Every year on 4/20, cannabis retailers across the U.S. gear up to celebrate the unofficial April 20 marijuana holiday with promotions, deals and in-store events aimed at attracting new customers and keeping the ones they have.

While this year is no exception – coming three years after the start of the COVID-19 pandemic – many retailers are shifting their focus from 4/20 being a one-day event to a week- or even monthlong celebration with different daily promotions and other straightforward pitches intended to attract customers.

Kate Nelson, a senior vice president of New York-based Acreage Holdings, described the multistate operator’s plans for 4/20 as more of a “spring break” than a one-day event.

“Our goal is not to get everyone in the store on the same day,” she said. “We want all of our guests to have a wonderful experience.

“We’re having a different activation every day and volume-pricing opportunities. We’re doing a giveaway at the 20-minute mark of every hour.”

4Front Ventures, a Phoenix-based MSO, is allowing a few third-party vendors to hold pop-up events at its Mission retail outlets.

The deals offered won’t be complicated, but they will vary by state, said Kristie Shaw, the company’s vice president of retail.

For example, the first 200 customers who spend $80 at one of the company’s stores will get an eighth for $4.20. If they spend $150, they get a quarter for $4.20.

“Last year and in previous years, you’d go to dispensaries and it would be a laundry list of things they have on sale,” Shaw said.

“Having a really easy promotion to understand is critical and is going to be important.”

Some businesses also use 4/20 to launch new brands and products.

The Flower Shop, a Phoenix-based vertically integrated company with operations in Arizona and Utah, is launching three brands in April to coincide with 4/20:

- The female-focused Ladylike.

- High Tide, a THC-infused seltzer.

- High Variety, which involves a range of cannabis products.

The Flower Shop is offering 20 days of 4/20 at its outlets to ensure it can accommodate the anticipated foot traffic, said Greta Brandt, the company’s president.

“It will alleviate a lot of the traffic issues we have,” Brandt said. “From an operational standpoint, we’re trying to spread out the deals so we make sure we’ve got the inventory.”

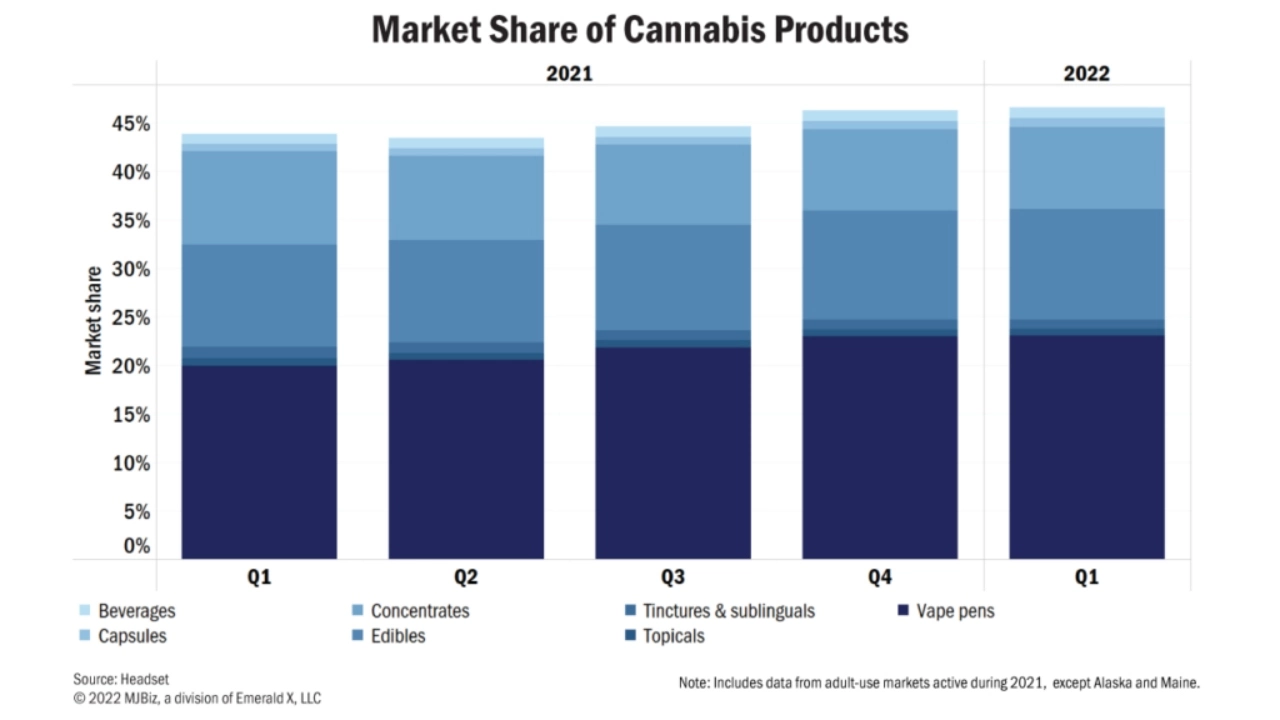

While flower was the dominant category consumers purchased pre-pandemic, the market has since shifted, Brandt said.

