Management teams for capital-intensive businesses such as cultivation need to be “stellar” to get the attention of Jen Piro, an angel investor who has placed more than 25 investments in plant-touching and ancillary companies—primarily through the Cannabis Syndicate, a network of marijuana angel investors.

“They’re going to need a lot of creativity about how they’re going to raise the capital that’s needed—and think about buildings and licenses and real estate, and putting all this into play to package their company, to showcase how they’ll meet those CapEx requirements, OpEx requirements, and then continue to grow and scale,” added Piro, who also has invested through the Arcview Collective Fund, a network of angel investors affiliated with The Arcview Group.

Managing this long list of needs becomes difficult, Piro said, when founder-executives try to do everything themselves. “It’s all about capability and capacity,” she said. “And a lot of the trouble with solo teams is that they run out of hours of the day.”

Plans and research

The proof that teams have thought about obstacles that might get in the way of realizing their goals usually lies in a strong business plan, Piro said.

Good plans are backed by thorough market research, and investors are attracted to companies whose leaders have done their research. Many people underestimate the challenge of starting a cannabis brand, Piro noted.

“When they come back with real market research data, that’s way more impressive to me and shows that they are really thinking about how they’re going to carve out a niche,” she said.

Piro offered Union Electric, a premium California flower brand, as an example of a business that impressed her with its research, prompting her to invest.

“They went around to 100 different dispensaries and asked them, ‘What do you wish you had more of?’ And when those dispensary owners said premium indoor flower, they put together a premium indoor flower brand and secured contracts with a lot of their friends who are growing great indoor flower,” Piro said, adding that this allowed the company to secure exclusive deals for the flower it wanted. “They were able to walk into a dispensary and say, ‘Here, I’ve got a year’s worth of contracts. … And they’re flourishing.’”

“I love when people are on the ground asking the right questions, talking to both sides of the supply chain and really understanding their market segment. I really get excited when people can prove that they have a product market fit or role. … And those are the kind of plans I like to see,” Piro said.

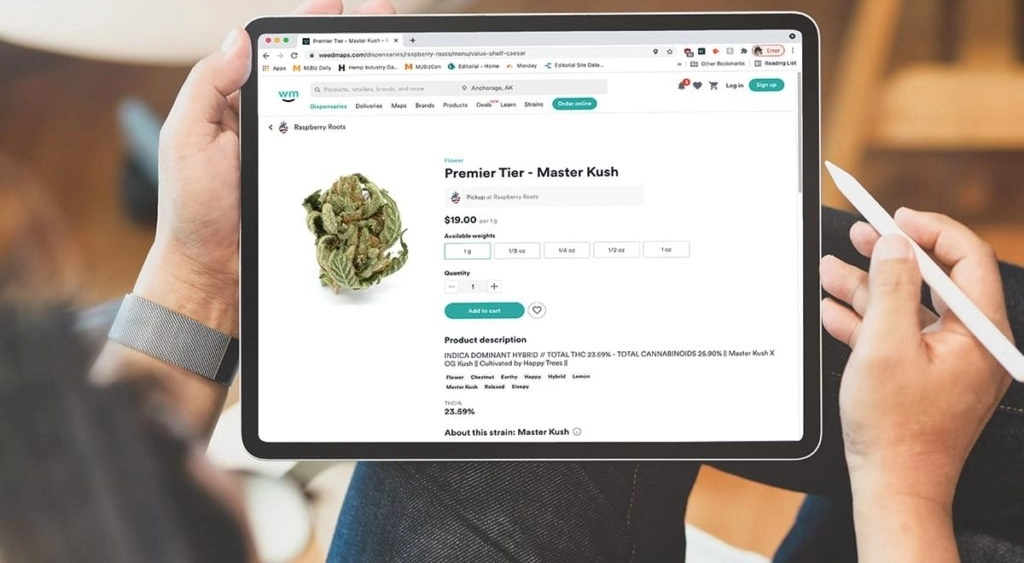

Technology and marketing

Piro believes the cannabis technology sector could not only revolutionize the cannabis space but also the way business is done in general. She cited payments and marketing as examples of unique cannabis industry challenges in need of solutions.

Even if the SAFE Banking Act or federal legalization happen soon, neither banks nor payment processors will change overnight.

“That’ll take a little more time ,” Piro said. “So I’m really excited about people who are carving out that moat right now.”

“I’m looking for companies that will, in three to five years, be venture bankable, that can scale, be really large and become hopefully regional and national players,” Piro said.

Follow the links on this page to learn what other investors look for when making funding decisions.