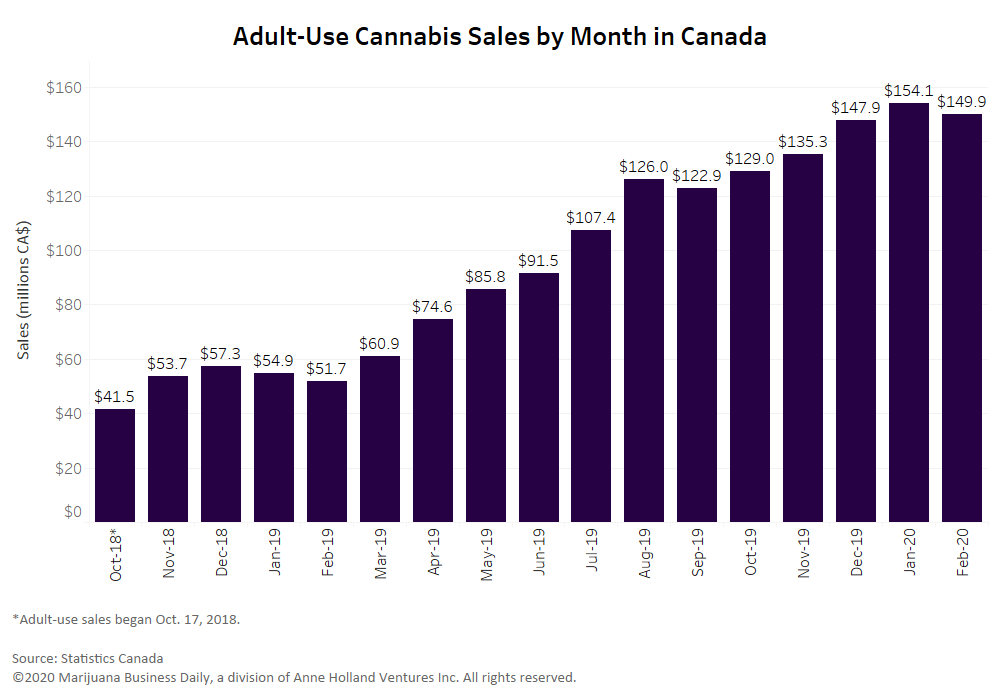

Canada’s adult-use cannabis sales fell to just under CA$150 million ($105.7 million) in February, the last full month of purchases before the COVID-19 crisis slammed the global economy.

Eight of the 13 provinces and territories experienced lower sales in the month, according to the latest Statistics Canada data, but most of the decreases were within the margin for error.

The lower sales were mostly a reflection of fewer shopping days in the month of February, said Chris Damas, editor of Ontario-based BCMI Cannabis Report.

“The only explanation I can give for the decline of CA$2.4 million in Quebec sales was the shortened month and winter weather. People aren’t quite as enthusiastic to go out to shop in bricks and mortar when it is snowing hard,” he wrote in a note to subscribers.

Quebec’s recreational cannabis sales fell to CA$29.2 million for the month – the only decline among the four largest provinces.

Ontario’s sales rose 3% to CA$38.1 million.

British Columbia saw improved sales, up 2% to CA$20.2 million.

Alberta reported sales worth CA$33.3 million for the month, about the same as January, rounding out the top four.

Saskatchewan, a distant fifth, saw adult-use cannabis sales dip to CA$8 million.

Statistics Canada’s sales data for January begins to capture the impact of so-called “cannabis 2.0” products such as vape pens and edibles.

However, the full impact of those products is not expected to be noticeable in monthly sales until spring.

“Cannabis 2.0 product sales in February were probably small in percentage terms for at least two reasons,” Damas told Marijuana Business Daily.

“Ordering by the provincial control boards was tentative, as they wanted to avoid big unsold inventories, as happened with gel caps and low-potency flower last year.”

“Secondly only a few (federal license holders), including Canopy, Dosecann, Tilray and Aurora, had 2.0 offerings, and they sold out quickly.”

February’s sales do not account for the COVID-19 pandemic period.

Provinces started putting measures in place to contain the new coronavirus in mid-March.

Some cannabis stores reported an immediate “unprecedented” surge in sales as the crisis started unfolding.

However, retailers were quick to warn that the boost to in-store transactions could be short-lived, as buying shifts to online for a prolonged COVID-19 fight.

The vast majority of legal cannabis stores in Canada – about 80% – remain barred from offering online sales and delivery, and it is unclear whether provincial online monopolies will be stay competitive amid the pandemic.

Ontario has temporarily allowed its five dozen stories to engage in full e-commerce.

A monthly breakdown of Canada’s adult-use cannabis sales is available here.

Matt Lamers is Marijuana Business Daily’s international editor, based near Toronto. He can be reached at mattl@mjbizdaily.com.

For more of Marijuana Business Daily’s ongoing coverage of the coronavirus pandemic and its effects on the cannabis industry, click here.