(This is Part Two of a special series revealing key elements of more than 200 pages of internal IRS documents obtained by Marijuana Business Daily related to the enforcement of Section 280E of the federal tax code and the cannabis industry. The previous installment is available here. And the documents can be accessed here.)

Marijuana industry tax experts have known for years the IRS was circulating among its agents a document akin to an Audit Technique Guide – essentially, a manuscript for how agents should deal with Section 280E of the Internal Revenue Code and the state-legal cannabis businesses that it covers.

But unlike formal Audit Technique Guides for, say, the construction or winemaking industries, the marijuana audit guide has been kept under wraps by the IRS for at least six years.

Until now.

The cannabis industry audit guide – identified by the IRS as a Participant Guide – was released to Marijuana Business Daily through a broader Freedom of Information Act request.

Finally getting a look at the Participant Guide will give marijuana business owners a better idea of what to expect when an IRS agent comes knocking on the door.

Mainstream companies have had access to such guides, which are typically published online by the service, for decades.

“The audit guide is something we’d been looking for, for a while,” said Katherine Allen, an attorney with San Francisco-based Wykowski Law who specializes in federal tax law.

Allen noted the IRS “has a website where they publicly list a bunch of industry audit guides, and the cannabis industry isn’t included. So they’ve had this since 2015, and they’ve decided that it shouldn’t be public.”

Denver tax attorney Nick Richards said the guide remains relevant today and that IRS agents use it during ongoing audits for cannabis businesses.

“It’s very much a playbook, and it’s very much followed by the agents,” said Richards, who is also a former IRS lawyer. “You can tell.

“It’s not sitting on the desk in front of them when you’re talking to them. But they’ve read it, they know it and they’re following it.”

The document covers the basics of how the modern marijuana industry functions, including outlines of different types of products, flower strains, cultivation techniques and more.

“It’s almost like a tourist guide,” Richards said, chuckling.

Much of the guide is no laughing matter for cannabis companies, however – especially an informal procedure for calculating indoor grow yields based on utility bills, which Richards blasted as “ridiculous.”

The IRS declined to comment on why the guide has been kept confidential, but agency spokeswoman Sarah Maxwell wrote in an email to MJBizDaily that the Participant Guide was “developed and used for internal training purposes.”

That makes it distinct and different from an Audit Technique Guide, Maxwell wrote, which is a classification for similar IRS documents that are “for public and internal use and primarily to provide guidance for the examination of a specific industry.”

Maxwell also noted that the IRS offers several webpages devoted to marijuana industry information. That includes:

- An audit guide for cash intensive businesses (most recently revised in 2010, making it roughly five years older than the cannabis industry Participant Guide)

- A marijuana industry landing page

- A marijuana industry FAQ page

A 2020 report from the Treasury Inspector General for Tax Administration (TIGTA) said IRS leadership had not released the marijuana Participant Guide because “there is too much difficulty in addressing the differences in state and local law and there is too much uncertainty given the potential for changes in Federal and State laws.”

More in this series

- 280E is a political weapon targeting marijuana companies, but there may be a fix

- Documents reveal how IRS became more adept at evaluating marijuana company taxes

- Newly released IRS documents detail efforts to collect taxes from marijuana companies under 280E

- A primer on marijuana-related IRS terminology

Typically, Allen said, Audit Technique Guides are just as much for use by the industries themselves to remain compliant with federal tax law.

Which, she said, is another indication of the double standard applied to cannabis companies.

Cannabis attorney Henry Wykowski scoffed at the TIGTA report’s reasoning from the IRS as to why the marijuana industry Participant Guide hasn’t been published.

“It’s bullshit,” Wykowski said. “What difference does the state law of California have to do with COGS (cost of goods sold) as computed by the IRS? That’s just ludicrous.”

Wykowski believes the IRS has kept the guide under wraps simply to give its agents a tactical advantage in dealing with the marijuana industry.

“Giving somebody like me that type of information would enhance my ability to represent clients in an audit,” Wykowski said.

“Unfortunately, especially with audits of cannabis dispensaries, the IRS has gone out of its way to make them more difficult and opaque than other audits.”

A guide to the guide

Early in the marijuana Participant Guide, IRS agents are urged to glean as much potentially revealing information from business owners as possible – before MJ executives hire tax attorneys to represent them.

“The most effective audit technique for obtaining income information is the interview with the taxpayer,” the guide states. “As many taxpayers hire representation after the initial interview, it may be the only chance you have to talk directly with the taxpayer.”

