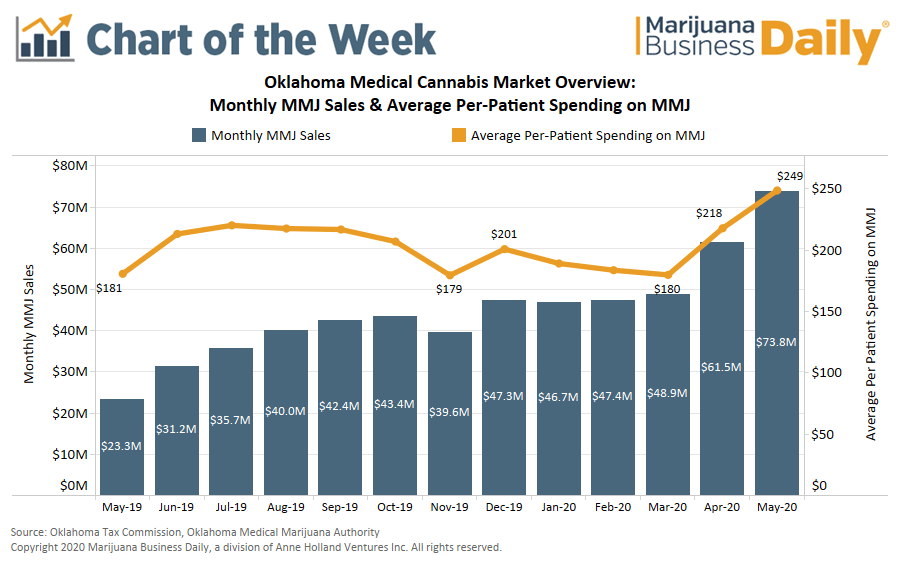

Already one of the largest and fastest-growing markets in the country, Oklahoma’s medical marijuana industry broke sales records in both April and May as consumers stocked up on products amid the coronavirus pandemic.

In April, sales in Oklahoma shot up to $61.5 million, a 21% increase from March.

Sales rose again in May to reach nearly $74 million – a monthly figure that far exceeds that of adult-use markets in Illinois, Massachusetts, Michigan and Nevada.

Patients continued to enroll in Oklahoma’s medical cannabis program throughout the COVID-19 crisis – rising from roughly 272,000 in March to 297,000 by the end of May – though the recent monthly sales gains were driven by additional spending from existing patients.

For the first three months of 2020, the average patient spent $184 on medical cannabis products. In May, the average spend was $249, a 35% increase.

Oklahoma declared medical marijuana businesses as essential during the pandemic, allowing dispensaries to provide curbside-pickup services to patients.

Generally speaking, when retailers and dispensaries allow customers and patients to order online or call ahead before coming to the store to pick up products, average order sizes increase.

What remains to be seen is how these per-patient spending figures will fare in the coming months.

If patients are consuming more during the pandemic and that trend persists, sales likely will remain higher than their pre-pandemic levels.

But patients might have been stocking up in April and May for many reasons – such as limiting the number of trips to the dispensary or ensuring they had enough product on-hand in the event of a supply shortage.

If consumption habits haven’t meaningfully changed, it’s likely that many patients will curb their spending on medical marijuana and monthly sales will pull back.

Eli McVey can be reached at elim@mjbizdaily.com