.

Marijuana courier license holders can transport products from retailers and are paid by the store. They can’t sell directly to shoppers or buy wholesale.

Marijuana delivery operators, by contrast, can buy products wholesale directly from producers and deliver from their own warehouse. They are not allowed to operate a store or repackage goods.

License holders can work with companies such as Eaze and Dutchie, but the two businesses must have third-party relationships with the licensees and can’t hold the permits themselves – at least for now.

The state is awarding all delivery licenses exclusively to members of its social equity and economic empowerment program for the first three years.

According to David O’Brien, the president and CEO of the Massachusetts Cannabis Business Association, the rationale was that delivery operations don’t require the same amount of capital as cultivation and retail storefronts, which were barriers to those in the program looking at other aspects of the industry.

It’s a decision that has come with some controversy.

Some retailers felt the ability to bypass a storefront wasn’t fair, and the Commonwealth Dispensary Association launched a lawsuit against the CCC that was later withdrawn after the group faced a backlash from some of its members.

The Massachusetts Cannabis Business Association, on the other hand, expressed support of the move.

“I’m excited about the potential it has for leveling the playing field,” O’Brien said.

So far, more than 60 licenses have been awarded, but licensees haven’t yet announced when the first delivery will happen.

Delivery demand unclear

When the COVID-19 pandemic first hit, cannabis sales skyrocketed as consumers stocked up to get through lockdowns, and delivery’s popularity increased.

According to Eaze Insights, the data and market research arm of Eaze, in the first month after March 13, 2020:

- New sign-ups increased by almost 60%.

- First-time deliveries jumped by 44%.

- Order sizes increased by 15%.

But those numbers have leveled off, and Marie Montmarquet – co-founder of San Francisco Bay Area-based cannabis companies MD Numbers and Marie’s Deliverables – wonders whether delivery through the pandemic has helped grow the business.

“The question for delivery owners,” she said, ” … is are these new people or are these the same people that were coming in the store? So now we’re just bringing it to them? We’re doing all the work?”

That said, no one believes the demand for delivery is going away, and it certainly isn’t unique to cannabis.

“We live in a convenience-driven society where I don’t even want to disclose how much money I spend on DoorDash,” Dutchie’s Bond said.

“Ultimately, as a society, that’s driven by instant gratification – the ability to do and receive results immediately is woven into every single thing that we do from a technology standpoint.

“So delivery and cannabis is no different, right?”