The booklet primes IRS agents for an adversarial relationship with cannabis business owners, noting their antipathy toward Section 280E of the Internal Revenue Code (IRC), which prohibits standard business deductions for any company that traffics in federally controlled substances.

The booklet begins,

“Marijuana industry supporters rarely agree with proposed IRC 280E adjustments because they believe IRC 280E will soon no longer apply to the marijuana industry, perhaps sooner than the time it takes their case to work its way through an examination, then to appeals, and finally to tax court.”

The version of the Participant Guide provided to MJBizDaily is titled “Marijuana Training” and was “revised” as of April 2015.

That suggests an earlier original publication date.

Plus, Richards said he can’t believe the IRS wouldn’t have updated the guide since then.

If it hasn’t been updated, then it’s nearly antiquated because of the many developments in the industry in the past six years, he said.

“It doesn’t have anything in it from the adult-use industry at all. It’s all based on medical cases,” Richards noted.

“One of the things that’s fundamentally different … are robust state regulations that require very specific things in order to get a license to be a marijuana business.

“So there’s this whole underlying big, big list of things that show up in a post-2014 business that are not part of their (Participant Guide).”

The IRS was targeting the marijuana industry for audits as far back as 2002.

That was the year the IRS audited a California medical marijuana operation, a case that ultimately developed into one of the industry’s seminal rulings, the 2007 Californians Helping to Alleviate Medical Problems (CHAMP). Wykowski was a lead attorney in that case.

Then, in 2010, the IRS launched the first of five Compliance Initiative Projects, a series of targeted audits focused on cannabis companies.

The marijuana Participant Guide makes clear the IRS has been tracking marijuana industry tax returns for what it considered to be wrongly classified expenses.

Marijuana companies, it noted, have tried to include expenditures such as wages in the cost of producing inventory – otherwise known as COGS – as a workaround for 280E.

That’s because COGS are deductible for cannabis businesses, while many other expenses – such as wages – are not.

It was an attempt by some marijuana businesses to exploit a potential loophole. The IRS picked up on that tactic quickly and clearly notified its agents.

“More and more taxpayers are combining their disallowed business expenses and wages with the reported COGS,” the guide points out, noting it is “extremely important” for IRS agents to focus on costs of goods sold.

The guide reveals the existence of a December 2012 memo written by the IRS Office of Chief Counsel titled, “Questions to be Asked at the Start of a Dispensary Audit and Other Revenue Estimation Issues.”

The guide describes these as “a good starting point for structuring your interview questions.” (The IRS did not disclose the 2012 memo to MJBizDaily, saying it was considered privileged as part of an attorney-client communication.)

Wykowski, who is a former federal prosecutor and has faced the IRS in court numerous times over 280E, said questioning unsuspecting targets in such a fashion is a common agency practice.

“That’s always been a tactic of the IRS, and they’re good at it,” Wykowski said.

“They know that if the dispensary senses that they’re being audited and have anything to worry about, they’re going to call someone like me.

“And the first thing I’m going to do is say, ‘I represent them, and no more contact with the taxpayer. Everything goes through me.'”

Taking the tour

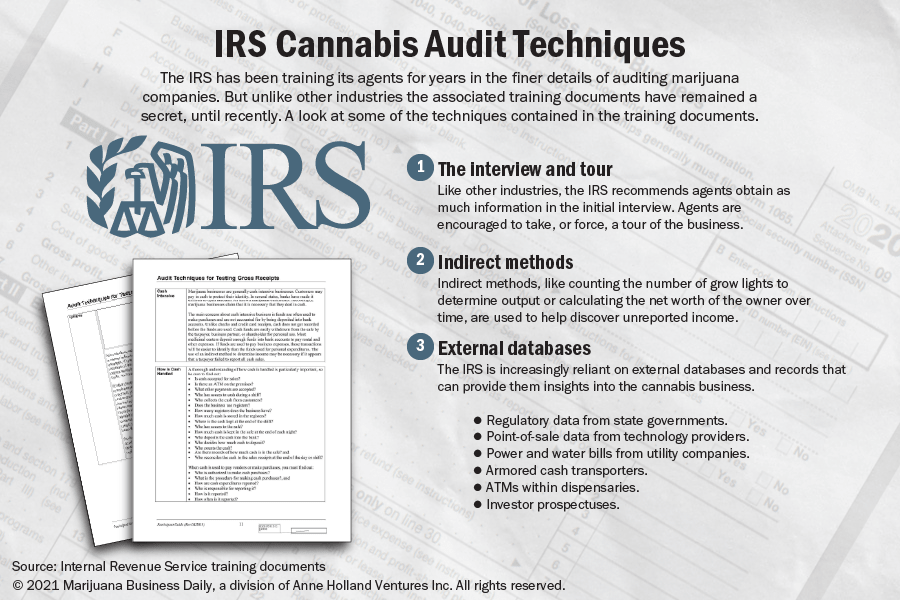

The Participant Guide also urges IRS agents to tour marijuana businesses to gather information, including signs of unreported income through what are known as “indirect methods.”