“There’s been diversification of product selection because of COVID,” she said. “Now it’s vape and edibles.

“The larger consumer base is interested in the convenience and confidentiality – they don’t smell like flower or pre-rolls.”

New York-based MSO Curaleaf Holdings is celebrating daily leading up to 4/20 with exclusive giveaways and events, said Dinesh Penugonda, vice president of retail operations.

New this year is Curaleaf’s revamped rewards program, which covers 14 states and boasts more than 1.8 million members.

Customers earn loyalty points to be redeemed on future purchases at any Curaleaf-operated store in the U.S.

Appealing to newbies

4/20 is a great way to attract – and keep – new customers.

The average new-customer return rate for the top 10 redeemed discounts was 35.9% last year, and the average customer repeat rate for all 4/20 discounts is about 22.8%, according to Treez, an Oakland, California-based company providing cannabis industry software, including point-of-sale and inventory-management services.

“Last year during 4/20, aggregated sales grew 25%,” Treez CEO John Yang said. “This year, we expect a lower increase overall as consumers spend less per order.

“However, total sales will continue to grow on a same-store basis – perhaps 10% to 15% over 2022.

“Last year, total number of transactions rose 36%, and (the) total number of customers purchasing cannabis at Treez retailers increased 34% compared to the year prior. We expect to see similar increases in total transactions, perhaps slightly lower in terms of new consumers.”

No matter how cannabis businesses approach 4/20, the day historically has been a boon for them.

Retailers purchased 26% more product in March than they had last year to stock up for the unofficial cannabis holiday, said Ryan Smith, co-founder and executive chair of the wholesale online cannabis marketplace LeafLink.

“This will really put a strain on the supply chain, so it’s best to be as prepared as you can be,” he said.

“Prices have been low, and people are stocking up. Even if margins are tight, get as many units as you can.”

Smith said many companies placed orders a month in advance to ensure they have enough product on hand to satisfy customer demand.

Top brands can sell as much as $5 million in products in the four-week period leading up to 4/20.

“It’s always a scramble in the last two weeks before 4/20,” Smith said. “People can place all the orders they want, but if they can’t get that product to them, they could run out of inventory on 4/20, which is the worst.”

Pandemic hangover

This year’s 4/20 celebration also marks three years since the start of the COVID-19 pandemic, a public health emergency that forced cannabis retailers to pivot.

Like all businesses that were deemed essential during the early days of the pandemic, cannabis retailers implemented protocols designed to keep their customers and staff safe from the virus.

Some of those practices remain in place – think curbside pickup and drive-thru services – while others have fallen by the wayside.

Denver-based Native Roots, for example, implemented online ordering and curbside pickup during COVID-19 – a service that’s proved so popular the company is revamping its website to make it easier for customers to navigate.

The new version will launch this summer, said Buck Dutton, Native Roots’ vice president of marketing.

“Customers want to shop online,” he said. “They don’t need to spend 30 minutes talking to a budtender.”

Native Roots also opened a drive-thru window at one of its Denver shops that is as popular now as it was during the pandemic.

Online ordering and drive-thru windows were key during the pandemic for Good Day Farm, which operates retail locations in Arkansas, Mississippi and Missouri and as a brand in Louisiana.

“COVID allowed for us to make positive changes to our sales floors and our online menus, which we have kept in place,” said Amy Dailey, vice president of marketing for the Little Rock, Arkansas-based company.

But for other operators, many of the practices adopted during the pandemic have fallen by the wayside.

The Flower Shop implemented curbside pickup to streamline the contactless process during COVID-19 and offered delivery service for its medical marijuana customers in Arizona and Utah. The company has since discontinued delivery service in Arizona.

“Medical delivery didn’t support continuing that operation,” Brandt said. “Arizona doesn’t allow recreational delivery yet.”

Post-pandemic, Curaleaf expanded its home-delivery networks, curbside options, touchless-payment solutions and drive-thru access to ensure its customers are comfortable shopping at its stores.

“As each market is different,” Penugonda said, “we continue to innovate new ways to service our customers at each location based on their feedback.”