(You can have cannabis finance content such as this delivered directly to your inbox. Simply sign up here for our weekly MJBizFinance newsletter.)

Deal of the Week / In partnership with Viridian Capital Advisors

Hydrofarm at it again, boosting ag-tech segment

On Aug. 3, Hydrofarm Holdings Group (Nasdaq: HYFM) closed its acquisition of Greenstar Plant Products, the latest in its series of acquisitions of plant-nutrient manufacturers and the largest closed cannabis M&A deal of the week.

Hydrofarm utilized $83 million of cash from existing balances and the company’s credit facility to fund the acquisition.

As of March 31, the company had $50 million available under its JPMorgan senior revolving credit facility. That facility has a compellingly low interest rate of Libor +1.95% with no Libor floor (in other words, no minimum applicable Libor rate). So it makes excellent sense to use the facility for acquisition financing.

We would expect to see Hydrofarm issue more equity to refinance at least some portion of this debt and provide ammunition for further acquisitions. Hydrofarm has used a high percentage of cash in its 2021 acquisitions, and we expect the trend to continue.

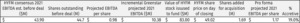

Accordingly, New York-based Viridian Capital Advisors analyzed the impact of the transaction as though it were equity financed.

Hyrdrofarm purchased British Columbia-based Greenstar for approximately 8X the company’s projected 2021 adjusted EBITDA, resulting in a transaction that is 19% accretive in terms of EBITDA per share.

The accretion percentage is lower than for some of the company’s other recent transactions, but Hydrofarm and Greenstar have a longstanding relationship.

Hydrofarm historically has distributed Greenstar’s Grotek and Gaia Green brands, representing more than 50% of Greenstar’s sales.

Pennsylvania-based Hydrofarm knows Greenstar’s business and customers well, and the existing relationship should make integration of this acquisition easier and less risky.

Agriculture-technology M&A activity continues to heat up in 2021 (see chart at top), and year-to-date, the sector’s total consideration and number of transactions are already well ahead of the previous full year’s activity.

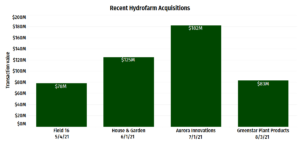

Hydrofarm has played a significant part of this upturn. Although the company has completed only four of the 18 deals Viridian tracked, Hydrofarm accounts for more than 80% of the total value.

The chart below shows the four acquisitions Hydrofarm has made in 2021, totaling $463 million in transaction value.

How Cuomo’s resignation could affect New York’s adult-use marijuana program

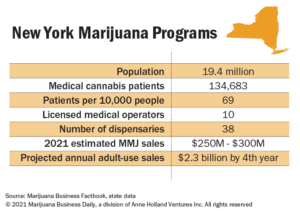

The launch of New York’s $2 billion-plus adult-use marijuana market is facing likely delays, potentially slipping into 2023 because of the political turmoil in the state.

Gov. Andrew Cuomo’s resignation amid sexual harassment allegations means that Lt. Gov. Kathy Hochul will take the reins later this month.

While Hochul supports adult-use marijuana legalization as “long overdue,” it’s uncertain how quickly she will make the critical appointment of chair to the Cannabis Control Board.

That decision also needs the consent of the state Senate, which would require either a special legislative session or waiting until the next regular session starts in January.

“Any kind of political disruption certainly can delay (the program), especially at this point in the process,” said Rob DiPisa, co-chair of the cannabis practice at New Jersey-based Cole Schotz.

Minority entrepreneurs and other small businesses preparing to apply for licenses likely will be the most affected by these issues.

But not every industry observer expects major delays.

Viridian Capital Advisors sees the possibility of Hochul steadying the timeline and being more cooperative than Cuomo, whom Viridan described as a “reluctant supporter” of a recreational marijuana program.

But Viridian notes that any fast-tracking by the state most likely will benefit existing medical marijuana businesses – of which 90% are multistate operators.

Unless smaller operators have deep financial pockets, they will need to be careful not to make financial commitments too soon in securing real estate, even if it means losing a choice location, industry experts said.

While location, location, location is the real estate axiom, patience, timing and then location might be the realistic operative term for New York.

New York’s recreational marijuana program, signed into law by Cuomo in late March, has a goal of issuing 50% of all licenses to social and economic equity applicants.

That could become the gold standard of the marijuana industry. It also could be a difficult goal to achieve if market delays deplete some applicants’ finances before they’ve even had an opportunity to open their doors.

If an entrepreneur commits early to a location, then has to wait two years before opening, that could be financially “ruinous,” said Steve Hawkins, CEO of the U.S. Cannabis Council and executive director of the Marijuana Policy Project.

Market growth also could be constrained somewhat if rival New Jersey gets a big jump-start on New York.

Jeff Smith can be reached at jeff.smith@mjbizdaily.com.