The document asserts:

“An indirect method to prove unreported income … involves computing the amount of marijuana that could be produced from a grow facility based upon electricity usage. Actively touring a grow house and retail facility will also assist in providing knowledge of the square footage as used in the allocation of expenses between growing and retail using IRC 280E.”

The document later suggests that IRS agents perform a “light count” while touring indoor grows because the number of grow lights could be used as “a strong indicator of the amount of marijuana produced and sold.”

“Generally, a 1KW light and ballast module will produce 1.5 to 2 pounds of dried saleable product within a cycle, and there are usually 5-6 harvest cycles per year,” the guide notes.

But Richards, the Denver tax attorney and former IRS lawyer, said such methodology is absurd.

“Everyone who’s been in this business for a while knows that every grower is different,” Richards said. “To be able to look at an electricity bill and say, ‘You should get a certain yield out of that,’ that’s just not a reliable indicator at all because there’s so much variance.”

The guide further informs IRS agents that they can force companies to comply with requests to tour the business premises, with a writ of entry if need be.

Business owners can be fined up to $500 for refusing entry to IRS agents, the guide notes.

The Participant Guide further preps IRS agents to be skeptical when it comes to records kept by marijuana businesses:

“It is important to find out who takes cash to the bank and what accounts it may be deposited into.

“If the same employee (or owner) who records the income and prepares the bank deposit slip also takes the cash to the bank, they could change the amount on the deposit ticket and skim some or all of the cash.”

Other ‘indirect methods’

Some of the most revealing parts of the Participant Guide have to do with “indirect methods” employed by IRS agents dealing with cannabis companies that might not have kept proper records – or if there is concern a business is lying.

“Neither the (Internal Revenue) Code nor the (Treasury Department) Regulations define or specifically authorize the use of formal indirect methods,” the guide specifies.

But, it notes, a provision in the federal tax code “provides that if no method of accounting has been regularly used by the taxpayer, or if the method used does not clearly reflect income,” then indirect methods are acceptable and backed by legal precedents.

Analyzing electricity bills for indoor grows would fall into this category.

Other “indirect methods” include:

- Examining bank deposits and comparing them to cash expenditures.

- Comparing records related to sources of income with expenditures.

- Establishing a net worth for a business owner and calculating how much that changed based on various records.

The IRS considers in-person interviews to be key in this area – especially before a marijuana business owner hires a tax attorney.

“The most challenging part of using any indirect method is determining the taxpayer’s personal living expenses and the amount of cash the taxpayer has accumulated,” the guide notes.

But “oral testimony” may be used to determine how much actual income was gathered during a given period, which, according to the audit guide, could be used as evidence to determine the true level of income:

“Taxpayers operating a business in the marijuana industry are unlikely to willingly show you their accumulation of cash.

“The taxpayer may state they have a small accumulation of cash at the beginning of the year and claim they used it all up during the year.

“Determining personal living expenses and the accumulation of cash is one of the most significant parts of the equation.”

External records, databases assisting IRS

The Participant Guide makes clear the IRS is increasingly reliant on external databases and records that track marijuana industry developments.

For instance, the guide repeatedly refers to information that can be gleaned from the Colorado Marijuana Enforcement Division (MED), a division of that state’s Department of Revenue.

Such information could include “plant counts and lighting module counts, including an identification of the type of lighting used.”

In addition, the guide suggests that marijuana business information can be obtained through utility bills, “armored cash transporters used by the taxpayer,” production records filed with state regulators, investor prospectuses, ATMs that are set up within dispensaries and even from common point-of-sale software systems provided by cannabis technology companies.

Has your cannabis company been audited by the IRS? If so, we’d like to hear about it. Contact John Schroyer at john.schroyer@mjbizdaily.com.

(This series would not have been possible without support from several Marijuana Business Daily staff members, including Roger Fillion, Andrew Long and Jenel Stelton-Holtmeier.)